Enlarge image

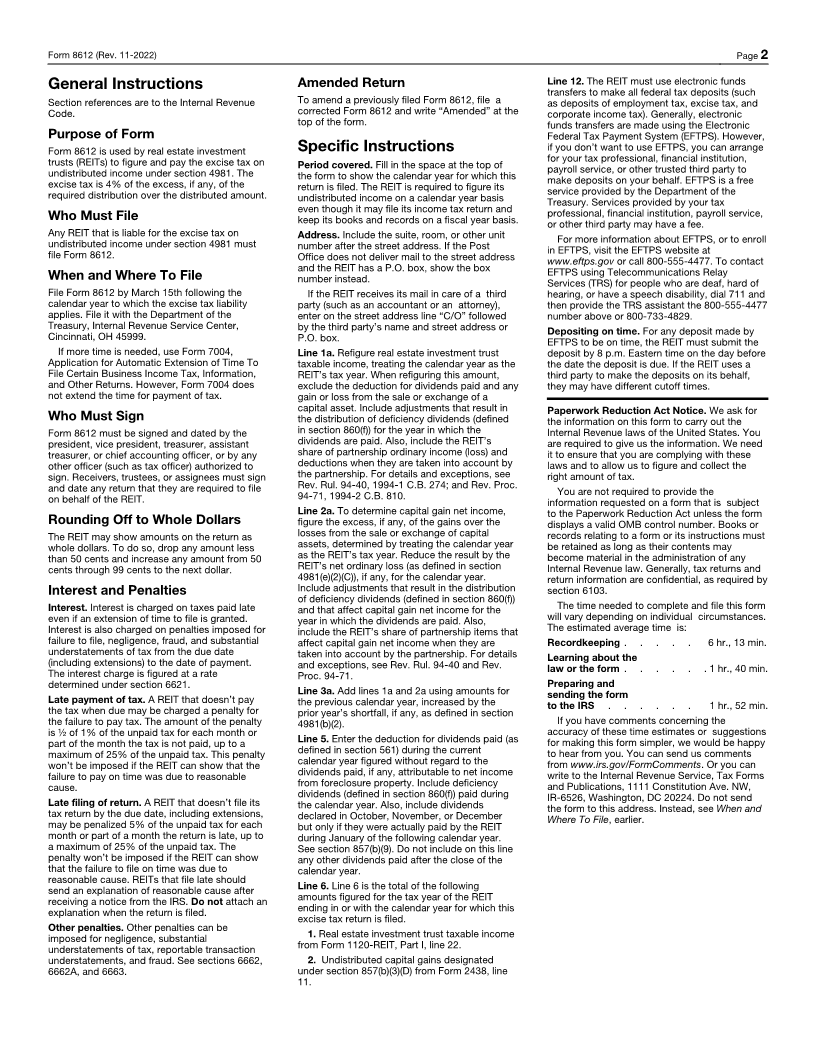

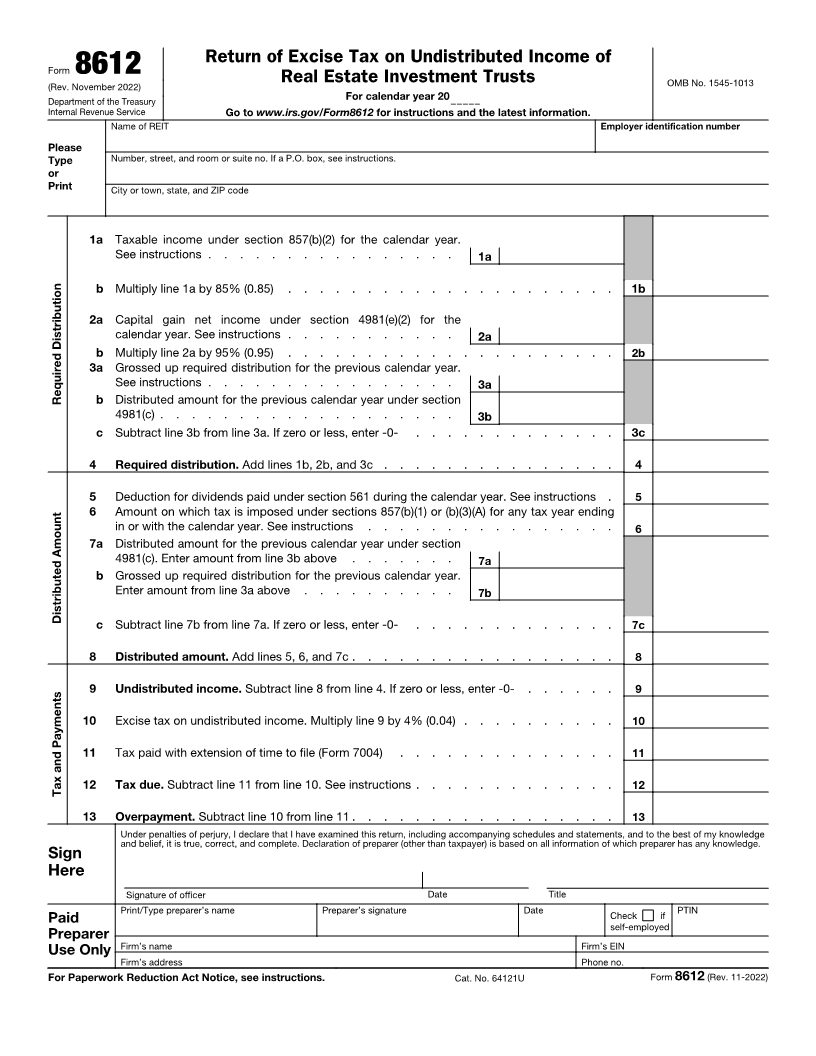

Return of Excise Tax on Undistributed Income of

Form 8612 Real Estate Investment Trusts OMB No. 1545-1013

(Rev. November 2022)

Department of the Treasury For calendar year 20

Internal Revenue Service Go to www.irs.gov/Form8612 for instructions and the latest information.

Name of REIT Employer identification number

Please

Type Number, street, and room or suite no. If a P.O. box, see instructions.

or

Print City or town, state, and ZIP code

1 a Taxable income under section 857(b)(2) for the calendar year.

See instructions . . . . . . . . . . . . . . . . 1a

b Multiply line 1a by 85% (0.85) . . . . . . . . . . . . . . . . . . . . . 1b

2 a Capital gain net income under section 4981(e)(2) for the

calendar year. See instructions . . . . . . . . . . . 2a

b Multiply line 2a by 95% (0.95) . . . . . . . . . . . . . . . . . . . . . 2b

3 a Grossed up required distribution for the previous calendar year.

See instructions . . . . . . . . . . . . . . . . 3a

Required Distribution b Distributed amount for the previous calendar year under section

4981(c) . . . . . . . . . . . . . . . . . . . 3b

c Subtract line 3b from line 3a. If zero or less, enter -0- . . . . . . . . . . . . . 3c

4 Required distribution. Add lines 1b, 2b, and 3c . . . . . . . . . . . . . . . 4

5 Deduction for dividends paid under section 561 during the calendar year. See instructions . 5

6 Amount on which tax is imposed under sections 857(b)(1) or (b)(3)(A) for any tax year ending

in or with the calendar year. See instructions . . . . . . . . . . . . . . . . 6

7 a Distributed amount for the previous calendar year under section

4981(c). Enter amount from line 3b above . . . . . . . 7a

b Grossed up required distribution for the previous calendar year.

Enter amount from line 3a above . . . . . . . . . . 7b

Distributed Amount

c Subtract line 7b from line 7a. If zero or less, enter -0- . . . . . . . . . . . . . 7c

8 Distributed amount. Add lines 5, 6, and 7c . . . . . . . . . . . . . . . . . 8

9 Undistributed income. Subtract line 8 from line 4. If zero or less, enter -0- . . . . . . 9

10 Excise tax on undistributed income. Multiply line 9 by 4% (0.04) . . . . . . . . . . 10

11 Tax paid with extension of time to file (Form 7004) . . . . . . . . . . . . . . 11

Tax and Payments 12 Tax due. Subtract line 11 from line 10. See instructions . . . . . . . . . . . . . 12

13 Overpayment. Subtract line 10 from line 11 . . . . . . . . . . . . . . . . . 13

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

Signature of officer Date Title

Print/Type preparer’s name Preparer’s signature Date

Paid Check if PTIN

self-employed

Preparer

Use Only Firm’s name Firm’s EIN

Firm’s address Phone no.

For Paperwork Reduction Act Notice, see instructions. Cat. No. 64121U Form 8612 (Rev. 11-2022)