Enlarge image

OMB No. 1545-1430

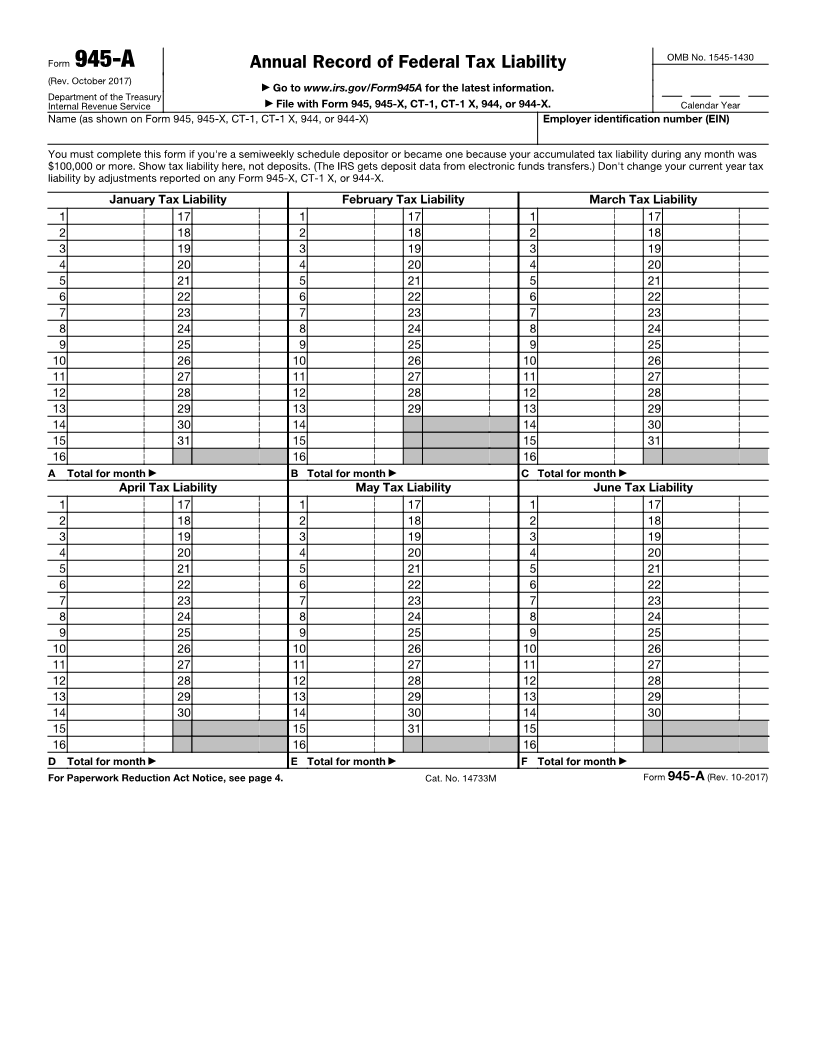

Form 945-A Annual Record of Federal Tax Liability

(Rev. October 2017) ▶ Go to www.irs.gov/Form945A for the latest information.

Department of the Treasury ▶ File with Form 945, 945-X, CT-1, CT-1 X, 944, or 944-X. Calendar Year

Internal Revenue Service

Name (as shown on Form 945, 945-X, CT-1, CT-1 X, 944, or 944-X) Employer identification number (EIN)

You must complete this form if you're a semiweekly schedule depositor or became one because your accumulated tax liability during any month was

$100,000 or more. Show tax liability here, not deposits. (The IRS gets deposit data from electronic funds transfers.) Don't change your current year tax

liability by adjustments reported on any Form 945-X, CT-1 X, or 944-X.

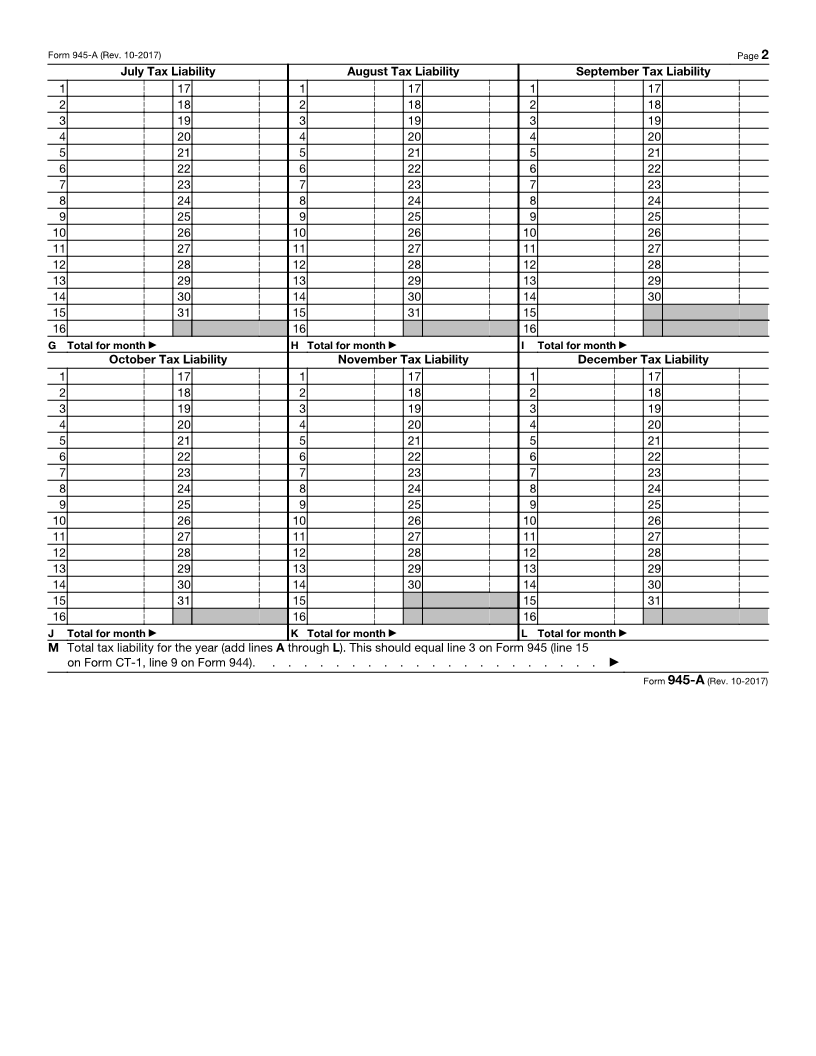

January Tax Liability February Tax Liability March Tax Liability

1 17 1 17 1 17

2 18 2 18 2 18

3 19 3 19 3 19

4 20 4 20 4 20

5 21 5 21 5 21

6 22 6 22 6 22

7 23 7 23 7 23

8 24 8 24 8 24

9 25 9 25 9 25

10 26 10 26 10 26

11 27 11 27 11 27

12 28 12 28 12 28

13 29 13 29 13 29

14 30 14 14 30

15 31 15 15 31

16 16 16

A Total for month ▶ B Total for month ▶ C Total for month ▶

April Tax Liability May Tax Liability June Tax Liability

1 17 1 17 1 17

2 18 2 18 2 18

3 19 3 19 3 19

4 20 4 20 4 20

5 21 5 21 5 21

6 22 6 22 6 22

7 23 7 23 7 23

8 24 8 24 8 24

9 25 9 25 9 25

10 26 10 26 10 26

11 27 11 27 11 27

12 28 12 28 12 28

13 29 13 29 13 29

14 30 14 30 14 30

15 15 31 15

16 16 16

D Total for month ▶ E Total for month ▶ F Total for month ▶

For Paperwork Reduction Act Notice, see page 4. Cat. No. 14733M Form 945-A (Rev. 10-2017)