Enlarge image

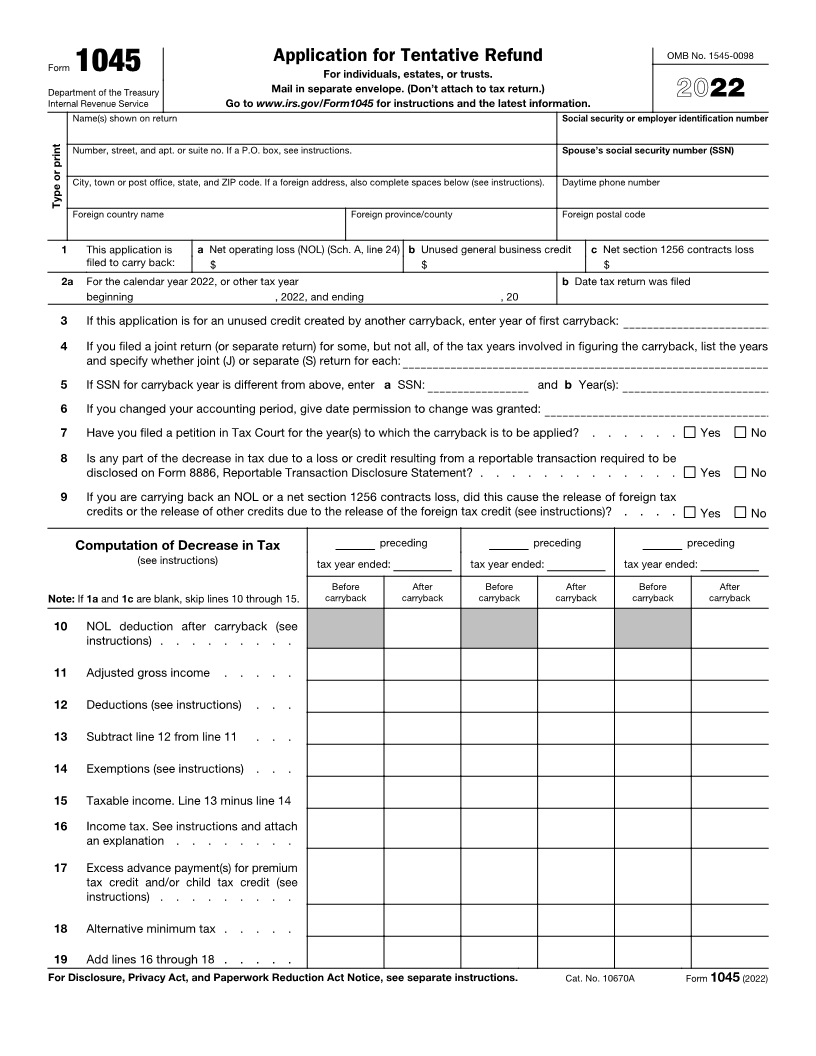

Application for Tentative Refund OMB No. 1545-0098

Form 1045 For individuals, estates, or trusts.

Department of the Treasury Mail in separate envelope. (Don’t attach to tax return.) 2022

Internal Revenue Service Go to www.irs.gov/Form1045 for instructions and the latest information.

Name(s) shown on return Social security or employer identification number

Number, street, and apt. or suite no. If a P.O. box, see instructions. Spouse’s social security number (SSN)

City, town or post office, state, and ZIP code. If a foreign address, also complete spaces below (see instructions). Daytime phone number

Type or print

Foreign country name Foreign province/county Foreign postal code

1 This application is a Net operating loss (NOL) (Sch. A, line 24) b Unused general business credit c Net section 1256 contracts loss

filed to carry back: $ $ $

2 a For the calendar year 2022, or other tax year b Date tax return was filed

beginning , 2022, and ending , 20

3 If this application is for an unused credit created by another carryback, enter year of first carryback:

4 If you filed a joint return (or separate return) for some, but not all, of the tax years involved in figuring the carryback, list the years

and specify whether joint (J) or separate (S) return for each:

5 If SSN for carryback year is different from above, enter a SSN: and bYear(s):

6 If you changed your accounting period, give date permission to change was granted:

7 Have you filed a petition in Tax Court for the year(s) to which the carryback is to be applied? . . . . . . Yes No

8 Is any part of the decrease in tax due to a loss or credit resulting from a reportable transaction required to be

disclosed on Form 8886, Reportable Transaction Disclosure Statement? . . . . . . . . . . . . . Yes No

9 If you are carrying back an NOL or a net section 1256 contracts loss, did this cause the release of foreign tax

credits or the release of other credits due to the release of the foreign tax credit (see instructions)? . . . . Yes No

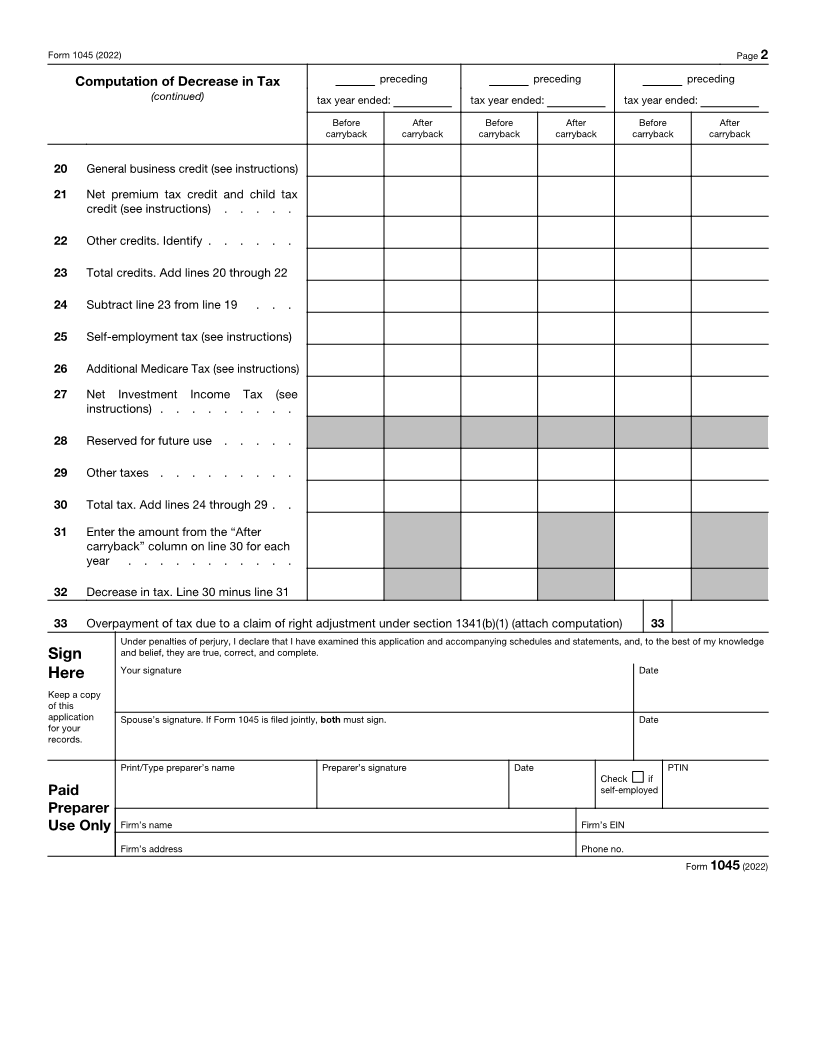

Computation of Decrease in Tax preceding preceding preceding

(see instructions) tax year ended: tax year ended: tax year ended:

Before After Before After Before After

Note: If1a and 1c are blank, skip lines 10 through 15. carryback carryback carryback carryback carryback carryback

10 NOL deduction after carryback (see

instructions) . . . . . . . . .

11 Adjusted gross income . . . . .

12 Deductions (see instructions) . . .

13 Subtract line 12 from line 11 . . .

14 Exemptions (see instructions) . . .

15 Taxable income. Line 13 minus line 14

16 Income tax. See instructions and attach

an explanation . . . . . . . .

17 Excess advance payment(s) for premium

tax credit and/or child tax credit (see

instructions) . . . . . . . . .

18 Alternative minimum tax . . . . .

19 Add lines 16 through 18 . . . . .

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 10670A Form 1045 (2022)