Enlarge image

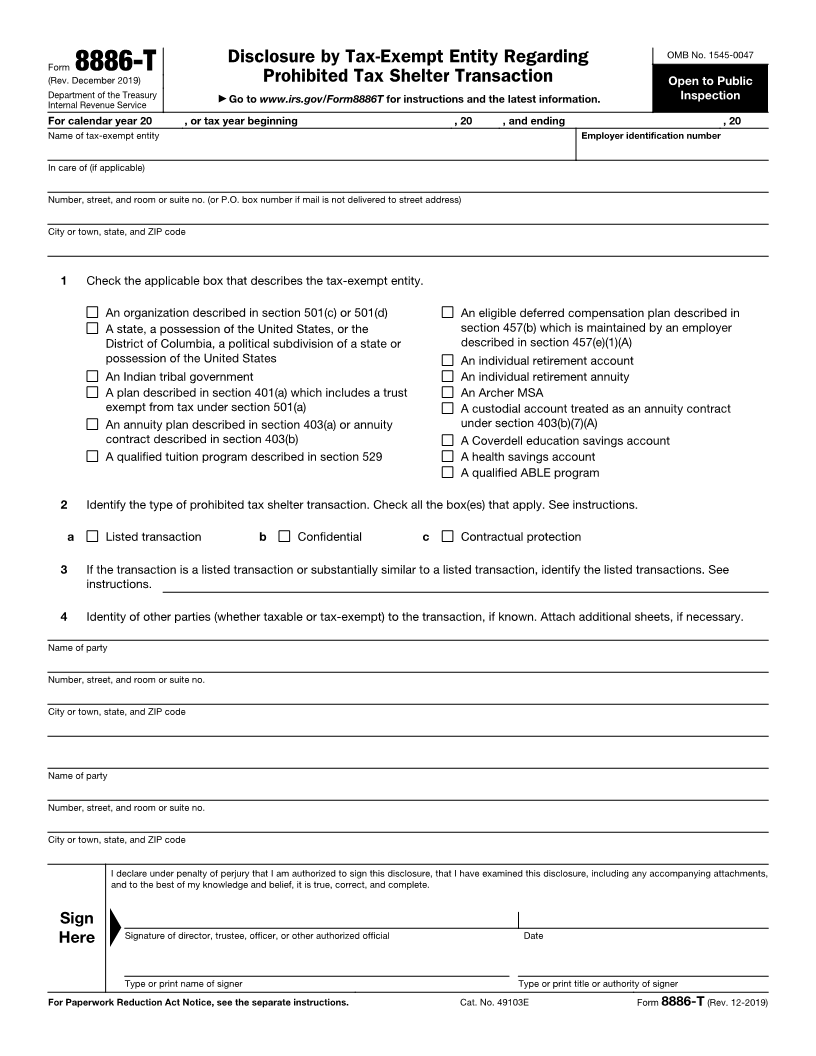

OMB No. 1545-0047

Disclosure by Tax-Exempt Entity Regarding

Form 8886-T

(Rev. December 2019) Prohibited Tax Shelter Transaction Open to Public

Department of the Treasury ▶ Go to www.irs.gov/Form8886T for instructions and the latest information. Inspection

Internal Revenue Service

For calendar year 20 , or tax year beginning , 20 , and ending , 20

Name of tax-exempt entity Employer identification number

In care of (if applicable)

Number, street, and room or suite no. (or P.O. box number if mail is not delivered to street address)

City or town, state, and ZIP code

1 Check the applicable box that describes the tax-exempt entity.

An organization described in section 501(c) or 501(d) An eligible deferred compensation plan described in

A state, a possession of the United States, or the section 457(b) which is maintained by an employer

District of Columbia, a political subdivision of a state or described in section 457(e)(1)(A)

possession of the United States An individual retirement account

An Indian tribal government An individual retirement annuity

A plan described in section 401(a) which includes a trust An Archer MSA

exempt from tax under section 501(a) A custodial account treated as an annuity contract

An annuity plan described in section 403(a) or annuity under section 403(b)(7)(A)

contract described in section 403(b) A Coverdell education savings account

A qualified tuition program described in section 529 A health savings account

A qualified ABLE program

2 Identify the type of prohibited tax shelter transaction. Check all the box(es) that apply. See instructions.

a Listed transaction b Confidential c Contractual protection

3 If the transaction is a listed transaction or substantially similar to a listed transaction, identify the listed transactions. See

instructions.

4 Identity of other parties (whether taxable or tax-exempt) to the transaction, if known. Attach additional sheets, if necessary.

Name of party

Number, street, and room or suite no.

City or town, state, and ZIP code

Name of party

Number, street, and room or suite no.

City or town, state, and ZIP code

I declare under penalty of perjury that I am authorized to sign this disclosure, that I have examined this disclosure, including any accompanying attachments,

and to the best of my knowledge and belief, it is true, correct, and complete.

▲

Sign

Here Signature of director, trustee, officer, or other authorized official Date

Type or print name of signer Type or print title or authority of signer

For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 49103E Form 8886-T (Rev. 12-2019)