Enlarge image

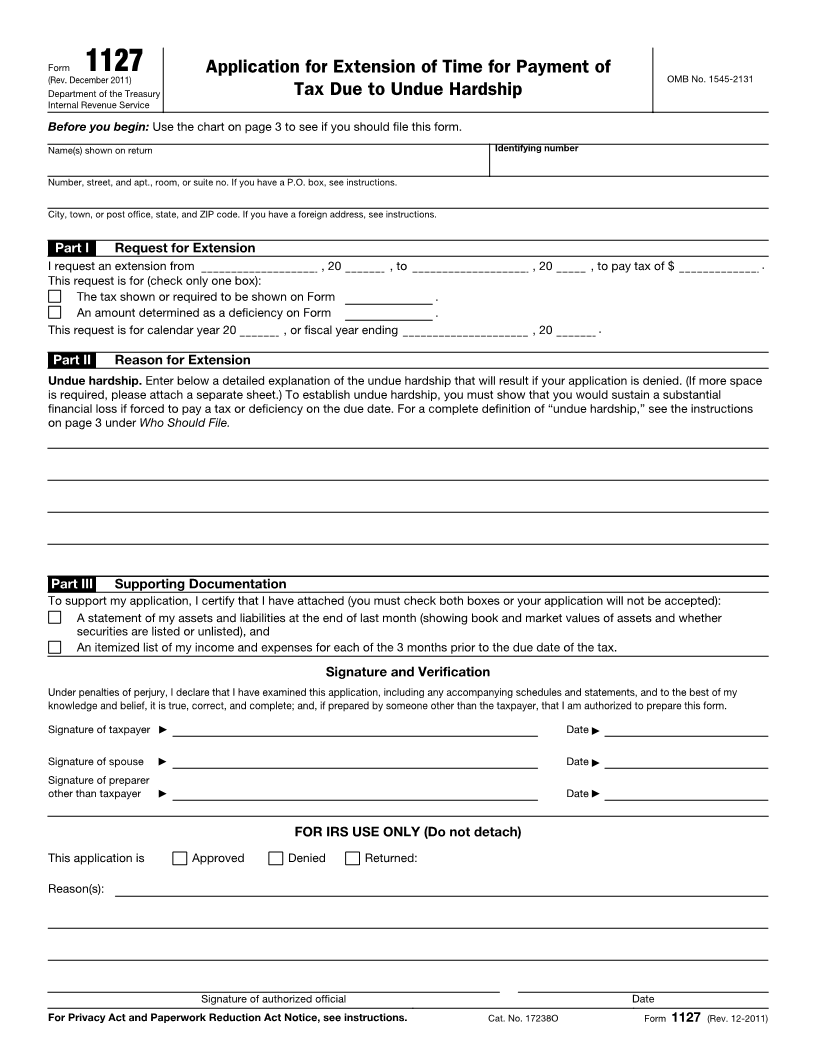

Form 1127 Application for Extension of Time for Payment of

(Rev. December 2011) OMB No. 1545-2131

Department of the Treasury Tax Due to Undue Hardship

Internal Revenue Service

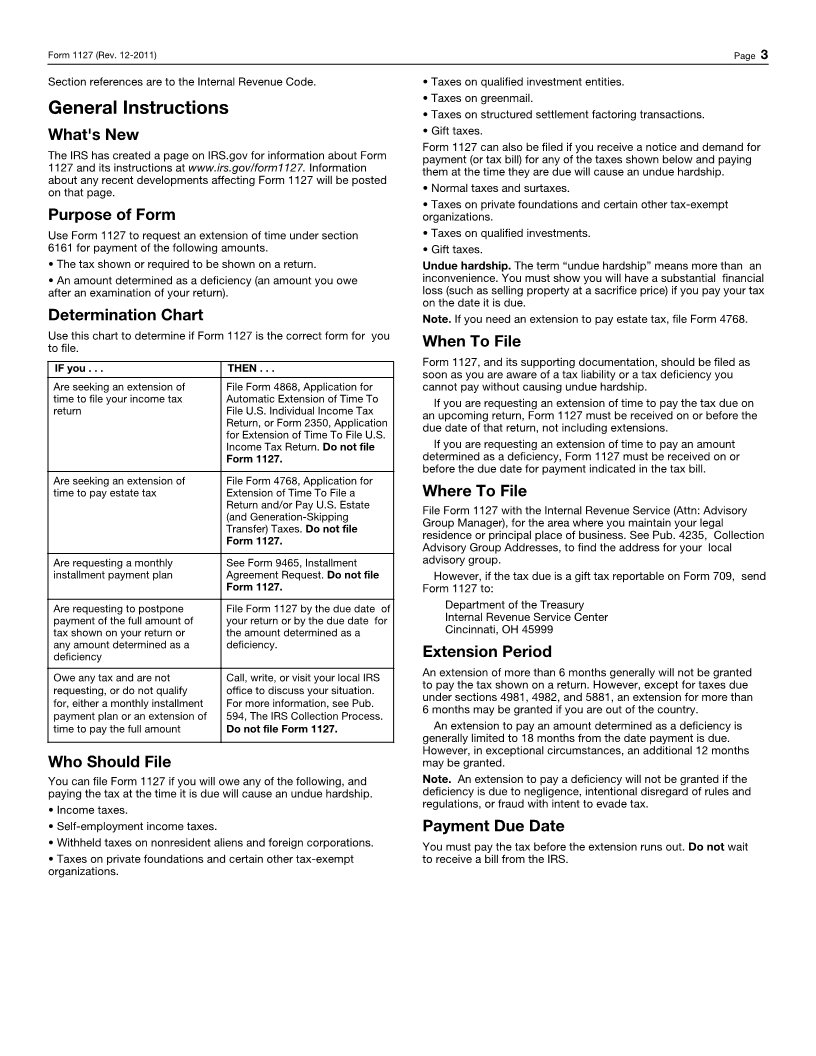

Before you begin: Use the chart on page 3 to see if you should file this form.

Name(s) shown on return Identifying number

Number, street, and apt., room, or suite no. If you have a P.O. box, see instructions.

City, town, or post office, state, and ZIP code. If you have a foreign address, see instructions.

Part I Request for Extension

I request an extension from , 20 , to , 20 , to pay tax of $ .

This request is for (check only one box):

The tax shown or required to be shown on Form .

An amount determined as a deficiency on Form .

This request is for calendar year 20 , or fiscal year ending , 20 .

Part II Reason for Extension

Undue hardship. Enter below a detailed explanation of the undue hardship that will result if your application is denied. (If more space

is required, please attach a separate sheet.) To establish undue hardship, you must show that you would sustain a substantial

financial loss if forced to pay a tax or deficiency on the due date. For a complete definition of “undue hardship,” see the instructions

on page 3 under Who Should File.

Part III Supporting Documentation

To support my application, I certify that I have attached (you must check both boxes or your application will not be accepted):

A statement of my assets and liabilities at the end of last month (showing book and market values of assets and whether

securities are listed or unlisted), and

An itemized list of my income and expenses for each of the 3 months prior to the due date of the tax.

Signature and Verification

Under penalties of perjury, I declare that I have examined this application, including any accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete; and, if prepared by someone other than the taxpayer, that I am authorized to prepare this form.

Signature of taxpayer ▶ Date ▶

Signature of spouse ▶ Date ▶

Signature of preparer

other than taxpayer ▶ Date ▶

FOR IRS USE ONLY (Do not detach)

This application is Approved Denied Returned:

Reason(s):

Signature of authorized official Date

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 17238O Form 1127 (Rev. 12-2011)