Enlarge image

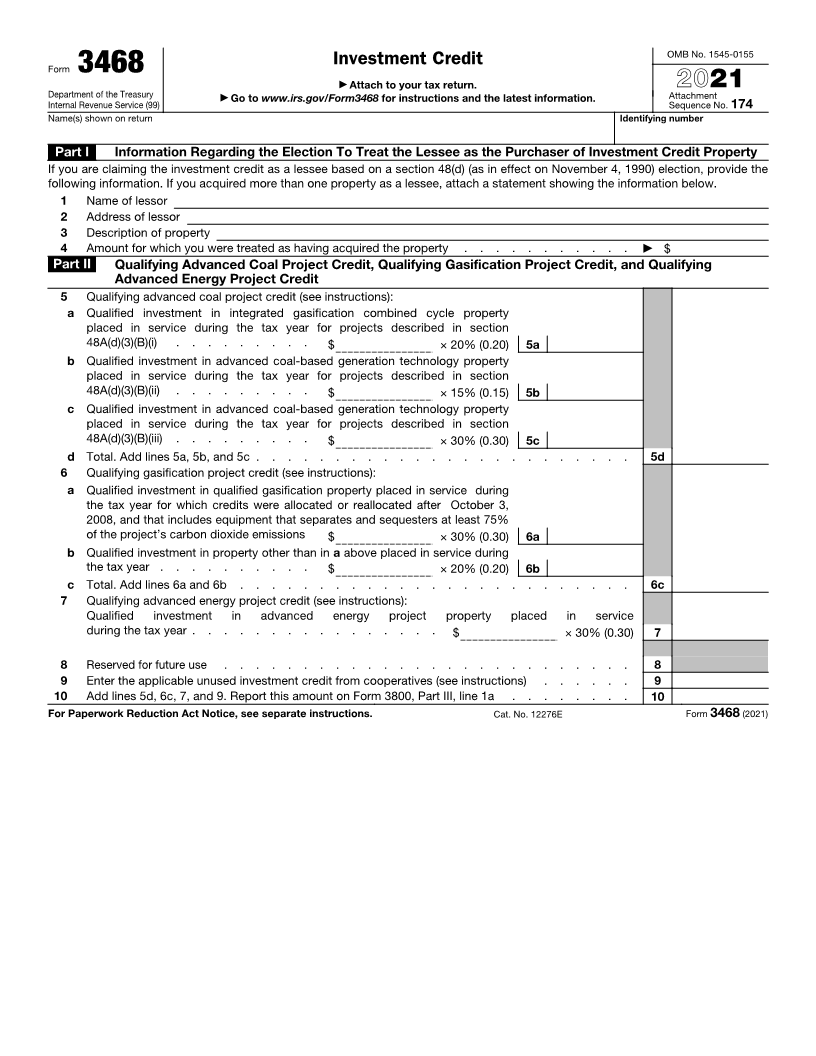

OMB No. 1545-0155

Investment Credit

Form 3468

▶ Attach to your tax return. 2021

Department of the Treasury ▶ Go to www.irs.gov/Form3468 for instructions and the latest information. Attachment

Internal Revenue Service (99) Sequence No. 174

Name(s) shown on return Identifying number

Part I Information Regarding the Election To Treat the Lessee as the Purchaser of Investment Credit Property

If you are claiming the investment credit as a lessee based on a section 48(d) (as in effect on November 4, 1990) election, provide the

following information. If you acquired more than one property as a lessee, attach a statement showing the information below.

1 Name of lessor

2 Address of lessor

3 Description of property

4 Amount for which you were treated as having acquired the property . . . . . . . . . . . ▶ $

Part II Qualifying Advanced Coal Project Credit, Qualifying Gasification Project Credit, and Qualifying

Advanced Energy Project Credit

5 Qualifying advanced coal project credit (see instructions):

a Qualified investment in integrated gasification combined cycle property

placed in service during the tax year for projects described in section

48A(d)(3)(B)(i) . . . . . . . . . $ × 20% (0.20) 5a

b Qualified investment in advanced coal-based generation technology property

placed in service during the tax year for projects described in section

48A(d)(3)(B)(ii) . . . . . . . . . $ × 15% (0.15) 5b

c Qualified investment in advanced coal-based generation technology property

placed in service during the tax year for projects described in section

48A(d)(3)(B)(iii) . . . . . . . . . $ × 30% (0.30) 5c

d Total. Add lines 5a, 5b, and 5c . . . . . . . . . . . . . . . . . . . . . . . . 5d

6 Qualifying gasification project credit (see instructions):

a Qualified investment in qualified gasification property placed in service during

the tax year for which credits were allocated or reallocated after October 3,

2008, and that includes equipment that separates and sequesters at least 75%

of the project’s carbon dioxide emissions $ × 30% (0.30) 6a

b Qualified investment in property other than in aabove placed in service during

the tax year . . . . . . . . . . $ × 20% (0.20) 6b

c Total. Add lines 6a and 6b . . . . . . . . . . . . . . . . . . . . . . . . . 6c

7 Qualifying advanced energy project credit (see instructions):

Qualified investment in advanced energy project property placed in service

during the tax year . . . . . . . . . . . . . . . . $ × 30% (0.30) 7

8 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Enter the applicable unused investment credit from cooperatives (see instructions) . . . . . . 9

10 Add lines 5d, 6c, 7, and 9. Report this amount on Form 3800, Part III, line 1a . . . . . . . . 10

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 12276E Form 3468 (2021)