Enlarge image

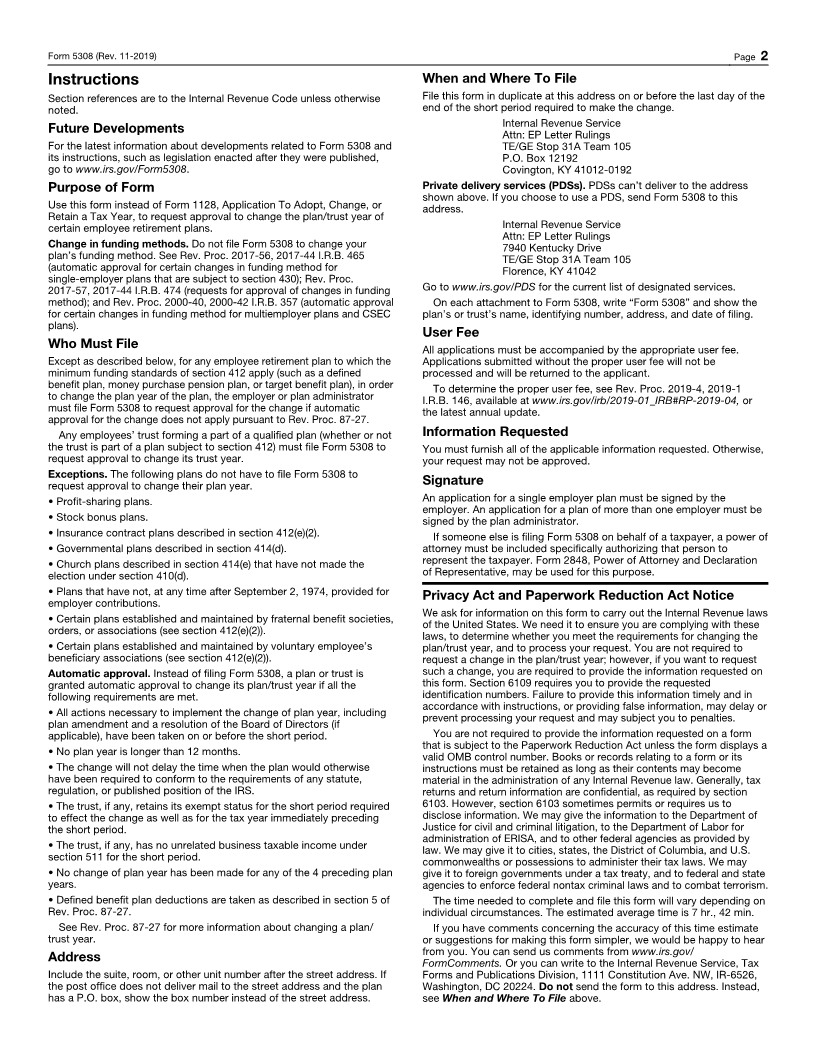

OMB No. 1545-0201

Request for Change in Plan/Trust Year

Form 5308

(Rev. November 2019) (Under section 412(d)(1) of the Internal Revenue Code) File in

Department of the Treasury ▶ Go to www.irs.gov/Form5308 for the latest information. Duplicate

Internal Revenue Service

Before you complete this form, read the instructions to see if your request for a change in plan/trust year qualifies

for automatic approval.

Name of employer (or plan administrator if a multiple employer plan or a multiemployer plan) Employer identification number

Number, street, and room or suite no. (if a P.O. box, see instructions) Check one or both:

Change in plan year . . . . . . . . . ▶

City or town, state, and ZIP code

Please type or print Change in trust year . . . . . . . . . ▶

1 Enter amount of user fee submitted ▶ $

2 Name of plan and/or trust 3 Plan number (enter each

digit in a separate block) ▶

4 Present plan and/or trust year ends 5 Permission is requested to change to a plan and/or trust year ending

6 The above change will require a return for a short period 7 Telephone number

beginning , , ending ,

8 Date of latest IRS determination letter (or opinion/advisory letter if the plan is a Master or Prototype/Volume Submitter Plan)

9 If this change affects the way deductions are taken for the tax year, please explain.

10 If you do not meet all the requirements for automatic approval for change in plan/trust year listed below, indicate the requirements you

do not meet by checking the appropriate box(es). Explain on an attached statement why you cannot meet the requirement(s). If you

cannot comply with item a, your request for approval will not be granted.

a All actions necessary to implement the change of plan d The trust, if any, retains its exempt status for the

year, including plan amendment and a resolution of the short period required to effect the change as well as

Board of Directors, if applicable, have been taken on or for the tax year immediately preceding the short

before the last day of the short period. period.

b No plan year is longer than 12 months. e The trust, if any, has no unrelated business taxable income

c The requested change will not delay the time when the under section 511 for the short period.

plan would otherwise have been required to conform to f No change of plan year has been made for any of the 4

the requirements of any statute, regulation, or published preceding plan years.

position of the IRS.

g Defined benefit plan deductions are taken as described in

section 5 of Rev. Proc. 87-27, 1987-1 C.B. 769.

Under penalties of perjury, I declare that I have examined this application, including any accompanying schedules and statements, and, to the best of my

knowledge and belief, it is true, correct, and complete.

▲ ▲

Sign

Here ▲ Print name Title

Signature Date

Do not write in the space below—For IRS Use Only

Approval Action Disapproval Action

Based solely on the information furnished in this application, the This application cannot be approved for the following reason:

requested change in the plan and/or trust year indicated above is Not timely filed

approved. Other

▲ ▲

Employee Plans Technical Manager Date Employee Plans Technical Manager Date

Person to contact ▶ Person to contact ▶

Phone ▶ Phone ▶

Symbols ▶ Symbols ▶

For Privacy Act and Paperwork Reduction Act Notice, see the instructions. Cat. No. 11834U Form 5308 (Rev. 11-2019)