Enlarge image

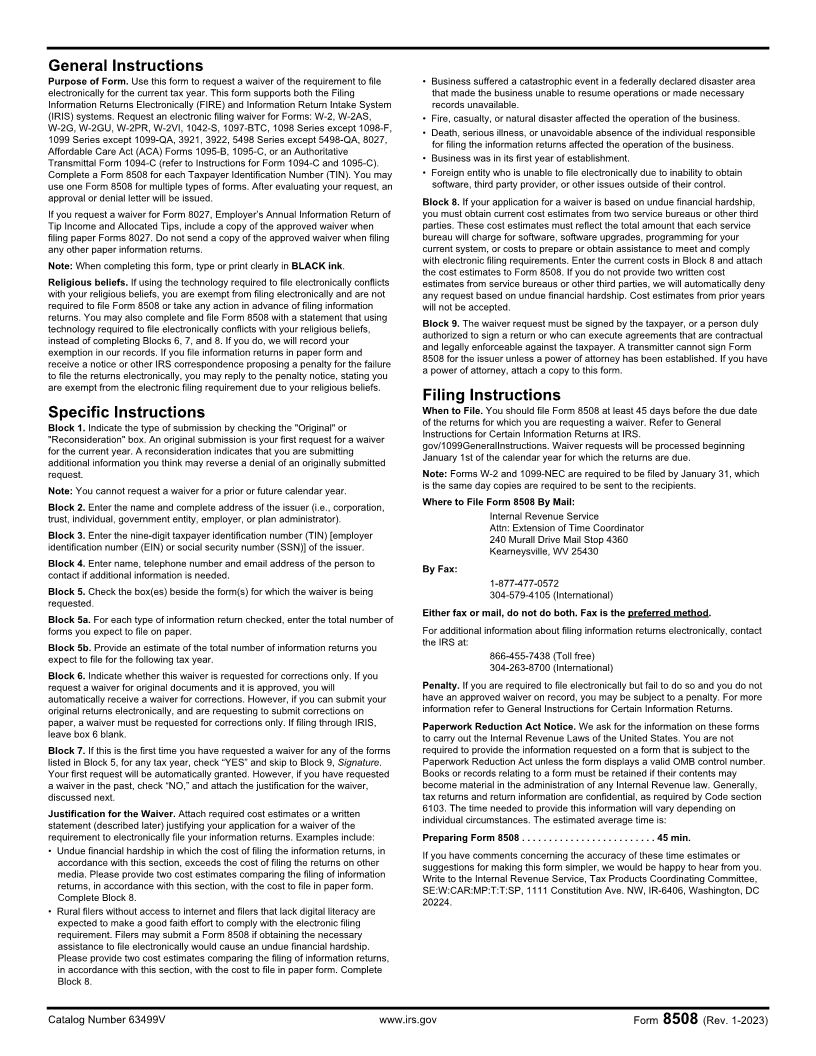

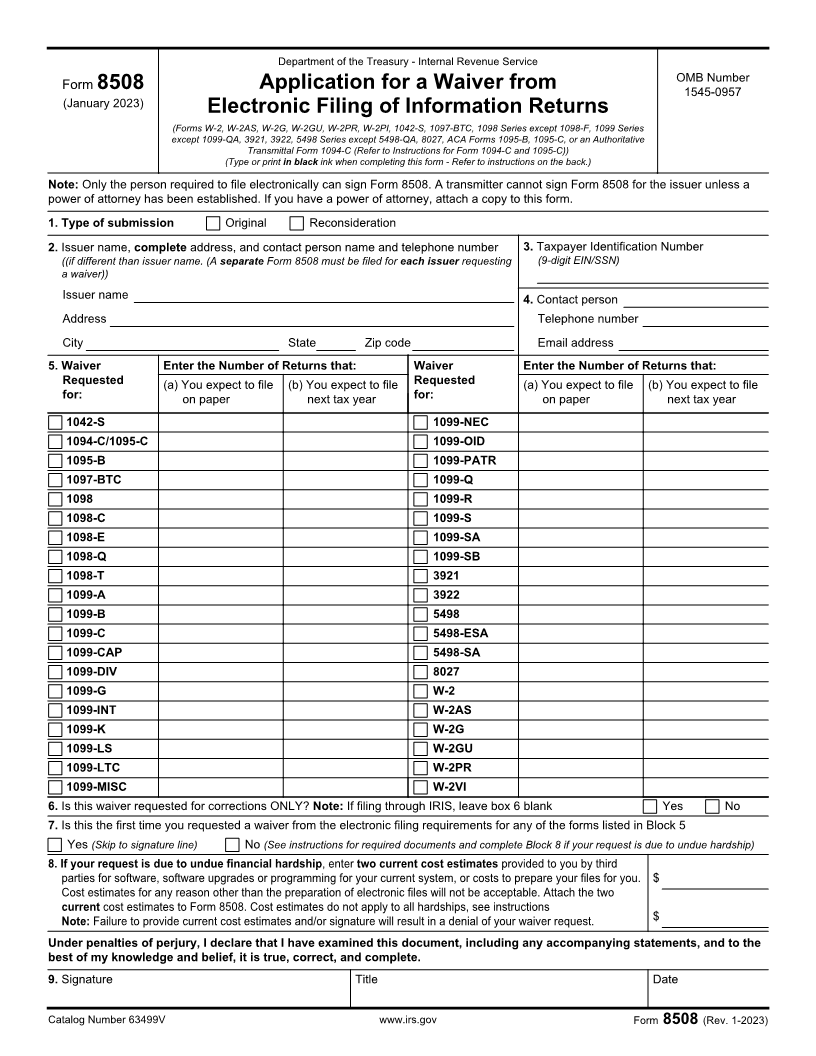

Department of the Treasury - Internal Revenue Service

OMB Number

Form 8508 Application for a Waiver from 1545-0957

(January 2023)

Electronic Filing of Information Returns

(Forms W-2, W-2AS, W-2G, W-2GU, W-2PR, W-2PI, 1042-S, 1097-BTC, 1098 Series except 1098-F, 1099 Series

except 1099-QA, 3921, 3922, 5498 Series except 5498-QA, 8027, ACA Forms 1095-B, 1095-C, or an Authoritative

Transmittal Form 1094-C (Refer to Instructions for Form 1094-C and 1095-C))

(Type or print in black ink when completing this form - Refer to instructions on the back.)

Note: Only the person required to file electronically can sign Form 8508. A transmitter cannot sign Form 8508 for the issuer unless a

power of attorney has been established. If you have a power of attorney, attach a copy to this form.

1. Type of submission Original Reconsideration

2. Issuer name, complete address, and contact person name and telephone number 3. Taxpayer Identification Number

((if different than issuer name. (A separate Form 8508 must be filed for each issuer requesting (9-digit EIN/SSN)

a waiver))

Issuer name 4. Contact person

Address Telephone number

City State Zip code Email address

5. Waiver Enter the Number of Returns that: Waiver Enter the Number of Returns that:

Requested (a) You expect to file (b) You expect to file Requested (a) You expect to file (b) You expect to file

for:

for: on paper next tax year on paper next tax year

1042-S 1099-NEC

1094-C/1095-C 1099-OID

1095-B 1099-PATR

1097-BTC 1099-Q

1098 1099-R

1098-C 1099-S

1098-E 1099-SA

1098-Q 1099-SB

1098-T 3921

1099-A 3922

1099-B 5498

1099-C 5498-ESA

1099-CAP 5498-SA

1099-DIV 8027

1099-G W-2

1099-INT W-2AS

1099-K W-2G

1099-LS W-2GU

1099-LTC W-2PR

1099-MISC W-2VI

6. Is this waiver requested for corrections ONLY? Note: If filing through IRIS, leave box 6 blank Yes No

7. Is this the first time you requested a waiver from the electronic filing requirements for any of the forms listed in Block 5

Yes (Skip to signature line) No (See instructions for required documents and complete Block 8 if your request is due to undue hardship)

8. If your request is due to undue financial hardship, enter two current cost estimates provided to you by third

parties for software, software upgrades or programming for your current system, or costs to prepare your files for you. $

Cost estimates for any reason other than the preparation of electronic files will not be acceptable. Attach the two

current cost estimates to Form 8508. Cost estimates do not apply to all hardships, see instructions

Note: Failure to provide current cost estimates and/or signature will result in a denial of your waiver request. $

Under penalties of perjury, I declare that I have examined this document, including any accompanying statements, and to the

best of my knowledge and belief, it is true, correct, and complete.

9. Signature Title Date

Catalog Number 63499V www.irs.gov Form 8508 (Rev. 1-2023)