Enlarge image

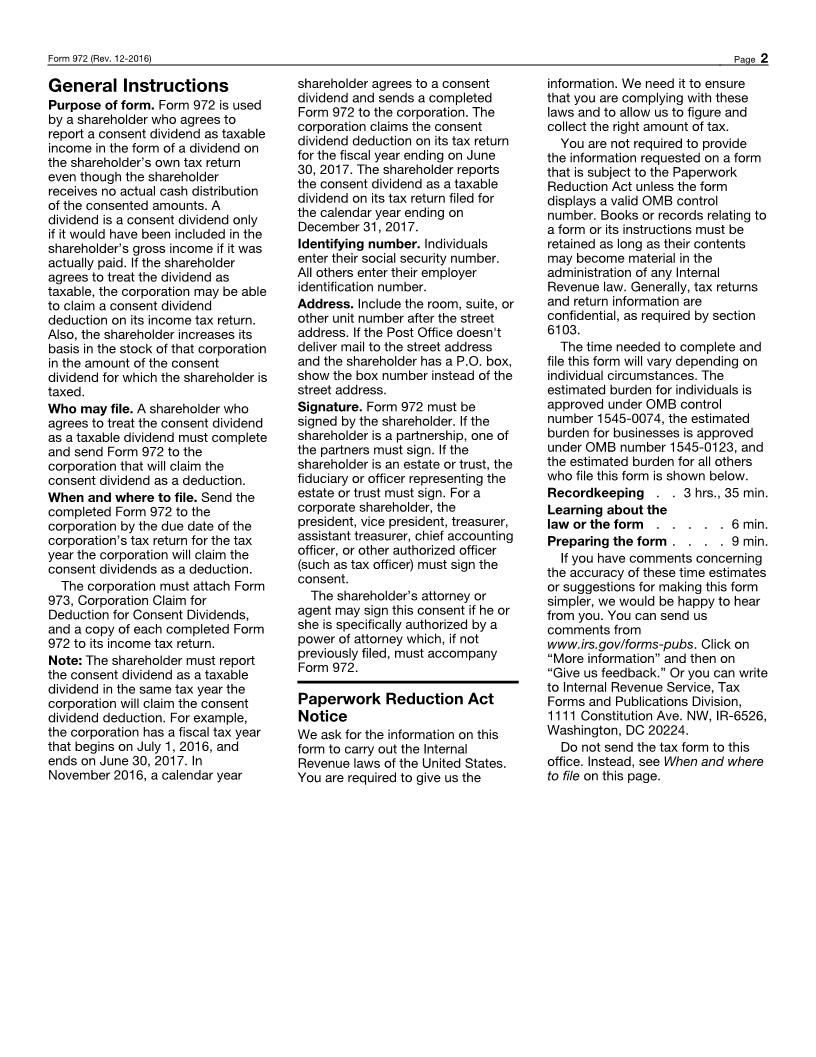

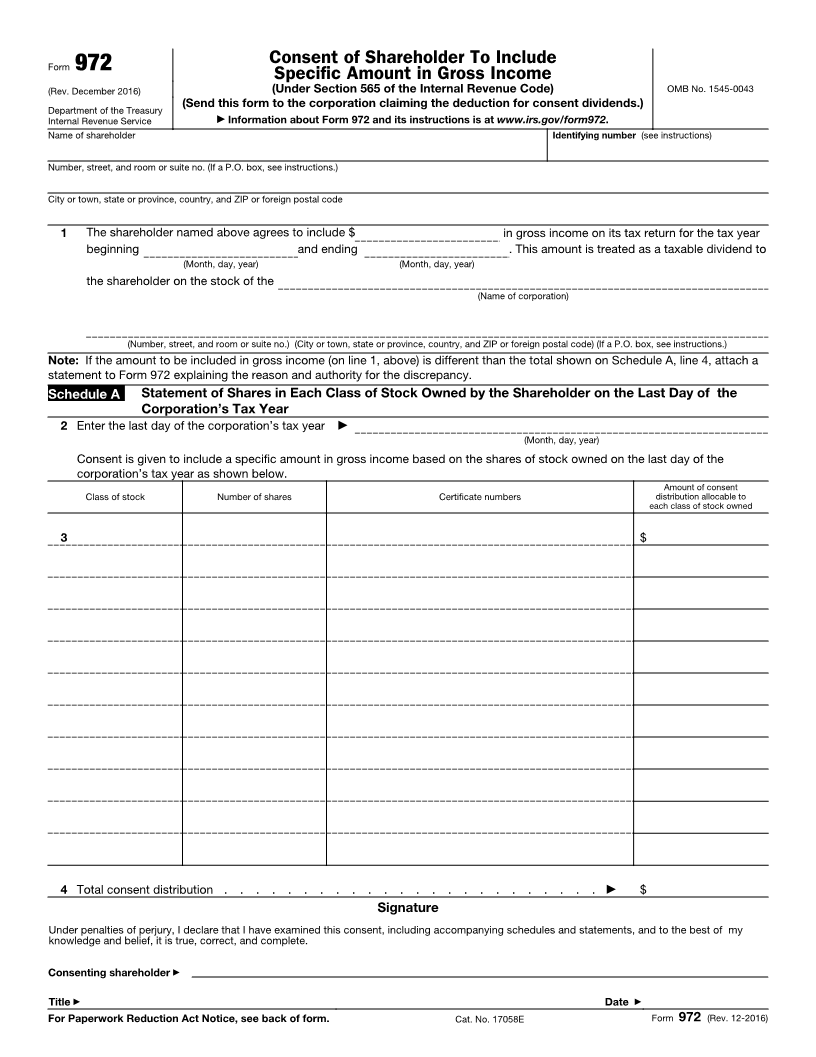

Consent of Shareholder To Include

Form 972

Specific Amount in Gross Income

(Rev. December 2016) (Under Section 565 of the Internal Revenue Code) OMB No. 1545-0043

Department of the Treasury (Send this form to the corporation claiming the deduction for consent dividends.)

Internal Revenue Service ▶ Information about Form 972 and its instructions is at www.irs.gov/form972.

Name of shareholder Identifying number (see instructions)

Number, street, and room or suite no. (If a P.O. box, see instructions.)

City or town, state or province, country, and ZIP or foreign postal code

1 The shareholder named above agrees to include $ in gross income on its tax return for the tax year

beginning and ending . This amount is treated as a taxable dividend to

(Month, day, year) (Month, day, year)

the shareholder on the stock of the

(Name of corporation)

(Number, street, and room or suite no.) (City or town, state or province, country, and ZIP or foreign postal code) (If a P.O. box, see instructions.)

Note: If the amount to be included in gross income (on line 1, above) is different than the total shown on Schedule A, line 4, attach a

statement to Form 972 explaining the reason and authority for the discrepancy.

Schedule A Statement of Shares in Each Class of Stock Owned by the Shareholder on the Last Day of the

Corporation’s Tax Year

2 Enter the last day of the corporation’s tax year ▶

(Month, day, year)

Consent is given to include a specific amount in gross income based on the shares of stock owned on the last day of the

corporation’s tax year as shown below.

Amount of consent

Class of stock Number of shares Certificate numbers distribution allocable to

each class of stock owned

3 $

4 Total consent distribution . . . . . . . . . . . . . . . . . . . . . . . . ▶ $

Signature

Under penalties of perjury, I declare that I have examined this consent, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete.

Consenting shareholder ▶

Title ▶ Date ▶

For Paperwork Reduction Act Notice, see back of form. Cat. No. 17058E Form 972 (Rev. 12-2016)