- 4 -

Enlarge image

|

Form 8717 (Rev. 9-2017) Page 2

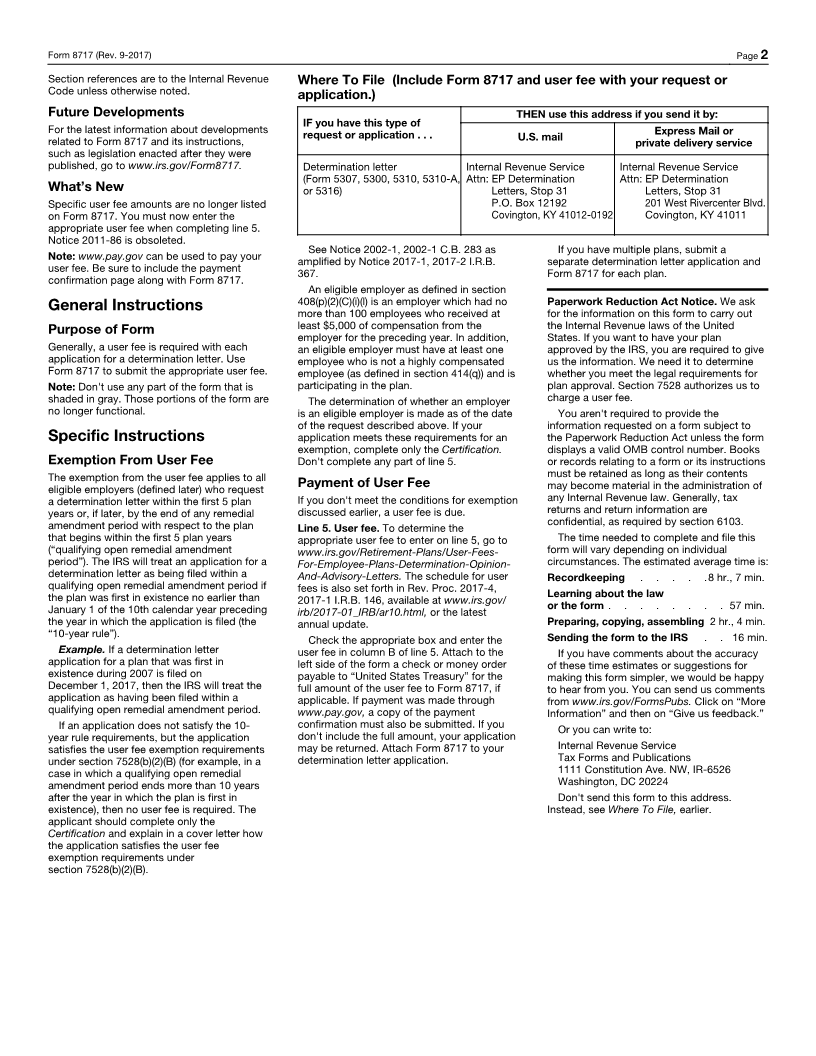

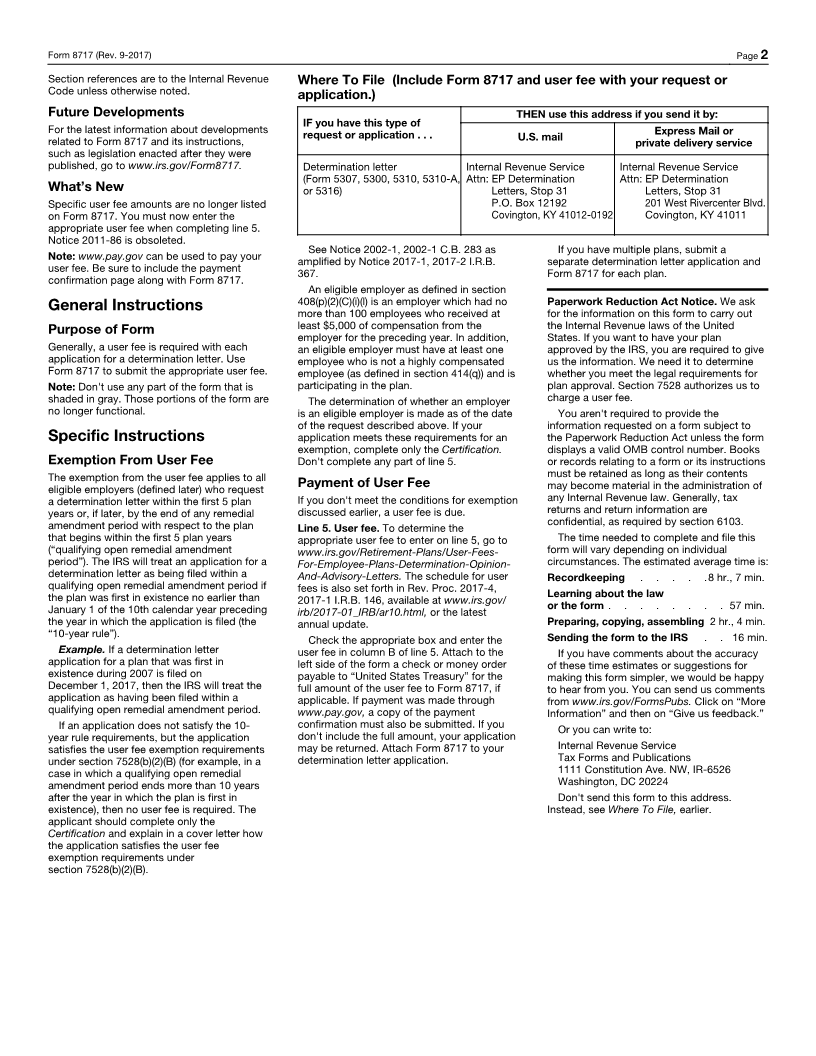

Section references are to the Internal Revenue Where To File (Include Form 8717 and user fee with your request or

Code unless otherwise noted. application.)

Future Developments THEN use this address if you send it by:

For the latest information about developments IF you have this type of

related to Form 8717 and its instructions, request or application . . . U.S. mail Express Mail or

private delivery service

such as legislation enacted after they were

published, go to www.irs.gov/Form8717. Determination letter Internal Revenue Service Internal Revenue Service

(Form 5307, 5300, 5310, 5310-A, Attn: EP Determination Attn: EP Determination

What’s New or 5316) Letters, Stop 31 Letters, Stop 31

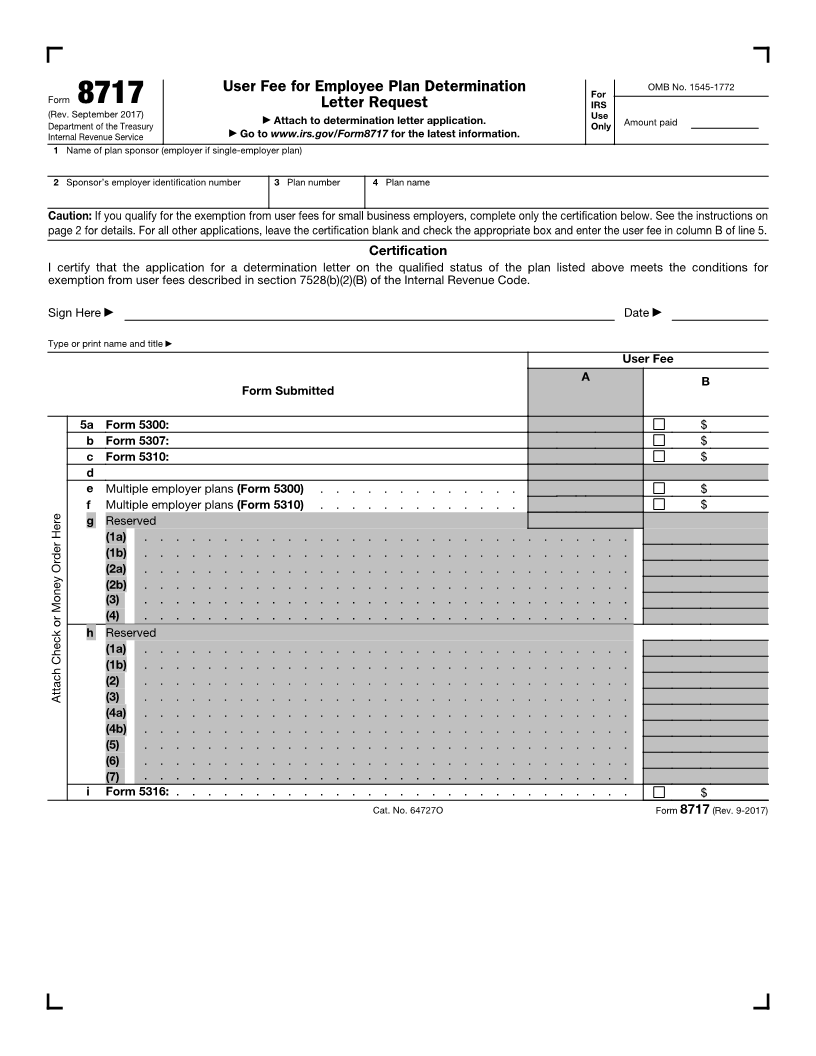

Specific user fee amounts are no longer listed P.O. Box 12192 201 West Rivercenter Blvd.

on Form 8717. You must now enter the Covington, KY 41012-0192 Covington, KY 41011

appropriate user fee when completing line 5.

Notice 2011-86 is obsoleted.

See Notice 2002-1, 2002-1 C.B. 283 as If you have multiple plans, submit a

Note: www.pay.gov can be used to pay your amplified by Notice 2017-1, 2017-2 I.R.B. separate determination letter application and

user fee. Be sure to include the payment 367. Form 8717 for each plan.

confirmation page along with Form 8717.

An eligible employer as defined in section

General Instructions 408(p)(2)(C)(i)(l) is an employer which had no Paperwork Reduction Act Notice. We ask

more than 100 employees who received at for the information on this form to carry out

Purpose of Form least $5,000 of compensation from the the Internal Revenue laws of the United

employer for the preceding year. In addition, States. If you want to have your plan

Generally, a user fee is required with each an eligible employer must have at least one approved by the IRS, you are required to give

application for a determination letter. Use employee who is not a highly compensated us the information. We need it to determine

Form 8717 to submit the appropriate user fee. employee (as defined in section 414(q)) and is whether you meet the legal requirements for

Note: Don't use any part of the form that is participating in the plan. plan approval. Section 7528 authorizes us to

shaded in gray. Those portions of the form are The determination of whether an employer charge a user fee.

no longer functional. is an eligible employer is made as of the date You aren't required to provide the

of the request described above. If your information requested on a form subject to

Specific Instructions application meets these requirements for an the Paperwork Reduction Act unless the form

exemption, complete only the Certification. displays a valid OMB control number. Books

Exemption From User Fee Don't complete any part of line 5. or records relating to a form or its instructions

must be retained as long as their contents

The exemption from the user fee applies to all Payment of User Fee may become material in the administration of

eligible employers (defined later) who request

a determination letter within the first 5 plan If you don't meet the conditions for exemption any Internal Revenue law. Generally, tax

years or, if later, by the end of any remedial discussed earlier, a user fee is due. returns and return information are

confidential, as required by section 6103.

amendment period with respect to the plan Line 5. User fee. To determine the

that begins within the first 5 plan years appropriate user fee to enter on line 5, go to The time needed to complete and file this

(“qualifying open remedial amendment www.irs.gov/Retirement-Plans/User-Fees- form will vary depending on individual

period”). The IRS will treat an application for a For-Employee-Plans-Determination-Opinion- circumstances. The estimated average time is:

determination letter as being filed within a And-Advisory-Letters. The schedule for user Recordkeeping . . . . .8 hr., 7 min.

qualifying open remedial amendment period if fees is also set forth in Rev. Proc. 2017-4, Learning about the law

the plan was first in existence no earlier than 2017-1 I.R.B. 146, available at www.irs.gov/ or the form . . . . . . . . 57 min.

January 1 of the 10th calendar year preceding irb/2017-01_IRB/ar10.html, or the latest

the year in which the application is filed (the annual update. Preparing, copying, assembling 2 hr., 4 min.

“10-year rule”). Sending the form to the IRS . . 16 min.

Check the appropriate box and enter the

Example. If a determination letter user fee in column B of line 5. Attach to the If you have comments about the accuracy

application for a plan that was first in left side of the form a check or money order of these time estimates or suggestions for

existence during 2007 is filed on payable to “United States Treasury” for the making this form simpler, we would be happy

December 1, 2017, then the IRS will treat the full amount of the user fee to Form 8717, if to hear from you. You can send us comments

application as having been filed within a applicable. If payment was made through from www.irs.gov/FormsPubs. Click on “More

qualifying open remedial amendment period. www.pay.gov, a copy of the payment Information” and then on “Give us feedback.”

If an application does not satisfy the 10- confirmation must also be submitted. If you Or you can write to:

year rule requirements, but the application don't include the full amount, your application

satisfies the user fee exemption requirements may be returned. Attach Form 8717 to your Internal Revenue Service

under section 7528(b)(2)(B) (for example, in a determination letter application. Tax Forms and Publications

case in which a qualifying open remedial 1111 Constitution Ave. NW, IR-6526

amendment period ends more than 10 years Washington, DC 20224

after the year in which the plan is first in Don't send this form to this address.

existence), then no user fee is required. The Instead, see Where To File, earlier.

applicant should complete only the

Certification and explain in a cover letter how

the application satisfies the user fee

exemption requirements under

section 7528(b)(2)(B).

|