Enlarge image

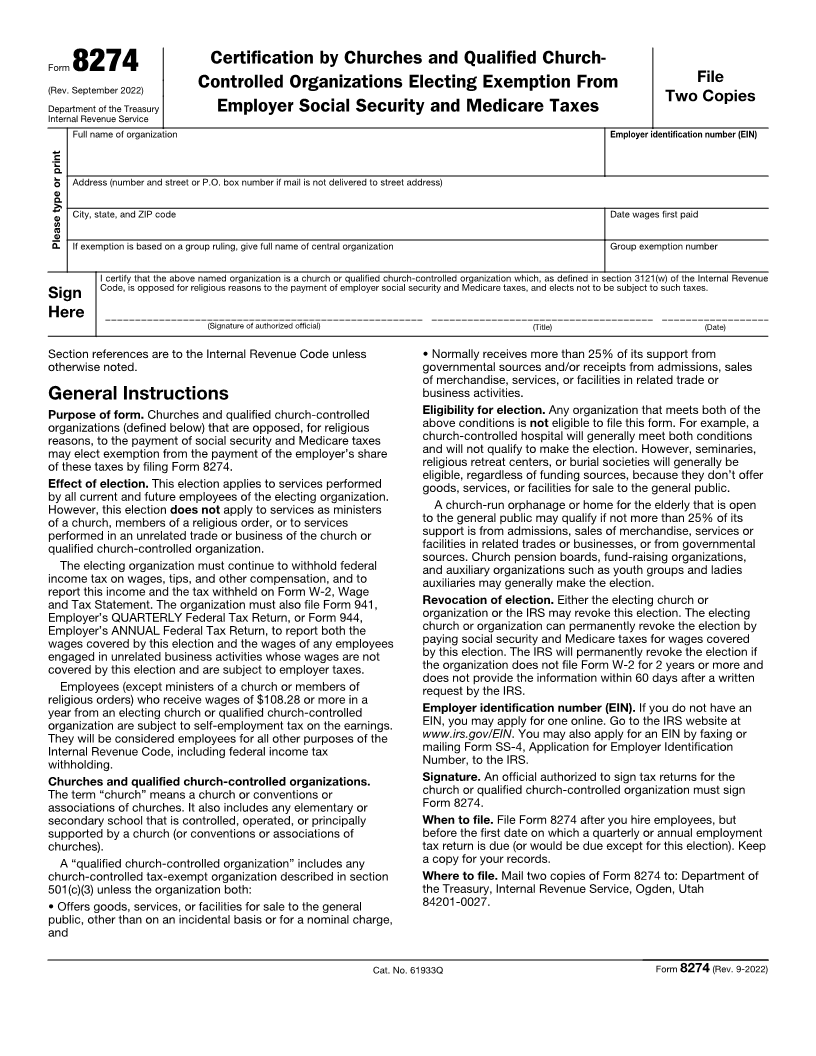

Certification by Churches and Qualified Church-

Form 8274

File

(Rev. September 2022) Controlled Organizations Electing Exemption From

Two Copies

Department of the Treasury Employer Social Security and Medicare Taxes

Internal Revenue Service

Full name of organization Employer identification number (EIN)

Address (number and street or P.O. box number if mail is not delivered to street address)

City, state, and ZIP code Date wages first paid

Please type or print If exemption is based on a group ruling, give full name of central organization Group exemption number

I certify that the above named organization is a church or qualified church-controlled organization which, as defined in section 3121(w) of the Internal Revenue

Code, is opposed for religious reasons to the payment of employer social security and Medicare taxes, and elects not to be subject to such taxes.

Sign

Here

(Signature of authorized official) (Title) (Date)

Section references are to the Internal Revenue Code unless • Normally receives more than 25% of its support from

otherwise noted. governmental sources and/or receipts from admissions, sales

of merchandise, services, or facilities in related trade or

General Instructions business activities.

Purpose of form. Churches and qualified church-controlled Eligibility for election. Any organization that meets both of the

organizations (defined below) that are opposed, for religious above conditions is not eligible to file this form. For example, a

reasons, to the payment of social security and Medicare taxes church-controlled hospital will generally meet both conditions

may elect exemption from the payment of the employer’s share and will not qualify to make the election. However, seminaries,

of these taxes by filing Form 8274. religious retreat centers, or burial societies will generally be

eligible, regardless of funding sources, because they don’t offer

Effect of election. This election applies to services performed goods, services, or facilities for sale to the general public.

by all current and future employees of the electing organization.

However, this election does not apply to services as ministers A church-run orphanage or home for the elderly that is open

of a church, members of a religious order, or to services to the general public may qualify if not more than 25% of its

performed in an unrelated trade or business of the church or support is from admissions, sales of merchandise, services or

qualified church-controlled organization. facilities in related trades or businesses, or from governmental

sources. Church pension boards, fund-raising organizations,

The electing organization must continue to withhold federal and auxiliary organizations such as youth groups and ladies

income tax on wages, tips, and other compensation, and to auxiliaries may generally make the election.

report this income and the tax withheld on Form W-2, Wage

and Tax Statement. The organization must also file Form 941, Revocation of election. Either the electing church or

Employer’s QUARTERLY Federal Tax Return, or Form 944, organization or the IRS may revoke this election. The electing

Employer’s ANNUAL Federal Tax Return, to report both the church or organization can permanently revoke the election by

wages covered by this election and the wages of any employees paying social security and Medicare taxes for wages covered

engaged in unrelated business activities whose wages are not by this election. The IRS will permanently revoke the election if

covered by this election and are subject to employer taxes. the organization does not file Form W-2 for 2 years or more and

does not provide the information within 60 days after a written

Employees (except ministers of a church or members of request by the IRS.

religious orders) who receive wages of $108.28 or more in a

year from an electing church or qualified church-controlled Employer identification number (EIN). If you do not have an

organization are subject to self-employment tax on the earnings. EIN, you may apply for one online. Go to the IRS website at

They will be considered employees for all other purposes of the www.irs.gov/EIN. You may also apply for an EIN by faxing or

Internal Revenue Code, including federal income tax mailing Form SS-4, Application for Employer Identification

withholding. Number, to the IRS.

Churches and qualified church-controlled organizations. Signature. An official authorized to sign tax returns for the

The term “church” means a church or conventions or church or qualified church-controlled organization must sign

associations of churches. It also includes any elementary or Form 8274.

secondary school that is controlled, operated, or principally When to file. File Form 8274 after you hire employees, but

supported by a church (or conventions or associations of before the first date on which a quarterly or annual employment

churches). tax return is due (or would be due except for this election). Keep

A “qualified church-controlled organization” includes any a copy for your records.

church-controlled tax-exempt organization described in section Where to file. Mail two copies of Form 8274 to: Department of

501(c)(3) unless the organization both: the Treasury, Internal Revenue Service, Ogden, Utah

• Offers goods, services, or facilities for sale to the general 84201-0027.

public, other than on an incidental basis or for a nominal charge,

and

Cat. No. 61933Q Form 8274 (Rev. 9-2022)