Enlarge image

2

TLS, have you I.R.S. SPECIFICATIONS TO BE REMOVED BEFORE PRINTING

transmitted all R INSTRUCTIONS TO PRINTERS Action Date Signature

text files for this

cycle update? FORM 712, PAGE 1 of 41 2 PRINTS: HEAD to HEAD O.K. to print

MARGINS: TOP 13mm ( ⁄ ”), CENTER SIDES.

PAPER: WHITE WRITING, SUB. 20. INK: BLACK 1 2

FLAT SIZE: 432mm (17") x 279mm (11") FOLD TO: 216mm (8 ⁄ ") x 279mm (11")

Date PERFORATE: ON THE FOLD Revised proofs

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT requested

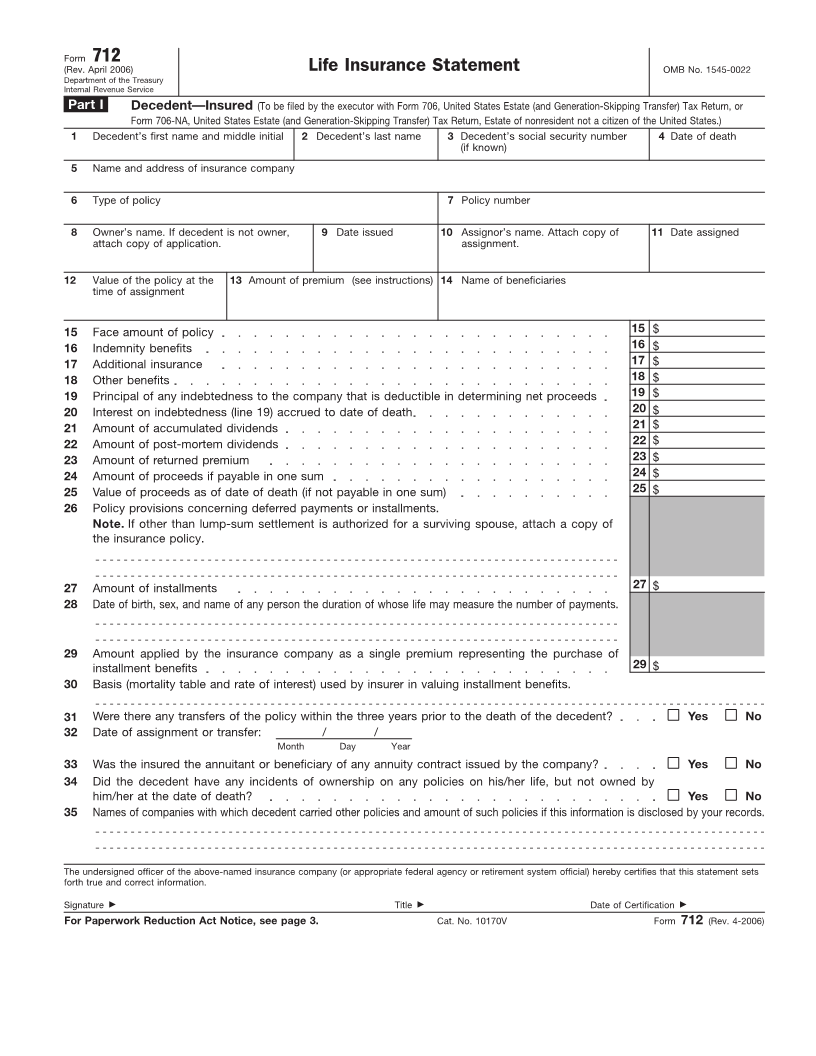

Form 712

(Rev. April 2006) Life Insurance Statement OMB No. 1545-0022

Department of the Treasury

Internal Revenue Service

Part I Decedent—Insured (To be filed by the executor with Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, or

Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return, Estate of nonresident not a citizen of the United States.)

1 Decedent’s first name and middle initial 2 Decedent’s last name 3 Decedent’s social security number 4 Date of death

(if known)

5 Name and address of insurance company

6 Type of policy 7 Policy number

8 Owner’s name. If decedent is not owner, 9 Date issued 10 Assignor’s name. Attach copy of 11 Date assigned

attach copy of application. assignment.

12 Value of the policy at the 13 Amount of premium (see instructions) 14 Name of beneficiaries

time of assignment

15 Face amount of policy 15 $

16 Indemnity benefits 16 $

17 Additional insurance 17 $

18 Other benefits 18 $

19 Principal of any indebtedness to the company that is deductible in determining net proceeds 19 $

20 Interest on indebtedness (line 19) accrued to date of death 20 $

21 Amount of accumulated dividends 21 $

22 Amount of post-mortem dividends 22 $

23 Amount of returned premium 23 $

24 Amount of proceeds if payable in one sum 24 $

25 Value of proceeds as of date of death (if not payable in one sum) 25 $

26 Policy provisions concerning deferred payments or installments.

Note. If other than lump-sum settlement is authorized for a surviving spouse, attach a copy of

the insurance policy.

27 Amount of installments 27 $

28 Date of birth, sex, and name of any person the duration of whose life may measure the number of payments.

29 Amount applied by the insurance company as a single premium representing the purchase of

installment benefits 29 $

30 Basis (mortality table and rate of interest) used by insurer in valuing installment benefits.

31 Were there any transfers of the policy within the three years prior to the death of the decedent? Yes No

32 Date of assignment or transfer: / /

Month Day Year

33 Was the insured the annuitant or beneficiary of any annuity contract issued by the company? Yes No

34 Did the decedent have any incidents of ownership on any policies on his/her life, but not owned by

him/her at the date of death? Yes No

35 Names of companies with which decedent carried other policies and amount of such policies if this information is disclosed by your records.

The undersigned officer of the above-named insurance company (or appropriate federal agency or retirement system official) hereby certifies that this statement sets

forth true and correct information.

Signature Title Date of Certification

For Paperwork Reduction Act Notice, see page 3. Cat. No. 10170V Form 712 (Rev. 4-2006)