Enlarge image

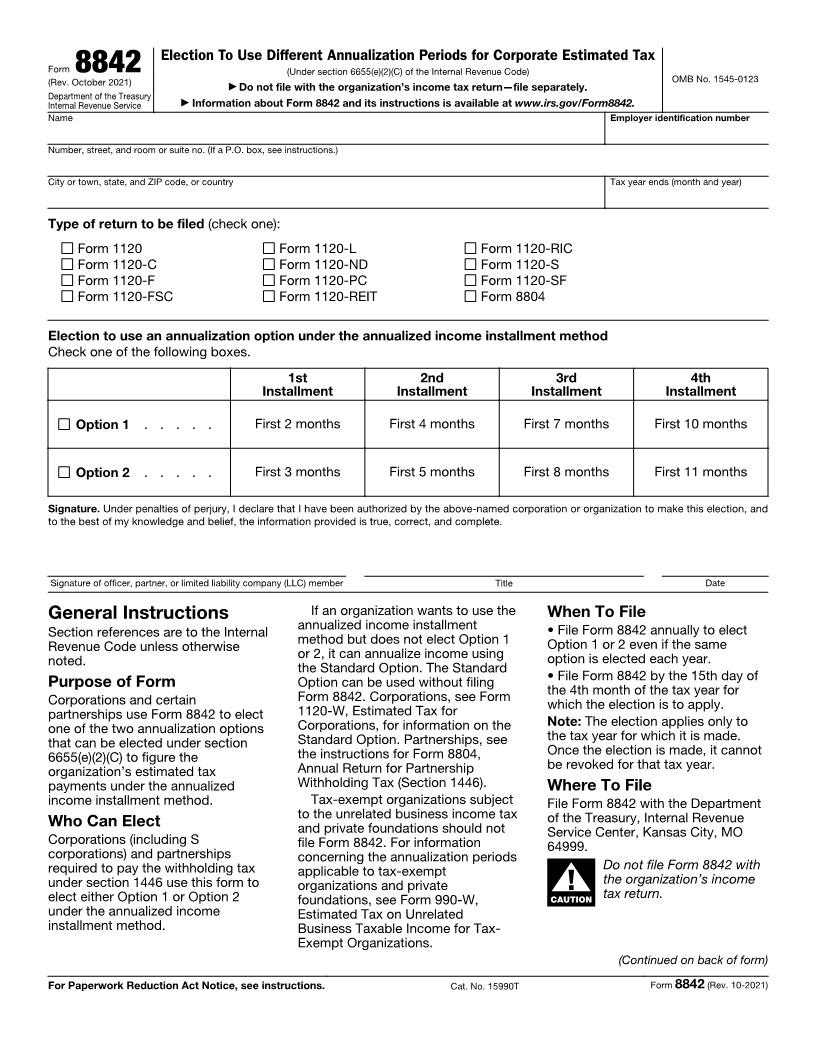

Election To Use Different Annualization Periods for Corporate Estimated Tax

Form 8842 (Under section 6655(e)(2)(C) of the Internal Revenue Code)

OMB No. 1545-0123

(Rev. October 2021) ▶ Do not file with the organization’s income tax return—file separately.

Department of the Treasury ▶ Information about Form 8842 and its instructions is available at www.irs.gov/Form8842.

Internal Revenue Service

Name Employer identification number

Number, street, and room or suite no. (If a P.O. box, see instructions.)

City or town, state, and ZIP code, or country Tax year ends (month and year)

Type of return to be filed (check one):

Form 1120 Form 1120-L Form 1120-RIC

Form 1120-C Form 1120-ND Form 1120-S

Form 1120-F Form 1120-PC Form 1120-SF

Form 1120-FSC Form 1120-REIT Form 8804

Election to use an annualization option under the annualized income installment method

Check one of the following boxes.

1st 2nd 3rd 4th

Installment Installment Installment Installment

Option 1 . . . . . First 2 months First 4 months First 7 months First 10 months

Option 2 . . . . . First 3 months First 5 months First 8 months First 11 months

Signature. Under penalties of perjury, I declare that I have been authorized by the above-named corporation or organization to make this election, and

to the best of my knowledge and belief, the information provided is true, correct, and complete.

Signature of officer, partner, or limited liability company (LLC) member Title Date

General Instructions If an organization wants to use the When To File

annualized income installment

Section references are to the Internal • File Form 8842 annually to elect

method but does not elect Option 1

Revenue Code unless otherwise Option 1 or 2 even if the same

or 2, it can annualize income using

noted. option is elected each year.

the Standard Option. The Standard

Purpose of Form Option can be used without filing • File Form 8842 by the 15th day of

Corporations and certain Form 8842. Corporations, see Form the 4th month of the tax year for

partnerships use Form 8842 to elect 1120-W, Estimated Tax for which the election is to apply.

one of the two annualization options Corporations, for information on the Note: The election applies only to

that can be elected under section Standard Option. Partnerships, see the tax year for which it is made.

6655(e)(2)(C) to figure the the instructions for Form 8804, Once the election is made, it cannot

organization’s estimated tax Annual Return for Partnership be revoked for that tax year.

payments under the annualized Withholding Tax (Section 1446). Where To File

income installment method. Tax-exempt organizations subject File Form 8842 with the Department

to the unrelated business income tax of the Treasury, Internal Revenue

Who Can Elect and private foundations should not Service Center, Kansas City, MO

Corporations (including S file Form 8842. For information 64999.

corporations) and partnerships concerning the annualization periods

required to pay the withholding tax applicable to tax-exempt Do not file Form 8842 with

the organization’s income

under section 1446 use this form to organizations and private ▲! tax return.

elect either Option 1 or Option 2 foundations, see Form 990-W, CAUTION

under the annualized income Estimated Tax on Unrelated

installment method. Business Taxable Income for Tax-

Exempt Organizations.

(Continued on back of form)

For Paperwork Reduction Act Notice, see instructions. Cat. No. 15990T Form 8842 (Rev. 10-2021)