Enlarge image

Department of the Treasury - Internal Revenue Service

Form 12508

(June 2021)

Questionnaire for Non-Requesting Spouse

We recognize that some of these questions involve sensitive subjects. However, we need this information to evaluate the

circumstances of the request for relief and properly determine whether relief should be given. If this form is not completed and returned,

the request for relief will be considered based on the information available to us.

If the requesting spouse petitions the Tax Court to review their request for relief, the Tax Court may only be allowed to consider

information you and the requesting spouse provided before we made our final determination, additional information we included in our

administrative file about the requesting spouse’s request for relief, and any information that is newly discovered or previously

unavailable. Therefore, it is important that you provide us with information you want us or the Tax Court to consider.

Part I - Tell Us About Yourself

1. Your current name Your social security number

Your current home address (number & street) Apartment number County

City, town or post office box, state and ZIP code Daytime phone number (between 6 a.m. and 5

p.m. eastern time)

2. What is the current status between you and your spouse for the years that relief was requested? (On this form we refer to your spouse

for the years that relief was requested as that individual)

Married and living together

Married living apart since (MM/DD/YYYY)

Legally separated since (MM/DD/YYYY)

Divorced since (MM/DD/YYYY)

Widowed since (MM/DD/YYYY)

Note: A divorce decree stating you must pay all taxes does not necessarily mean that individual will qualify for relief.

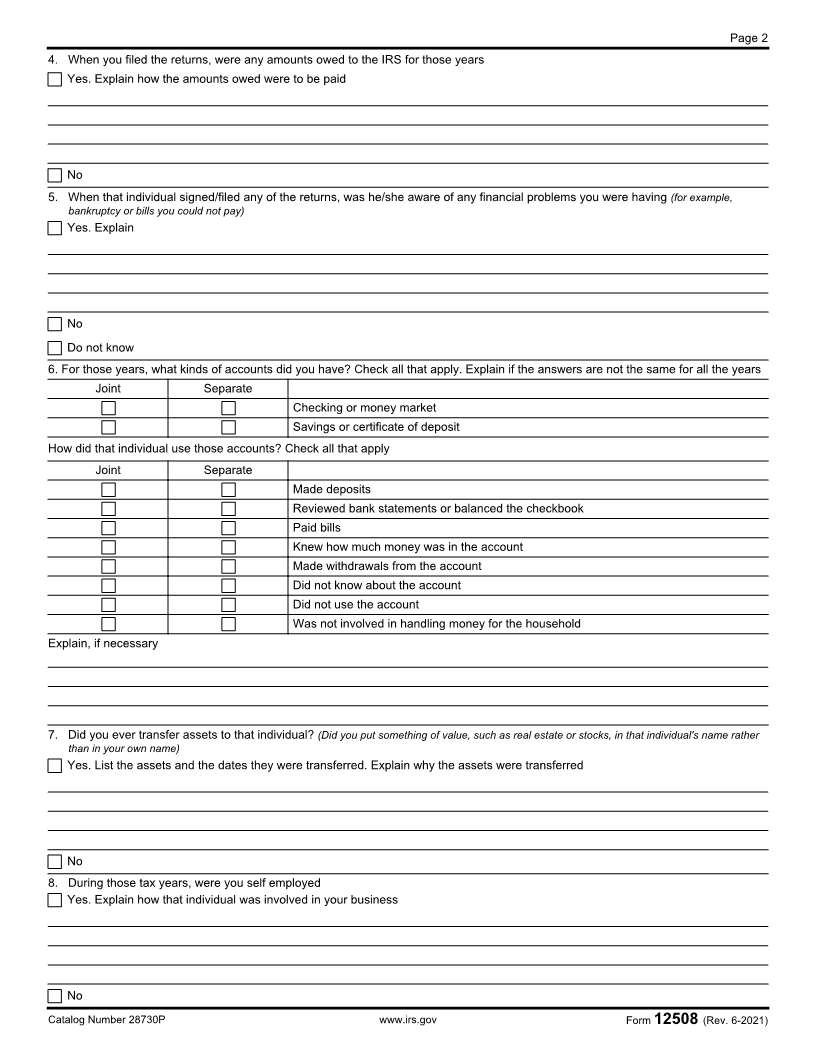

Part II - Tell Us About Filing the Returns and Your Financial Situation for the Years Listed on the Letter

If the information is not the same for all tax years, explain. If you need more room to write your answer for any question,

attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

3. How were both of you involved with preparing the returns during those tax years? Check all that apply and explain, if necessary. If

the answers are not the same for all the years, explain

You That Individual

Prepared or helped prepare the returns

Gathered receipts and canceled checks

Gave tax documents (such as W-2s, 1099s, etc.) to the person who prepared the returns

Asked the person who prepared the returns to explain any items or amounts

Reviewed the returns before filing them

Did not review the returns before filing them

Was not involved with preparing the return

Other

Explain, if necessary

Catalog Number 28730P www.irs.gov Form 12508 (Rev. 6-2021)