Enlarge image

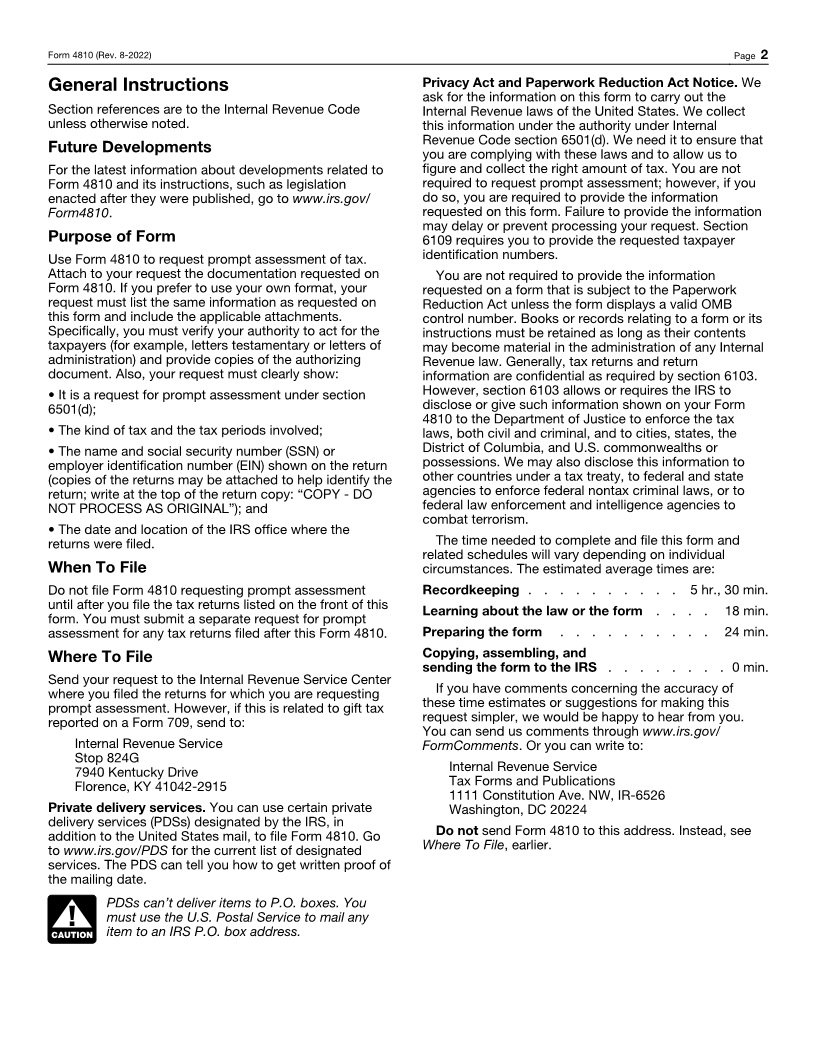

Request for Prompt Assessment Under OMB No. 1545-0430

Form 4810 Internal Revenue Code Section 6501(d)

(Rev. August 2022)

Department of the Treasury See instructions on back. For IRS Use Only

Internal Revenue Service Go to www.irs.gov/Form4810 for the latest information.

Requester’s name Kind of tax

Income

Gift

Title

Employment

Excise

Number, street, and room or suite no. (If a P.O. box, see instructions.)

City, town, or post office, state, and ZIP code Daytime phone number

Tax Returns for Which Prompt Assessment of Any Additional Tax Is Requested

Form Tax Period SSN/EIN on Name and Address Shown on Return Service Center Where Filed Date Filed

Number Ended Return

If applicable, provide the name of decedent’s spouse (surviving or deceased). Spouse’s social security number

If corporate income tax returns are included, check the applicable box below:

Dissolution has been completed.

Dissolution has begun and will be completed either before or after the 18-month period of limitation.

Dissolution has not begun but will begin before the 18-month period of limitation expires and will be completed either before or after that

period expires.

Attached are copies of:

The returns listed above.

Letters of administration or letters testamentary.

Other (describe):

I request a prompt assessment of any additional tax for the kind of tax and periods shown above, as provided by Internal Revenue Code section 6501(d).

Under penalties of perjury, I declare that I have examined this request, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete.

I certify that I have never been assessed any penalties for civil fraud for any federal or state tax matter nor have I been charged with, indicted for,

Sign or convicted of fraud. If you cannot certify this statement, attach a detailed statement explaining the circumstances under which you were

assessed a penalty, charged with, indicted for, or convicted of fraud.

Here

Signature of requester Date Identifying number

For Privacy Act and Paperwork Reduction Act Notice, see back of form. Cat. No. 42022S Form 4810 (Rev. 8-2022)