Enlarge image

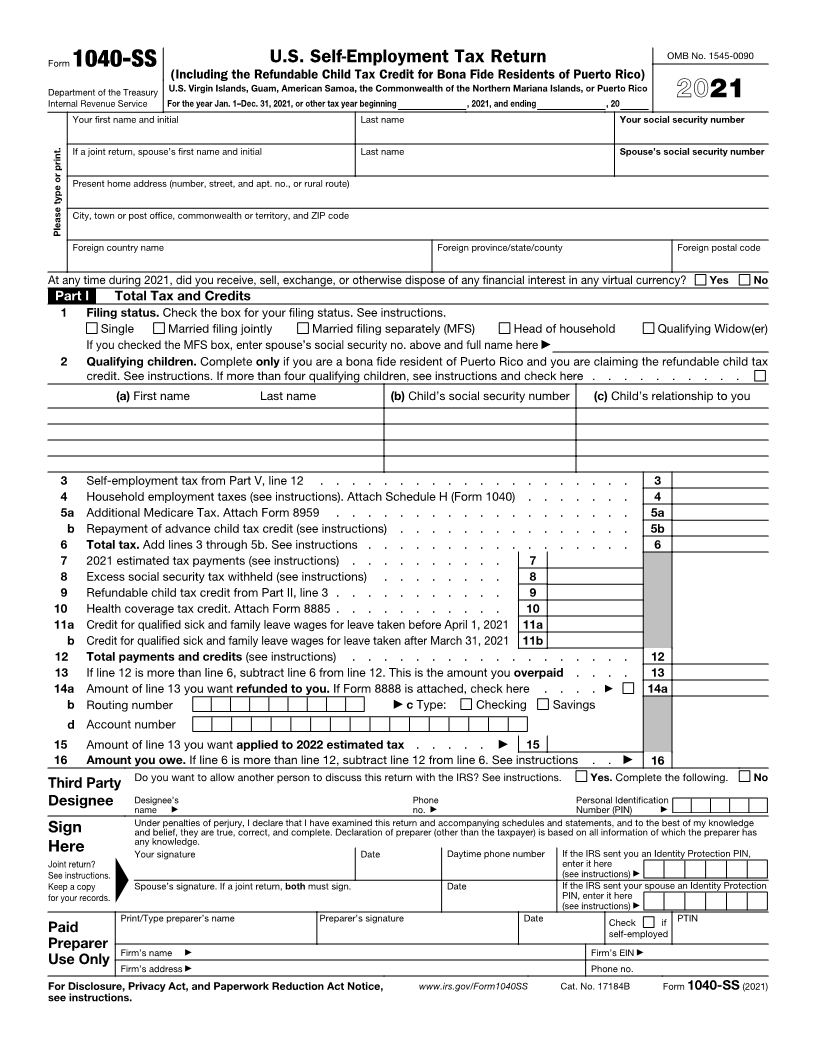

Form 1040-SS U.S. Self-Employment Tax Return OMB No. 1545-0090

(Including the Refundable Child Tax Credit for Bona Fide Residents of Puerto Rico)

Department of the Treasury U.S. Virgin Islands, Guam, American Samoa, the Commonwealth of the Northern Mariana Islands, or Puerto Rico 2021

Internal Revenue Service For the year Jan. 1–Dec. 31, 2021, or other tax year beginning , 2021, and ending , 20

Your first name and initial Last name Your social security number

If a joint return, spouse’s first name and initial Last name Spouse’s social security number

Present home address (number, street, and apt. no., or rural route)

City, town or post office, commonwealth or territory, and ZIP code

Please type or print.

Foreign country name Foreign province/state/county Foreign postal code

At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes No

Part I Total Tax and Credits

1 Filing status. Check the box for your filing status. See instructions.

Single Married filing jointly Married filing separately (MFS) Head of household Qualifying Widow(er)

If you checked the MFS box, enter spouse’s social security no. above and full name here ▶

2 Qualifying children. Complete only if you are a bona fide resident of Puerto Rico and you are claiming the refundable child tax

credit. See instructions. If more than four qualifying children, see instructions and check here . . . . . . . . . .

(a) First name Last name (b) Child’s social security number (c) Child’s relationship to you

3 Self-employment tax from Part V, line 12 . . . . . . . . . . . . . . . . . . . . 3

4 Household employment taxes (see instructions). Attach Schedule H (Form 1040) . . . . . . . 4

5 a Additional Medicare Tax. Attach Form 8959 . . . . . . . . . . . . . . . . . . . 5a

b Repayment of advance child tax credit (see instructions) . . . . . . . . . . . . . . . 5b

6 Total tax. Add lines 3 through 5b. See instructions . . . . . . . . . . . . . . . . . 6

7 2021 estimated tax payments (see instructions) . . . . . . . . . . 7

8 Excess social security tax withheld (see instructions) . . . . . . . . 8

9 Refundable child tax credit from Part II, line 3 . . . . . . . . . . . 9

10 Health coverage tax credit. Attach Form 8885 . . . . . . . . . . . 10

11a Credit for qualified sick and family leave wages for leave taken before April 1, 2021 11a

b Credit for qualified sick and family leave wages for leave taken after March 31, 2021 11b

12 Total payments and credits (see instructions) . . . . . . . . . . . . . . . . . . 12

13 If line 12 is more than line 6, subtract line 6 from line 12. This is the amount you overpaid . . . . 13

14a Amount of line 13 you want refunded to you. If Form 8888 is attached, check here . . . . ▶ 14a

b Routing number ▶ Type:c Checking Savings

d Account number

15 Amount of line 13 you want applied to 2022 estimated tax . . . . . ▶ 15

16 Amount you owe. If line 6 is more than line 12, subtract line 12 from line 6. See instructions . . ▶ 16

Do you want to allow another person to discuss this return with the IRS? See instructions. Yes. Complete the following. No

Third Party

Designee Designee’s Phone Personal Identification

name ▶ no. ▶ Number (PIN) ▶

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

Sign and belief, they are true, correct, and complete. Declaration of preparer (other than the taxpayer) is based on all information of which the preparer has

any knowledge.

Here ▲ Your signature Date Daytime phone number If the IRS sent you an Identity Protection PIN,

Joint return? enter it here

See instructions. (see instructions) ▶

Keep a copy Spouse’s signature. If a joint return, both must sign. Date If the IRS sent your spouse an Identity Protection

for your records. PIN, enter it here

(see instructions) ▶

Print/Type preparer’s name Preparer’s signature Date Check if PTIN

Paid self-employed

Preparer ▶ Firm’s EIN ▶

Firm’s name

Firm’s address

Use Only ▶ Phone no.

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, www.irs.gov/Form1040SS Cat. No. 17184B Form 1040-SS (2021)

see instructions.