Enlarge image

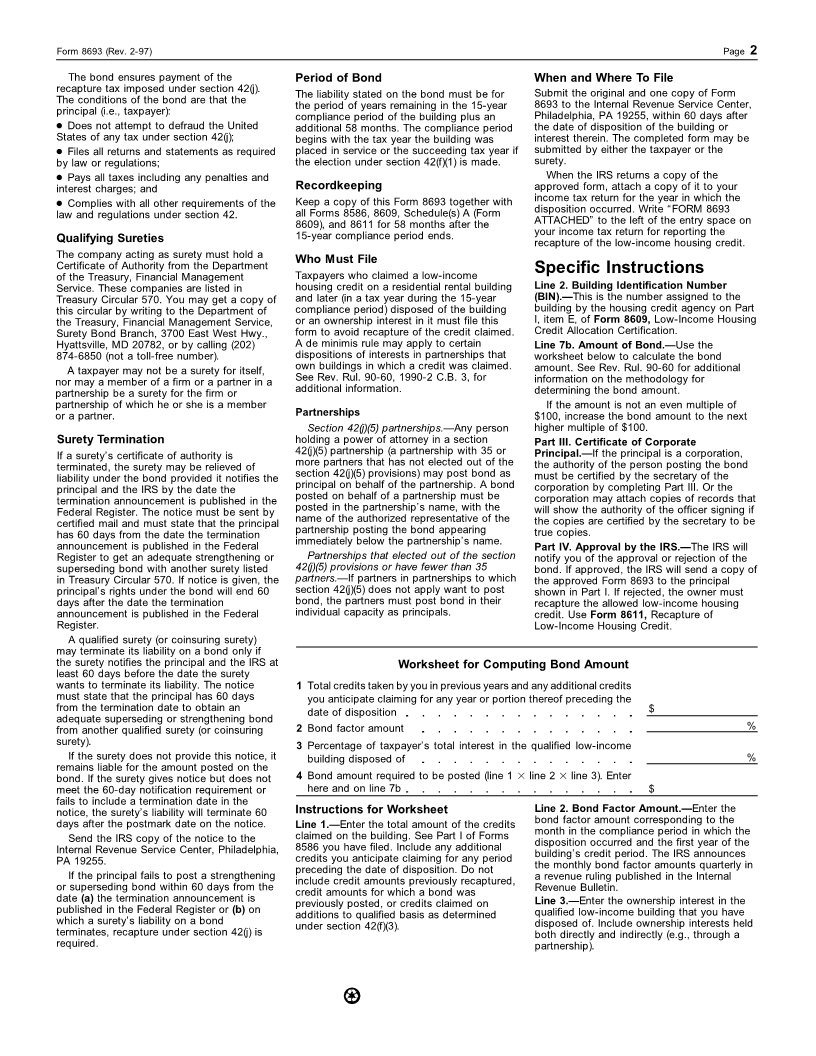

Form 8693 Low-Income Housing Credit Disposition Bond OMB No. 1545–1029

(Rev. February 1997) (For use by taxpayers posting bond under section 42(j)(6))

Department of the Treasury Attachment

Internal Revenue Service Attach to your return after receiving IRS approval. Sequence No. 91

Name of taxpayer making disposition Identifying number

Part I Bonding

1 Address of building as shown on Form 8609 (do not use P.O. box) 2 Building identification number

3 Date the 15-year compliance period ends

4 Check the box that applies: 5 Date property 6 Date bond issued

interest disposed of

This is an original bond, strengthening bond, or superseding bond.

7a Bond is given by ()

Principal Telephone number (optional)

Address

as principal and

Surety

as surety or sureties.

Address

7b As principal and surety, we are obligated to the United States in the amount of $ . We also

jointly and severally obligate our heirs, executors, administrators, successors, and assigns for the payment of this amount.

Part II Signatures

Under penalties of perjury, I declare that I have examined this form and any accompanying statements, and to the best of my knowledge and belief,

they are true, correct, and complete.

Signature of principal Name (please print) Date

Signature of principal Name (please print) Date

Signature of surety Name and identifying number (please print) Date

Signature of surety Name and identifying number (please print) Date

Part III Certificate of Corporate Principal (corporations only)

I certify that the person above, who signed on behalf of the principal, was an authorized representative of the corporation.

Signature of secretary of the corporation Name (please print) Date

Part IV Approval by IRS (See instructions.)

Bond approved

Date Internal Revenue Service official

General Instructions number. Books or records relating to a form If you have comments concerning the

or its instructions must be retained as long as accuracy of these time estimates or

Section references are to the Internal their contents may become material in the suggestions for making this form simpler, we

Revenue Code. administration of any Internal Revenue law. would be happy to hear from you. You can

Paperwork Reduction Act Generally, tax returns and return information write to the Tax Forms Committee, Western

are confidential, as required by section 6103. Area Distribution Center, Rancho Cordova,

Notice The time needed to complete and file this CA 95743-0001. DO NOT send Form 8693 to

We ask for the information on this form to form will vary depending on individual this address. Instead, see When and Where

carry out the Internal Revenue laws of the circumstances. The estimated average time To File on page 2.

United States. You are required to give us the is: Purpose of Form

information. We need it to ensure that you are Recordkeeping 13 min. Use Form 8693 to post a bond under section

complying with these laws and to allow us to Learning about the 42(j)(6) to avoid recapture of the low-income

figure and collect the right amount of tax. law or the form 14 min. housing credit.

You are not required to provide the Preparing, copying,

information requested on a form that is assembling, and sending

subject to the Paperwork Reduction Act the form to the IRS 40 min.

unless the form displays a valid OMB control

Cat. No. 10298Y Form 8693 (Rev. 2-97)