Enlarge image

OMB No. 1545-1809

Credit for Employer-Provided Childcare

Form 8882

(Rev. December 2017) Facilities and Services

▶ Attach to your tax return. Attachment

Sequence No. 131

Department of the Treasury ▶ Go to www.irs.gov/Form8882 for the latest information.

Internal Revenue Service

Name(s) shown on return Identifying number

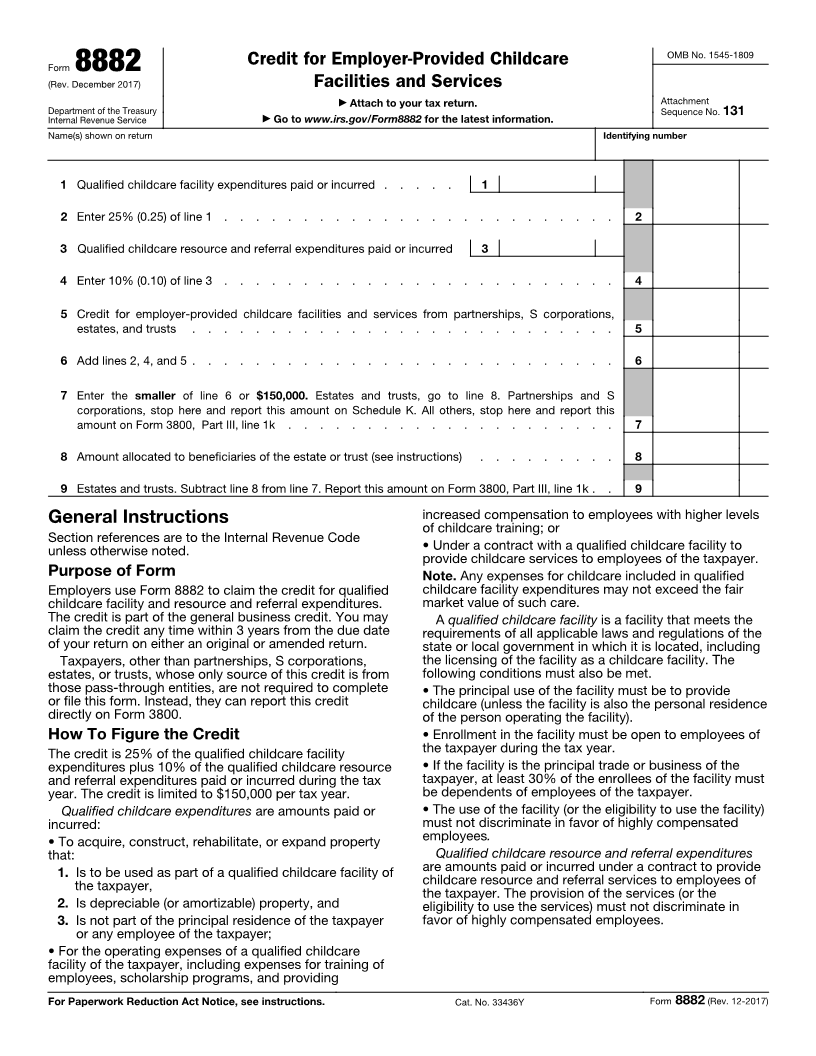

1 Qualified childcare facility expenditures paid or incurred . . . . . 1

2 Enter 25% (0.25) of line 1 . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Qualified childcare resource and referral expenditures paid or incurred 3

4 Enter 10% (0.10) of line 3 . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Credit for employer-provided childcare facilities and services from partnerships, S corporations,

estates, and trusts . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Add lines 2, 4, and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Enter the smaller of line 6 or $150,000. Estates and trusts, go to line 8. Partnerships and S

corporations, stop here and report this amount on Schedule K. All others, stop here and report this

amount on Form 3800, Part III, line 1k . . . . . . . . . . . . . . . . . . . . . 7

8 Amount allocated to beneficiaries of the estate or trust (see instructions) . . . . . . . . . 8

9 Estates and trusts. Subtract line 8 from line 7. Report this amount on Form 3800, Part III, line 1k . . 9

General Instructions increased compensation to employees with higher levels

of childcare training; or

Section references are to the Internal Revenue Code

unless otherwise noted. • Under a contract with a qualified childcare facility to

provide childcare services to employees of the taxpayer.

Purpose of Form Note. Any expenses for childcare included in qualified

Employers use Form 8882 to claim the credit for qualified childcare facility expenditures may not exceed the fair

childcare facility and resource and referral expenditures. market value of such care.

The credit is part of the general business credit. You may A qualified childcare facility is a facility that meets the

claim the credit any time within 3 years from the due date requirements of all applicable laws and regulations of the

of your return on either an original or amended return. state or local government in which it is located, including

Taxpayers, other than partnerships, S corporations, the licensing of the facility as a childcare facility. The

estates, or trusts, whose only source of this credit is from following conditions must also be met.

those pass-through entities, are not required to complete • The principal use of the facility must be to provide

or file this form. Instead, they can report this credit childcare (unless the facility is also the personal residence

directly on Form 3800. of the person operating the facility).

How To Figure the Credit • Enrollment in the facility must be open to employees of

The credit is 25% of the qualified childcare facility the taxpayer during the tax year.

expenditures plus 10% of the qualified childcare resource • If the facility is the principal trade or business of the

and referral expenditures paid or incurred during the tax taxpayer, at least 30% of the enrollees of the facility must

year. The credit is limited to $150,000 per tax year. be dependents of employees of the taxpayer.

Qualified childcare expenditures are amounts paid or • The use of the facility (or the eligibility to use the facility)

incurred: must not discriminate in favor of highly compensated

• To acquire, construct, rehabilitate, or expand property employees .

that: Qualified childcare resource and referral expenditures

1. Is to be used as part of a qualified childcare facility of are amounts paid or incurred under a contract to provide

the taxpayer, childcare resource and referral services to employees of

the taxpayer. The provision of the services (or the

2. Is depreciable (or amortizable) property, and eligibility to use the services) must not discriminate in

3. Is not part of the principal residence of the taxpayer favor of highly compensated employees.

or any employee of the taxpayer;

• For the operating expenses of a qualified childcare

facility of the taxpayer, including expenses for training of

employees, scholarship programs, and providing

For Paperwork Reduction Act Notice, see instructions. Cat. No. 33436Y Form 8882 (Rev. 12-2017)