Enlarge image

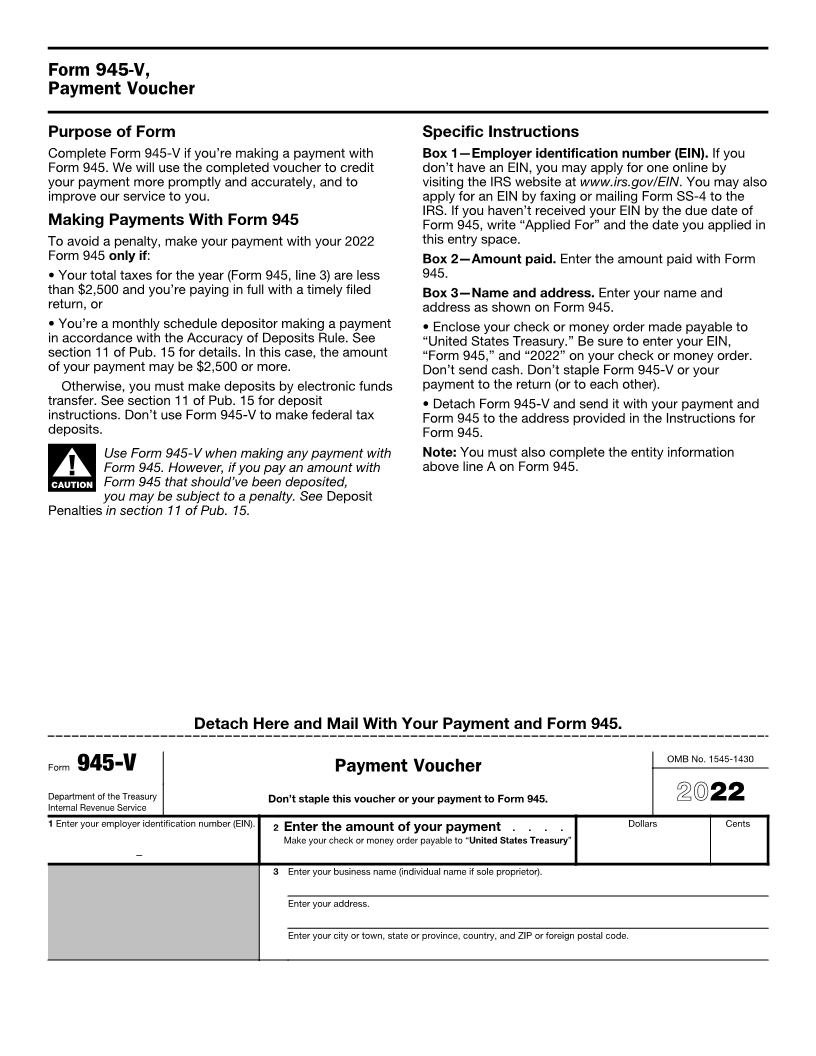

OMB No. 1545-1430

Annual Return of Withheld Federal Income Tax

Form 945 For withholding reported on Forms 1099 and W-2G.

Department of the Treasury For more information on income tax withholding, see Pub. 15 and Pub. 15-A.

Internal Revenue Service Go to www.irs.gov/Form945 for instructions and the latest information. 2022

Name (as distinguished from trade name) Employer identification number (EIN)

–

Trade name, if any If address is

Type different

from prior

or Address (number and street) return, check

Print

here.

City or town, state or province, country, and ZIP or foreign postal code

A If you don’t have to file returns in the future, check here and enter date final payments made.

1 Federal income tax withheld from pensions, annuities, IRAs, gambling winnings, etc. . . . . . 1

2 Backup withholding . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Total taxes. If $2,500 or more, this must equal line 7M below or Form 945-A, line M . . . . . 3

4 Total deposits for 2022, including overpayment applied from a prior year and overpayment applied

from Form 945-X . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Balance due. If line 3 is more than line 4, enter the difference and see the separate instructions . 5

6 Overpayment. If line 4 is more than line 3, enter the difference . . $

Check one: Apply to next return. Send a refund.

• All filers: If line 3 is less than $2,500, don’t complete line 7 or Form 945-A.

• Semiweekly schedule depositors: Complete Form 945-A and check here . . . . . . . . . . . . . . . . .

• Monthly schedule depositors:Complete line 7, entries A through M, and check here . . . . . . . . . . . . .

7 Monthly Summary of Federal Tax Liability. Don’t( complete if you were a semiweekly schedule depositor.)

Tax liability for month Tax liability for month Tax liability for month

A January . . . F June . . . . . K November . .

B February . . G July . . . . . L December . .

C March . . . H August . . . . M Total liability for

D April . . . . I September . . . year (add lines A

E May . . . . J October . . . . through L) . .

Do you want to allow another person to discuss this return with the IRS? See separate instructions. Yes. Complete the following. No.

Third-

Party

Designee Designee’s Phone Personal identification

name no. number (PIN)

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here Print Your

Signature Name and Title Date

Print/Type preparer’s name Preparer’s signature Date

Paid Check if PTIN

self-employed

Preparer

Firm’s name Firm’s EIN

Use Only Firm’s address Phone no.

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 14584B Form 945 (2022)