Enlarge image

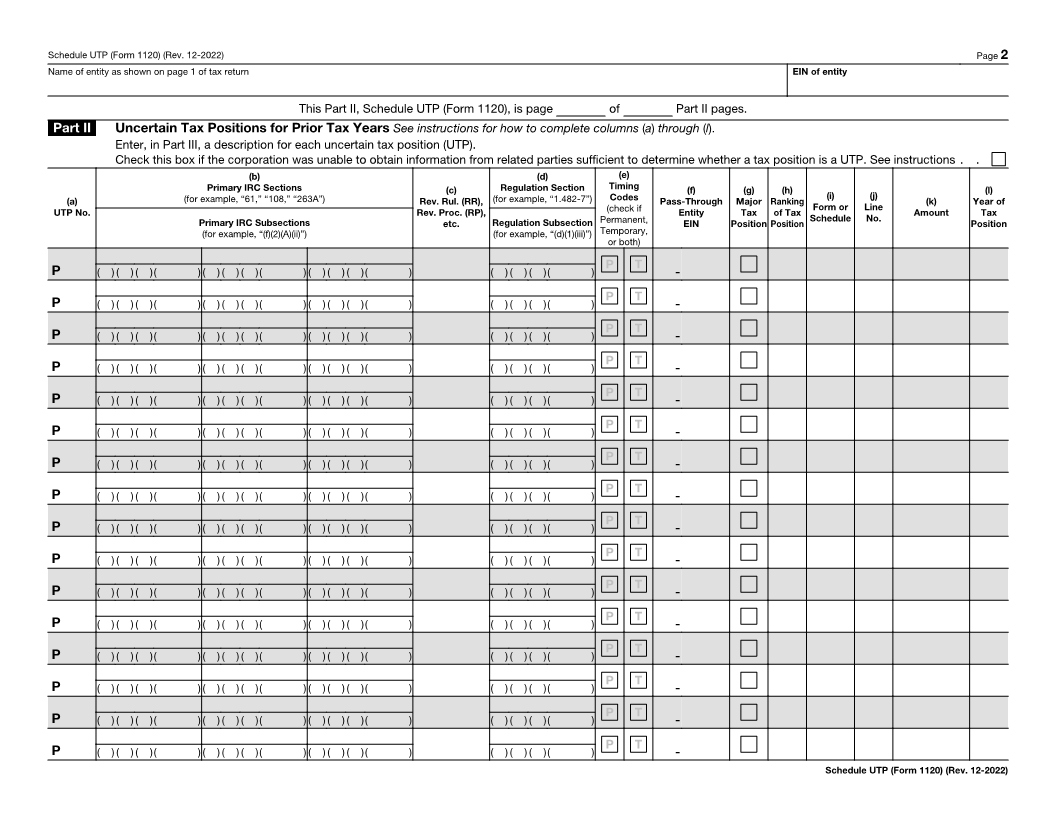

SCHEDULE UTP

(Form 1120) Uncertain Tax Position Statement

(Rev. December 2022) File with Form 1120, 1120-F, 1120-L, or 1120-PC. OMB No. 1545-0123

Department of the Treasury Go to www.irs.gov/Form1120 for instructions and the latest information.

Internal Revenue Service

Name of entity as shown on page 1 of tax return EIN of entity

This Part I, Schedule UTP (Form 1120), is page of Part I pages.

Part I Uncertain Tax Positions for the Current Tax Year See instructions for how to complete columns (a)through k ( ).

Enter, in Part III, a description for each uncertain tax position (UTP).

Check this box if the corporation was unable to obtain information from related parties sufficient to determine whether a tax position is a UTP. See instructions . .

(b) (d) (e)

Primary IRC Sections (c) Regulation Section Timing (f) (g) (h)

(a) (for example, “61,” “108,” “263A”) Rev. Rul. (RR), (for example, “1.482-7”) Codes Pass-Through Major Ranking (i) (j) (k)

UTP No. Rev. Proc. (RP), (check if Entity Tax of Tax Form or Line Amount

Primary IRC Subsections etc. Regulation Subsection Permanent, EIN Position Position Schedule No.

(for example, “(f)(2)(A)(ii)”) (for example, “(d)(1)(iii)”) Temporary,

or both)

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

P T

C ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) ( ) ( ) ( )( ) -

For Paperwork Reduction Act Notice, see the Instructions for Form 1120. Cat. No. 54658Q Schedule UTP (Form 1120) (Rev. 12-2022)