Enlarge image

Note: The form, instructions, or publication you are looking

for begins after this coversheet.

Please review the updated information below.

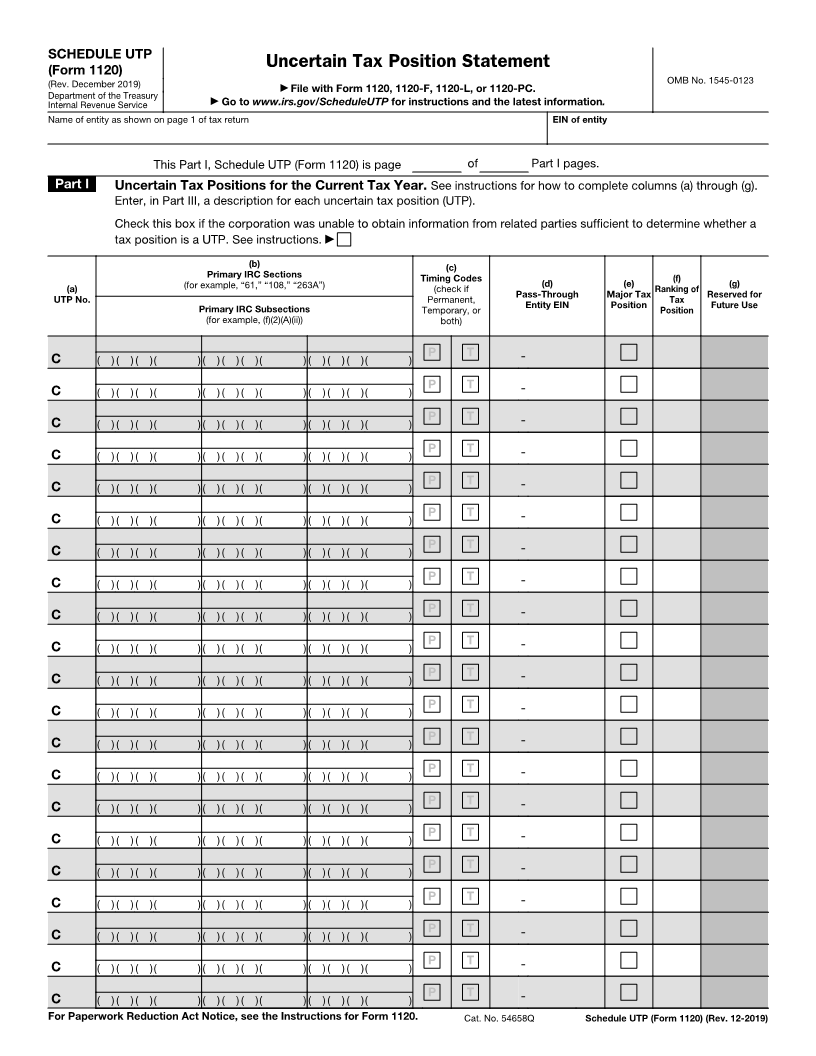

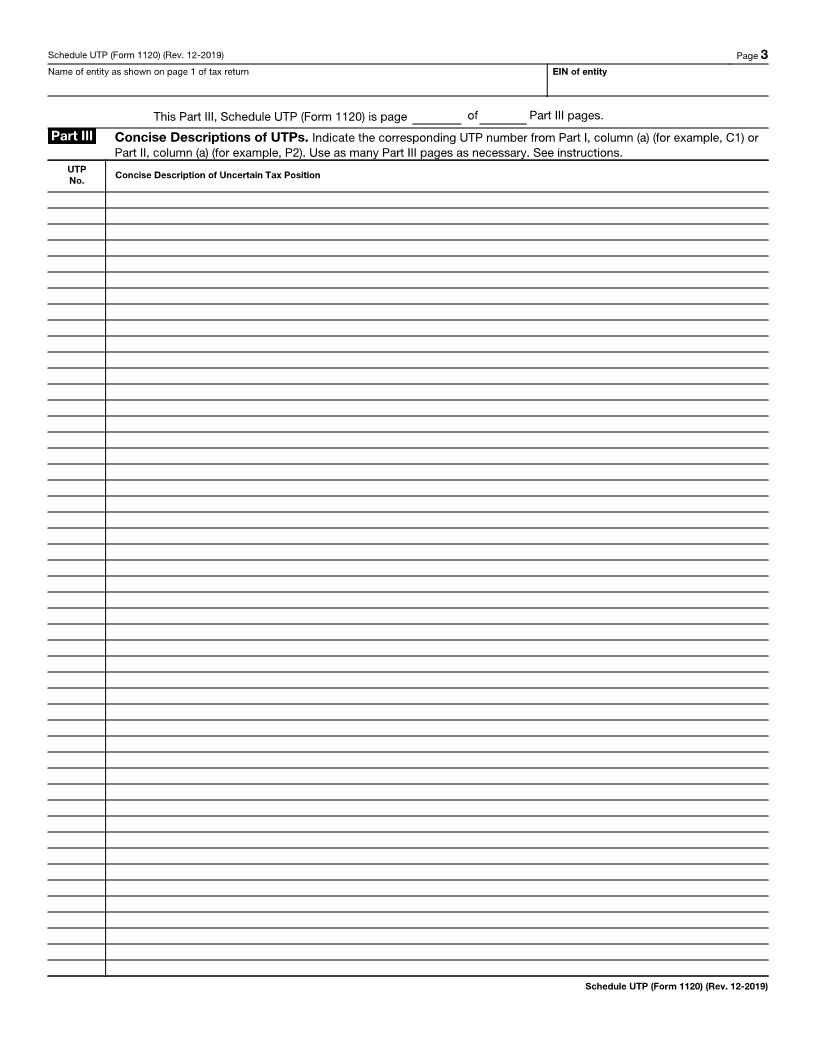

Clarification to the instructions for providing concise descriptions for

undisclosed tax positions (UTPs) on Schedule UTP (Form 1120), Part III

For tax positions which would otherwise be reported on Forms 8275, Disclosure Statement, or

8275-R, Regulation Disclosure Statement, the concise description of UTPs in Schedule UTP,

Part III, should include the information required under those forms.

If you are disclosing a position contrary to a rule (such as a statutory provision or IRS

revenue ruling) reportable on Form 8275, you must identify the rule by name. See the

Instructions for Form 8275.

For tax positions reportable on Form 8275-R, enter the full citation for each regulation for

which you have taken a contrary position. The citation should specify the section number,

including all designations of smaller units (lettered or numbered subsections, paragraphs,

subparagraphs, and clauses) to which the contrary position relates. For example, enter

"1.482-7(d)(1)(iii)" instead of "482 regs" or "1.482-7.”