Enlarge image

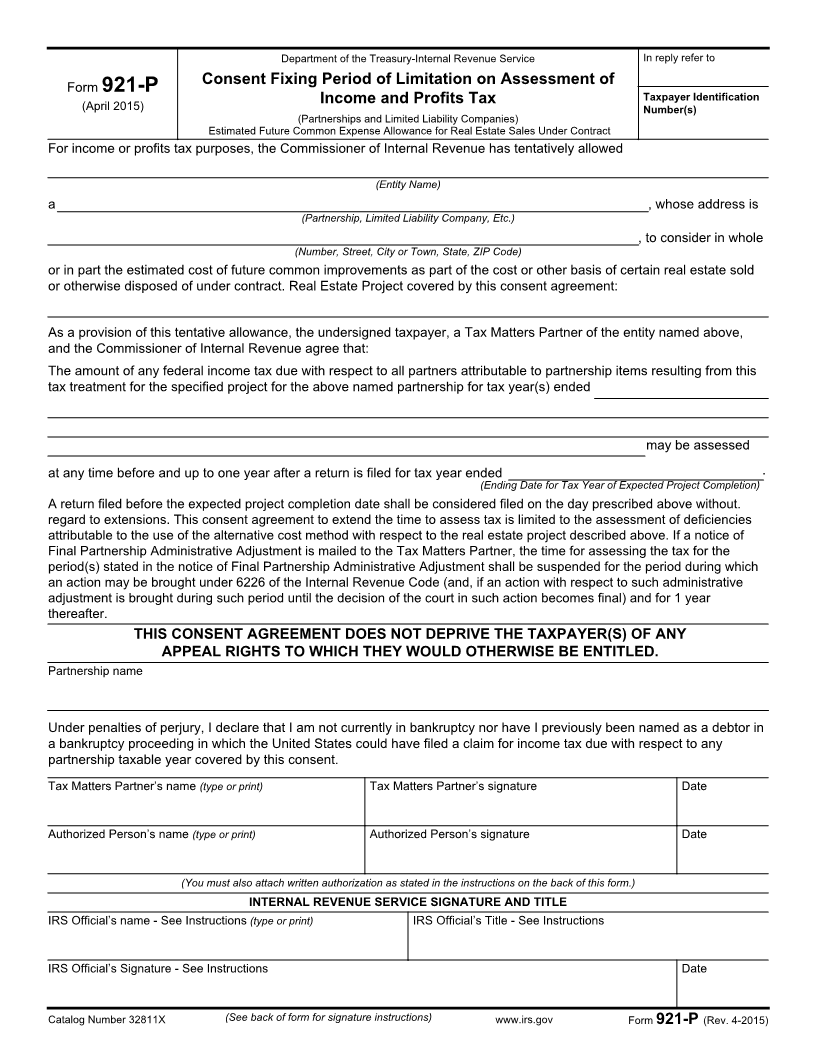

Department of the Treasury-Internal Revenue Service In reply refer to

Form 921-P Consent Fixing Period of Limitation on Assessment of

(April 2015) Income and Profits Tax Taxpayer Identification

Number(s)

(Partnerships and Limited Liability Companies)

Estimated Future Common Expense Allowance for Real Estate Sales Under Contract

For income or profits tax purposes, the Commissioner of Internal Revenue has tentatively allowed

(Entity Name)

a , whose address is

(Partnership, Limited Liability Company, Etc.)

, to consider in whole

(Number, Street, City or Town, State, ZIP Code)

or in part the estimated cost of future common improvements as part of the cost or other basis of certain real estate sold

or otherwise disposed of under contract. Real Estate Project covered by this consent agreement:

As a provision of this tentative allowance, the undersigned taxpayer, a Tax Matters Partner of the entity named above,

and the Commissioner of Internal Revenue agree that:

The amount of any federal income tax due with respect to all partners attributable to partnership items resulting from this

tax treatment for the specified project for the above named partnership for tax year(s) ended

may be assessed

at any time before and up to one year after a return is filed for tax year ended .

(Ending Date for Tax Year of Expected Project Completion)

A return filed before the expected project completion date shall be considered filed on the day prescribed above without.

regard to extensions. This consent agreement to extend the time to assess tax is limited to the assessment of deficiencies

attributable to the use of the alternative cost method with respect to the real estate project described above. If a notice of

Final Partnership Administrative Adjustment is mailed to the Tax Matters Partner, the time for assessing the tax for the

period(s) stated in the notice of Final Partnership Administrative Adjustment shall be suspended for the period during which

an action may be brought under 6226 of the Internal Revenue Code (and, if an action with respect to such administrative

adjustment is brought during such period until the decision of the court in such action becomes final) and for 1 year

thereafter.

THIS CONSENT AGREEMENT DOES NOT DEPRIVE THE TAXPAYER(S) OF ANY

APPEAL RIGHTS TO WHICH THEY WOULD OTHERWISE BE ENTITLED.

Partnership name

Under penalties of perjury, I declare that I am not currently in bankruptcy nor have I previously been named as a debtor in

a bankruptcy proceeding in which the United States could have filed a claim for income tax due with respect to any

partnership taxable year covered by this consent.

Tax Matters Partner’s name (type or print) Tax Matters Partner’s signature Date

Authorized Person’s name (type or print) Authorized Person’s signature Date

(You must also attach written authorization as stated in the instructions on the back of this form.)

INTERNAL REVENUE SERVICE SIGNATURE AND TITLE

IRS Official’s name - See Instructions (type or print) IRS Official’s Title - See Instructions

IRS Official’s Signature - See Instructions Date

Catalog Number 32811X (See back of form for signature instructions) www.irs.gov Form 921-P (Rev. 4-2015)