- 2 -

Enlarge image

|

Form 8948 (Rev. 9-2018) Page 2

General Instructions Specific Instructions

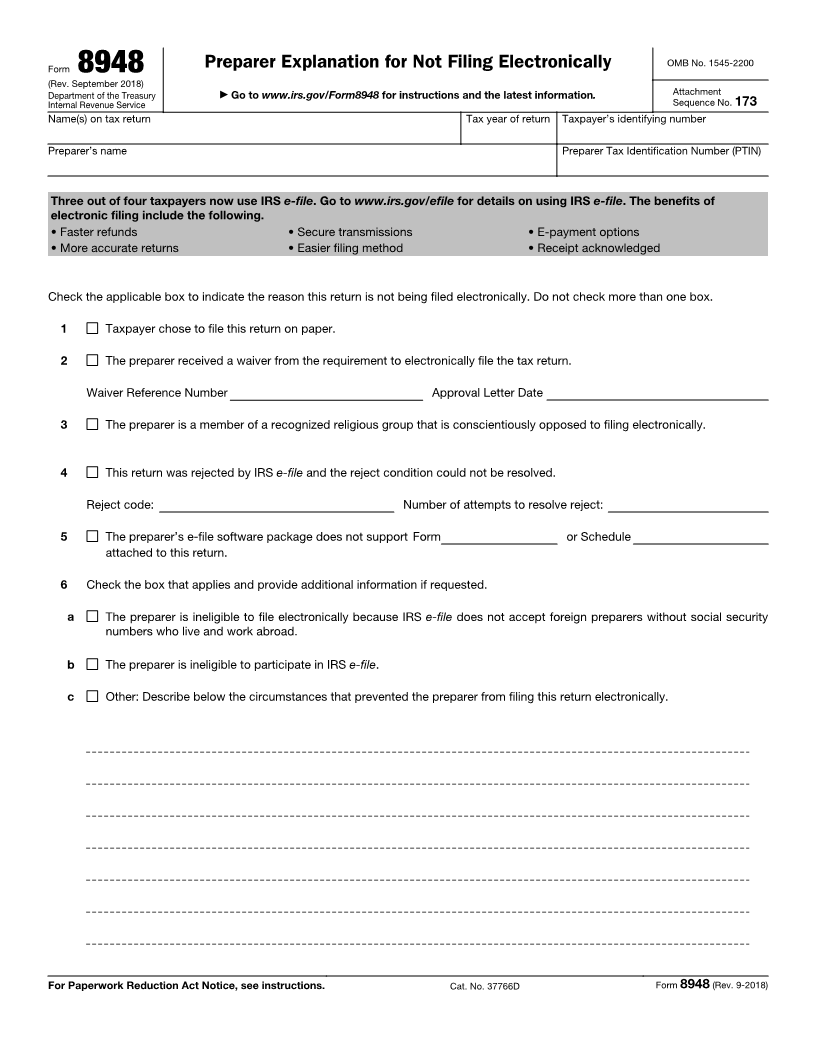

Section and subtitle A references are to the Internal Revenue Code unless Names on Tax Return, Tax Year of Return, and Taxpayer’s Identifying

otherwise noted. Number. Enter the taxpayer’s name(s), the tax year, and identifying number

(SSN or EIN) that appear on the tax return with which Form 8948 will be filed.

Future Developments If the return is an individual tax return using the Married Filing Jointly filing

For the latest information about developments related to Form 8948 and its status, enter the first SSN listed on the tax return.

instructions, such as legislation enacted after they were published, go to Name and PTIN of Preparer. Enter the preparer’s name and PTIN. Enter all

www.irs.gov/Form8948. the numbers of the PTIN.

Line 1. Check this box if the taxpayer has chosen to file on paper and the

What’s New return is prepared by the preparer, but will be submitted by mail by the

The tax year of the tax return associated with Form 8948 must be entered. taxpayer. See Rev. Proc. 2011-25, 2011-17 I.R.B. 725 for information on

The name and preparer tax identification number (PTIN) of the preparer also documenting a taxpayer’s choice to file on paper. Form 8948 does not meet

must be entered on the form. the criteria of a taxpayer choice statement as set forth in Rev. Proc. 2011-25.

Forms 1040A and/or 1040EZ are not being revised for tax year 2018. Line 2. Check this box if the preparer applied for and received an approved

Previous filers for these forms will file Form 1040 for 2018; all references for undue hardship waiver for the calendar year in which the return is being filed.

these forms have been revised accordingly. Use the previous revision Enter the waiver reference number and date of the approval letter. Do not

(September 2012) for this form to prepare any tax years prior to 2018. submit the approval letter with this form.

Line 3. Check this box if the preparer is a member of a recognized religious

Purpose of Form group that is conscientiously opposed to its members using electronic

Form 8948 is used only by specified tax return preparers (defined below) technology, including the filing of income tax returns electronically, and the

to explain why a particular return is being filed on paper. A specified tax group has existed continuously since December 31, 1950.

return preparer may be required by law to electronically file (e-file) certain Line 4. Check this box if the preparer attempted to e-file this return but was

covered returns (defined below). There are exceptions to this requirement, unable to do so because the return was rejected and the reject condition

and Form 8948 is used by specified tax return preparers to identify returns could not be resolved. Enter the reject code and the number of attempts

that meet allowable exceptions. made to resolve the reject.

When To File Line 5. Check this box if the preparer attempted to e-file this return but the

software package used to e-file did not support one or more of the forms or

Attach this form to the paper tax return you prepare and furnish to the schedules that are a part of this return. Enter the form and/or schedule

taxpayer for the taxpayer’s signature. File Form 8948 with the tax return that numbers the software did not support.

is filed on paper. Do not check this box if the reason you could not e-file this return is

that the IRS does not electronically accept a form or schedule

Form 8944, Preparer e-file Hardship Waiver Request, and received an ▲

Form 8944 and Form 8948.Specified tax return preparers who submitted CAUTION! attached to this return.

approval letter, should file Form 8948 with the tax return that is being sent to Line 6a. Check this box if the preparer is a foreign person without a social

the IRS. security number who cannot enroll in IRS e-file and the preparer is not a

The taxpayer choice statement, which is described in Regulations member of a firm that is eligible to e-file. To qualify to check this box, the

section 301.6011-7(a)(4)(ii), is a separate document that should be preparer must have applied for a PTIN and submitted Form 8946, PTIN

▲CAUTION! kept with the preparer’s records. Do not attach the taxpayer choice Supplemental Application For Foreign Persons Without a Social Security

statement to the tax return or otherwise send it to the IRS. Number. Do not attach the PTIN application or Form 8946 to the return.

Line 6b. Check this box if the preparer is ineligible to e-file due to an IRS

Specified Tax Return Preparer sanction. To qualify, the preparer must have received a letter from the IRS

A specified tax return preparer is a tax return preparer, as identified in enforcing the sanction and the sanction must be in effect for some or all of

section 7701(a)(36) and Regulations section 301.7701-15, who is a preparer the calendar year in which the return is being filed. Do not attach the

of covered returns and who reasonably expects (if the preparer is a member sanction letter to the return. The preparer may check this box until such time

of a firm, the firm’s members in the aggregate reasonably expect) to file 11 or as the sanction period ends or the IRS accepts the preparer into the IRS

more covered returns during a calendar year. e-file program, whichever occurs first. If the preparer has filed a pending

Aggregate filing of returns. For the e-file requirement, “aggregate” application for the IRS e-file program at the same time the sanction period

means the total number of covered returns reasonably expected to be filed ends, the preparer may continue to check this box until the IRS makes a

by the firm as a whole. For example, if a firm has 2 preparers and each decision about the preparer’s application.

preparer in the firm reasonably expects to prepare and file 6 covered returns, Line 6c. Check the box if the preparer is unable to e-file because of other

the aggregate for the firm equals 12 covered returns, and each preparer is a verifiable and documented technological difficulties experienced by the

specified tax return preparer. preparer that are not described elsewhere on this form. Describe the

When a return is considered filed by a preparer. For the e-file circumstances in the space provided.

requirement, a return is considered filed by a preparer if the preparer or any

member, employee, or agent of the preparer or the preparer’s firm submits Paperwork Reduction Act Notice. We ask for the information on these

the tax return to the IRS on the taxpayer’s behalf, either electronically or in forms to carry out the Internal Revenue laws of the United States. You are

paper format. For example, the act of submitting includes having the not required to provide the information requested on a form that is subject to

preparer or a member of the preparer’s firm drop the return in a mailbox for the Paperwork Reduction Act unless the form displays a valid OMB control

the taxpayer. Acts such as providing filing or delivery instructions, an number. Books or records relating to a form must be retained as long as their

addressed envelope, postage estimates, stamps, or similar acts designed to contents may become material in the administration of any Internal Revenue

assist the taxpayer in the taxpayer’s efforts to correctly mail or otherwise law. Generally, tax returns and return information are confidential, as required

deliver a paper return to the IRS do not constitute filing by the preparer as by Code section 6103.

long as the taxpayer actually mails or otherwise delivers the return to the IRS. The time needed to provide this information may vary depending on

individual circumstances. The estimated average time is:

Covered Returns Recordkeeping . . . . . . . . . . . . . . 57 min.

Covered returns include any return of tax imposed by subtitle A on Learning about the law

individuals, estates, or trusts. or the form . . . . . . . . . . . . . . . . 30 min.

Covered returns that cannot be filed electronically. Some covered

returns are not currently capable of being accepted electronically by the IRS. Preparing and sending

In certain instances, the IRS has instructed taxpayers not to file some the form . . . . . . . . . . . . . . . . 32 min.

covered returns electronically. Additionally, certain covered returns cannot be If you have comments concerning the accuracy of these time estimates or

e-filed if they have attached forms, schedules, or documents that the IRS suggestions for making this form simpler, we would be happy to hear from

does not accept electronically and these forms, schedules, or documents you. You can send us comments from www.irs.gov/FormComments. Or you

cannot be sent to the IRS separately using Form 8453 or Form 8453-F as a can write to the Internal Revenue Service, Tax Forms and Publications

transmittal document. In any of these situations, the preparer does not need Division, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do

to complete and submit Form 8948. However, if the forms, schedules, or not send this form to this office. Instead, see When To File, earlier.

documents can be sent to the IRS separately using Form 8453 or Form

8453-F as a transmittal document, the rest of the return must be e-filed. For

more information, see Form 8453, Form 8453-F, and Notice 2011-26,

2011-17 I.R.B. 720.

|