Enlarge image

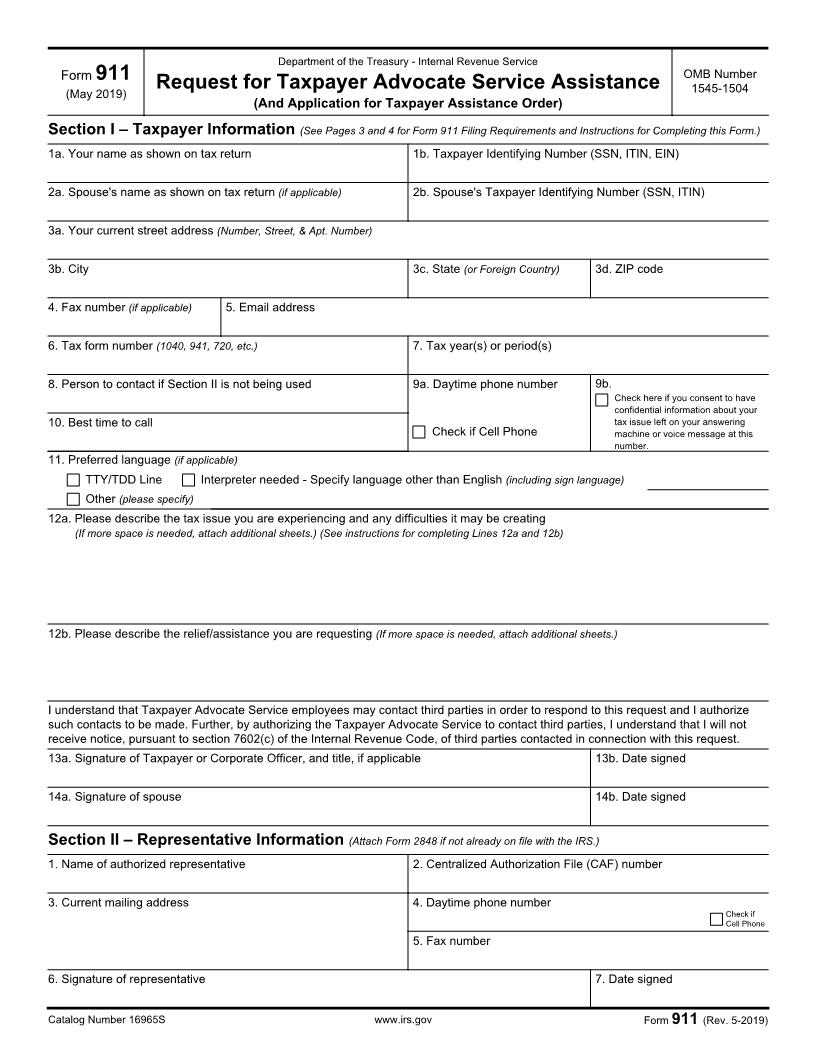

Department of the Treasury - Internal Revenue Service

Form 911 OMB Number

(May 2019) Request for Taxpayer Advocate Service Assistance 1545-1504

(And Application for Taxpayer Assistance Order)

Section I – Taxpayer Information (See Pages 3 and 4 for Form 911 Filing Requirements and Instructions for Completing this Form.)

1a. Your name as shown on tax return 1b. Taxpayer Identifying Number (SSN, ITIN, EIN)

2a. Spouse's name as shown on tax return (if applicable) 2b. Spouse's Taxpayer Identifying Number (SSN, ITIN)

3a. Your current street address (Number, Street, & Apt. Number)

3b. City 3c. State (or Foreign Country) 3d. ZIP code

4. Fax number (if applicable) 5. Email address

6. Tax form number (1040, 941, 720, etc.) 7. Tax year(s) or period(s)

8. Person to contact if Section II is not being used 9a. Daytime phone number 9b.

Check here if you consent to have

confidential information about your

10. Best time to call tax issue left on your answering

Check if Cell Phone machine or voice message at this

number.

11. Preferred language (if applicable)

TTY/TDD Line Interpreter needed - Specify language other than English (including sign language)

Other (please specify)

12a. Please describe the tax issue you are experiencing and any difficulties it may be creating

(If more space is needed, attach additional sheets.) (See instructions for completing Lines 12a and 12b)

12b. Please describe the relief/assistance you are requesting (If more space is needed, attach additional sheets.)

I understand that Taxpayer Advocate Service employees may contact third parties in order to respond to this request and I authorize

such contacts to be made. Further, by authorizing the Taxpayer Advocate Service to contact third parties, I understand that I will not

receive notice, pursuant to section 7602(c) of the Internal Revenue Code, of third parties contacted in connection with this request.

13a. Signature of Taxpayer or Corporate Officer, and title, if applicable 13b. Date signed

14a. Signature of spouse 14b. Date signed

Section II – Representative Information (Attach Form 2848 if not already on file with the IRS.)

1. Name of authorized representative 2. Centralized Authorization File (CAF) number

3. Current mailing address 4. Daytime phone number

Check if

Cell Phone

5. Fax number

6. Signature of representative 7. Date signed

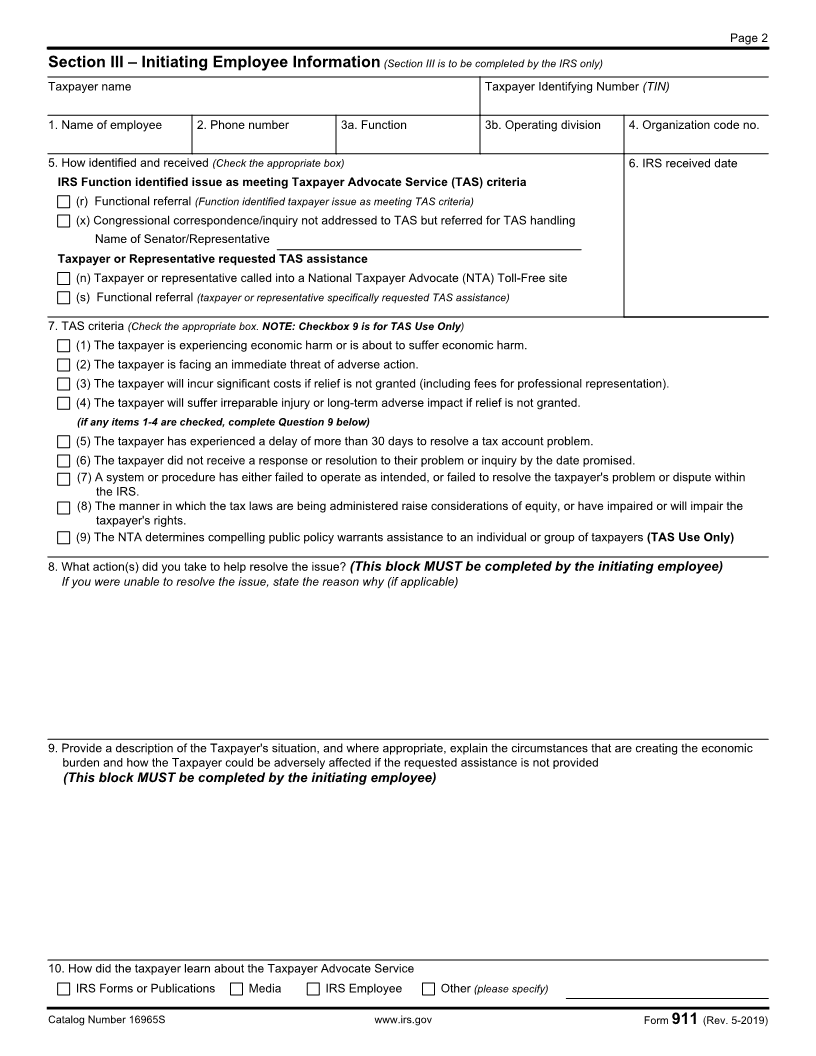

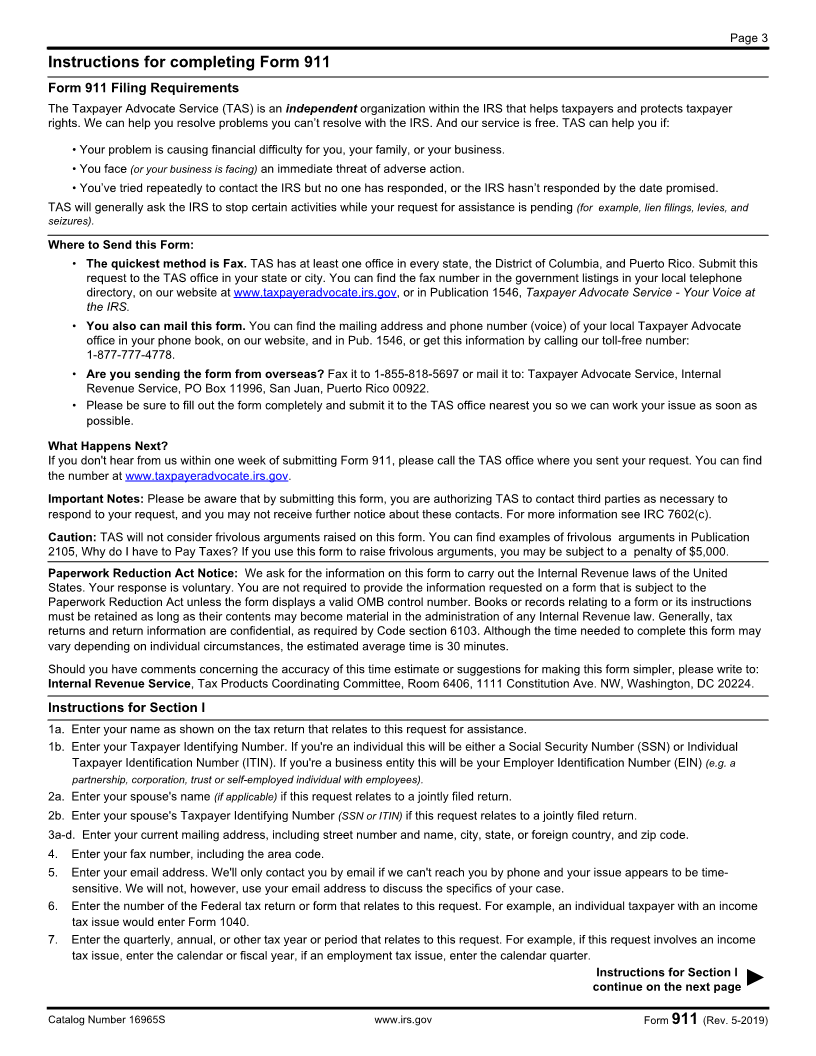

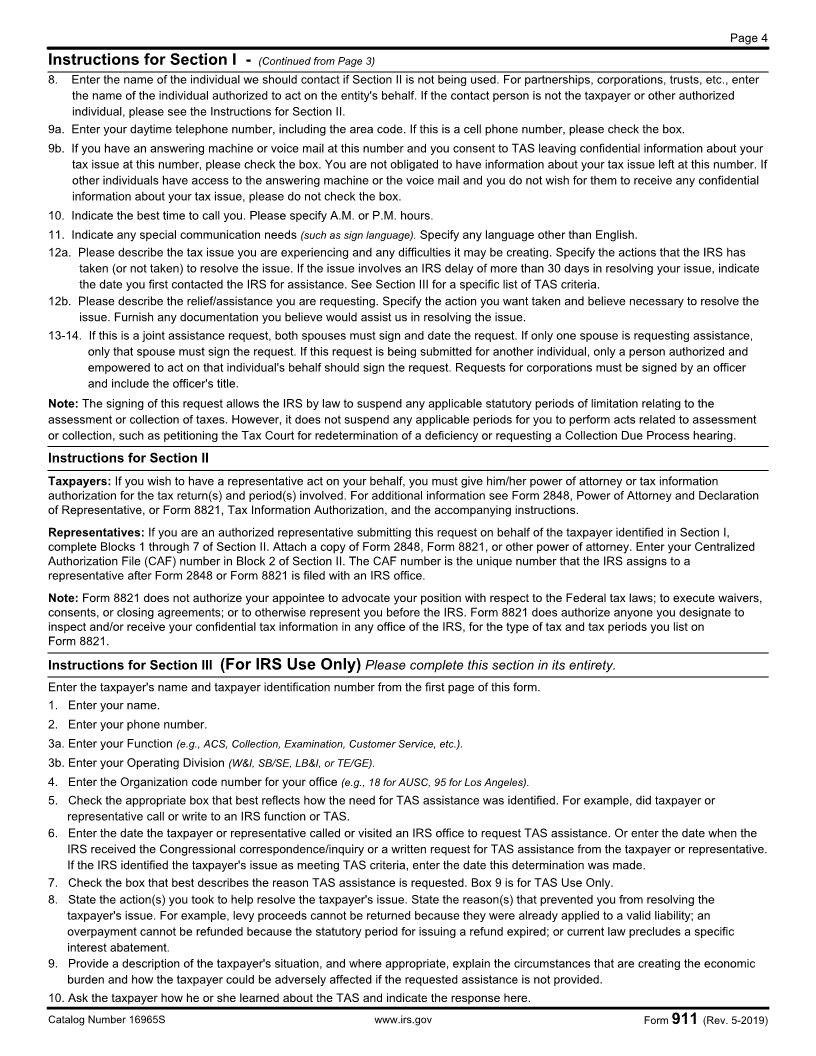

Catalog Number 16965S www.irs.gov Form 911 (Rev. 5-2019)