Enlarge image

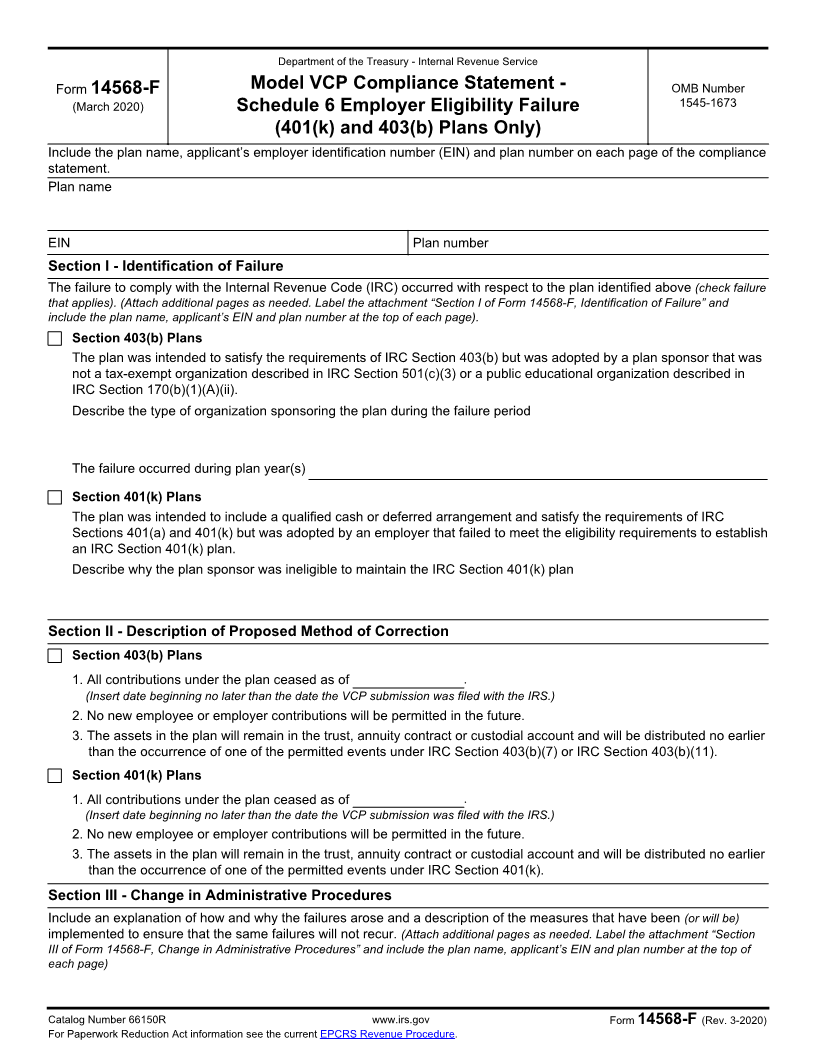

Department of the Treasury - Internal Revenue Service

Form 14568-F Model VCP Compliance Statement - OMB Number

1545-1673

(March 2020) Schedule 6 Employer Eligibility Failure

(401(k) and 403(b) Plans Only)

Include the plan name, applicant’s employer identification number (EIN) and plan number on each page of the compliance

statement.

Plan name

EIN Plan number

Section I - Identification of Failure

The failure to comply with the Internal Revenue Code (IRC) occurred with respect to the plan identified above (check failure

that applies). (Attach additional pages as needed. Label the attachment “Section I of Form 14568-F, Identification of Failure” and

include the plan name, applicant’s EIN and plan number at the top of each page).

Section 403(b) Plans

The plan was intended to satisfy the requirements of IRC Section 403(b) but was adopted by a plan sponsor that was

not a tax-exempt organization described in IRC Section 501(c)(3) or a public educational organization described in

IRC Section 170(b)(1)(A)(ii).

Describe the type of organization sponsoring the plan during the failure period

The failure occurred during plan year(s)

Section 401(k) Plans

The plan was intended to include a qualified cash or deferred arrangement and satisfy the requirements of IRC

Sections 401(a) and 401(k) but was adopted by an employer that failed to meet the eligibility requirements to establish

an IRC Section 401(k) plan.

Describe why the plan sponsor was ineligible to maintain the IRC Section 401(k) plan

Section II - Description of Proposed Method of Correction

Section 403(b) Plans

1. All contributions under the plan ceased as of .

(Insert date beginning no later than the date the VCP submission was filed with the IRS.)

2. No new employee or employer contributions will be permitted in the future.

3. The assets in the plan will remain in the trust, annuity contract or custodial account and will be distributed no earlier

than the occurrence of one of the permitted events under IRC Section 403(b)(7) or IRC Section 403(b)(11).

Section 401(k) Plans

1. All contributions under the plan ceased as of .

(Insert date beginning no later than the date the VCP submission was filed with the IRS.)

2. No new employee or employer contributions will be permitted in the future.

3. The assets in the plan will remain in the trust, annuity contract or custodial account and will be distributed no earlier

than the occurrence of one of the permitted events under IRC Section 401(k).

Section III - Change in Administrative Procedures

Include an explanation of how and why the failures arose and a description of the measures that have been (or will be)

implemented to ensure that the same failures will not recur. (Attach additional pages as needed. Label the attachment “Section

III of Form 14568-F, Change in Administrative Procedures” and include the plan name, applicant’s EIN and plan number at the top of

each page)

Catalog Number 66150R www.irs.gov Form 14568-F (Rev. 3-2020)

For Paperwork Reduction Act information see the current EPCRS Revenue Procedure.