Enlarge image

Form 608—General Information

(Certificate of Withdrawal of Registration)

The attached form is designed to meet minimal statutory filing requirements pursuant to the relevant

code provisions. This form and the information provided are not substitutes for the advice and services of an

attorney and tax specialist.

Commentary

When a foreign filing entity has ceased to transact business or conduct affairs in this state, the entity

may voluntarily withdraw its application for registration. This form is drafted to comply with section

9.011(b) of the Texas Business Organizations Code (BOC).

A foreign entity that has terminated its existence in its jurisdiction of formation because of dissolution,

termination, or merger should use Form 612 rather than this form to terminate its registration. A

foreign entity that has filed a merger or conversion in its jurisdiction of formation would use Form 422

rather than Forms 608 or 612 to transfer its registration to a successor foreign entity.

Instructions for Form

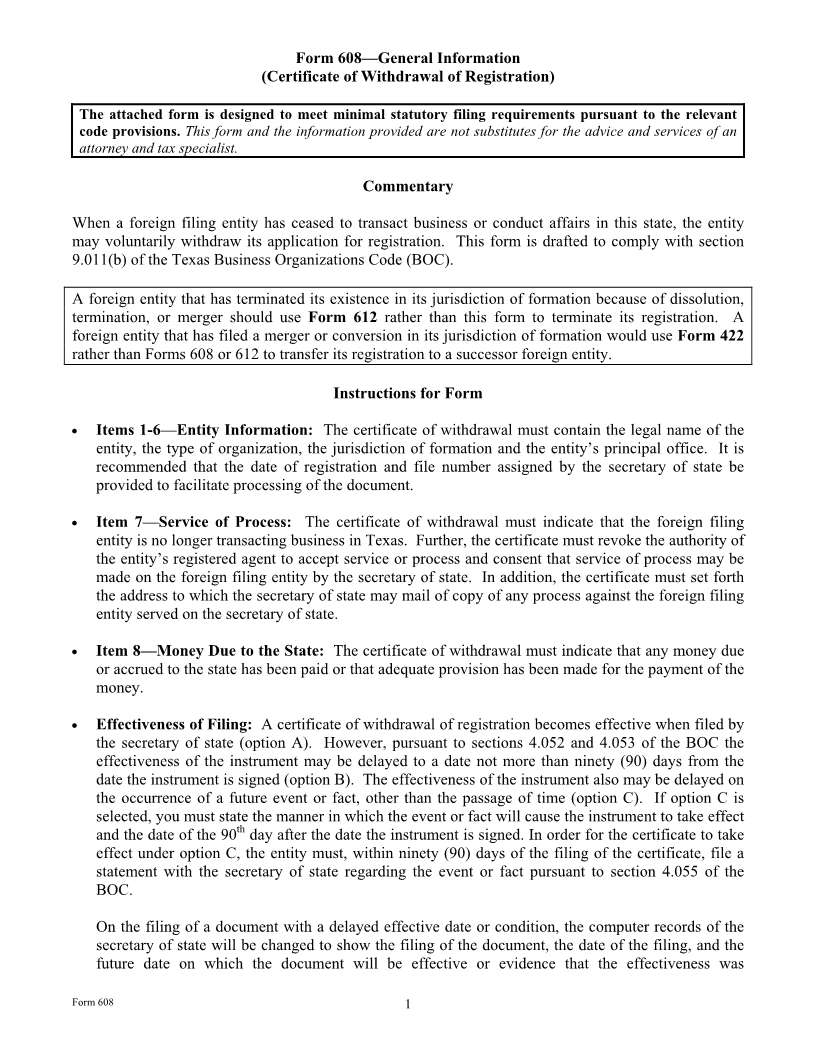

Items 1-6—Entity Information: The certificate of withdrawal must contain the legal name of the

entity, the type of organization, the jurisdiction of formation and the entity’s principal office. It is

recommended that the date of registration and file number assigned by the secretary of state be

provided to facilitate processing of the document.

Item 7—Service of Process: The certificate of withdrawal must indicate that the foreign filing

entity is no longer transacting business in Texas. Further, the certificate must revoke the authority of

the entity’s registered agent to accept service or process and consent that service of process may be

made on the foreign filing entity by the secretary of state. In addition, the certificate must set forth

the address to which the secretary of state may mail of copy of any process against the foreign filing

entity served on the secretary of state.

Item 8—Money Due to the State: The certificate of withdrawal must indicate that any money due

or accrued to the state has been paid or that adequate provision has been made for the payment of the

money.

Effectiveness of Filing: A certificate of withdrawal of registration becomes effective when filed by

the secretary of state (option A). However, pursuant to sections 4.052 and 4.053 of the BOC the

effectiveness of the instrument may be delayed to a date not more than ninety (90) days from the

date the instrument is signed (option B). The effectiveness of the instrument also may be delayed on

the occurrence of a future event or fact, other than the passage of time (option C). If option C is

selected, you must state the manner in which the event or fact will cause the instrument to take effect

th

and the date of the 90 day after the date the instrument is signed. In order for the certificate to take

effect under option C, the entity must, within ninety (90) days of the filing of the certificate, file a

statement with the secretary of state regarding the event or fact pursuant to section 4.055 of the

BOC.

On the filing of a document with a delayed effective date or condition, the computer records of the

secretary of state will be changed to show the filing of the document, the date of the filing, and the

future date on which the document will be effective or evidence that the effectiveness was

Form 608 1