Enlarge image

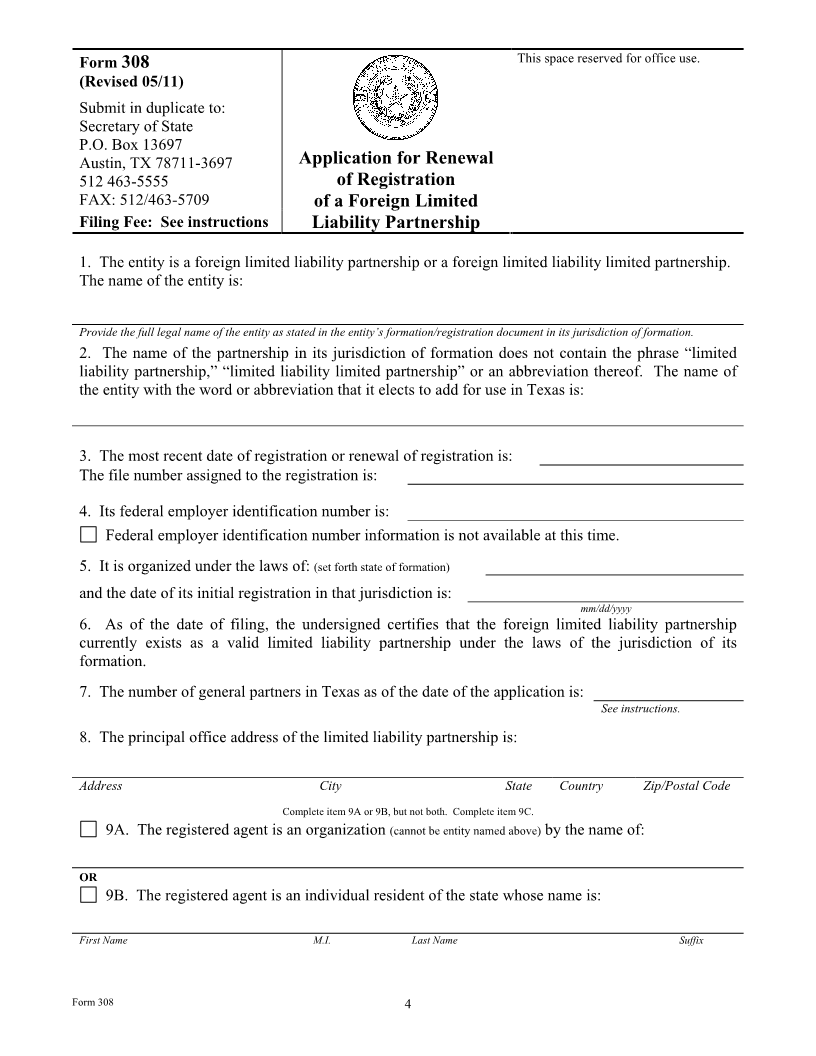

Form 308—General Information

(Application for Renewal of Registration of a Foreign Limited Liability Partnership)

The attached form is drafted to meet minimal statutory filing requirements pursuant to the relevant code

provisions. This form and the information provided are not substitutes for the advice and services of an

attorney and tax specialist.

Commentary

To transact business in Texas, a foreign limited liability partnership must register with the secretary of

state under chapters 9 and 152 of the Texas Business Organizations Code (BOC). A registration of a

foreign limited liability partnership is effective until the first anniversary of the date after the date of

registration or a later effective date unless renewed under section 152.908 of the BOC (BOC §

152.905(e)). This form may be used to renew the registration of a foreign limited liability partnership

prior to its expiration. When the renewal application is filed by the secretary of state, the registration is

continued for one year after the date the registration would otherwise expire. Renewal applications

submitted after expiration will not be accepted for filing and the foreign limited liability partnership will

be required to submit a new application for registration. Renewals should not be submitted earlier than

90 days prior to expiration.

Instructions for Form

Item 1—Entity Name: Provide the full legal name of the foreign entity as stated in the entity’s

formation document. The name of the foreign entity must comply with chapter 5 of the BOC.

Chapter 5 requires that the name of a foreign limited liability partnership contain a recognized term

of organization as listed in sections 5.055 and 5.063 of the BOC.

Item 2—Assumed Name: If the entity name fails to contain an appropriate organizational

designation for the entity type, a recognized organizational designation should be added to the legal

name and set forth in item 2. Accepted organizational designations for a foreign limited liability

partnership are “limited liability partnership” or an abbreviation of that phrase. The name of a

foreign limited partnership that is a limited liability partnership may contain the words “limited

liability limited partnership,” an abbreviation of that phrase, or the organization terms permitted by

section 5.063 (BOC § 5.055(b)).

In addition, the foreign entity is required to file an assumed name certificate in compliance with

chapter 71 of the Texas Business & Commerce Code. The promulgated form for filing the assumed

name with the secretary of state is Form 503. This form is not acceptable for filing with the county

clerk.

Item 3—Most Recent Date of Registration: Enter partnership’s most recent date of registration or

renewal of registration. Provide the file number of the registration being renewed.

Item 4—Federal Employer Identification Number: Enter the entity’s federal employer

identification number (FEIN) in the space provided. The FEIN is a 9-digit number (e.g., 12-

3456789) that is issued by the Internal Revenue Service (IRS). If the entity has not received its

FEIN at the time of submission, this should be noted in item 4 on the application form.

Form 308 1