Enlarge image

Form 403—General Information

(Certificate of Correction)

The attached form is drafted to meet minimal statutory filing requirements pursuant to the relevant code

provisions. This form and the information provided are not substitutes for the advice and services of an

attorney and tax specialist.

Commentary

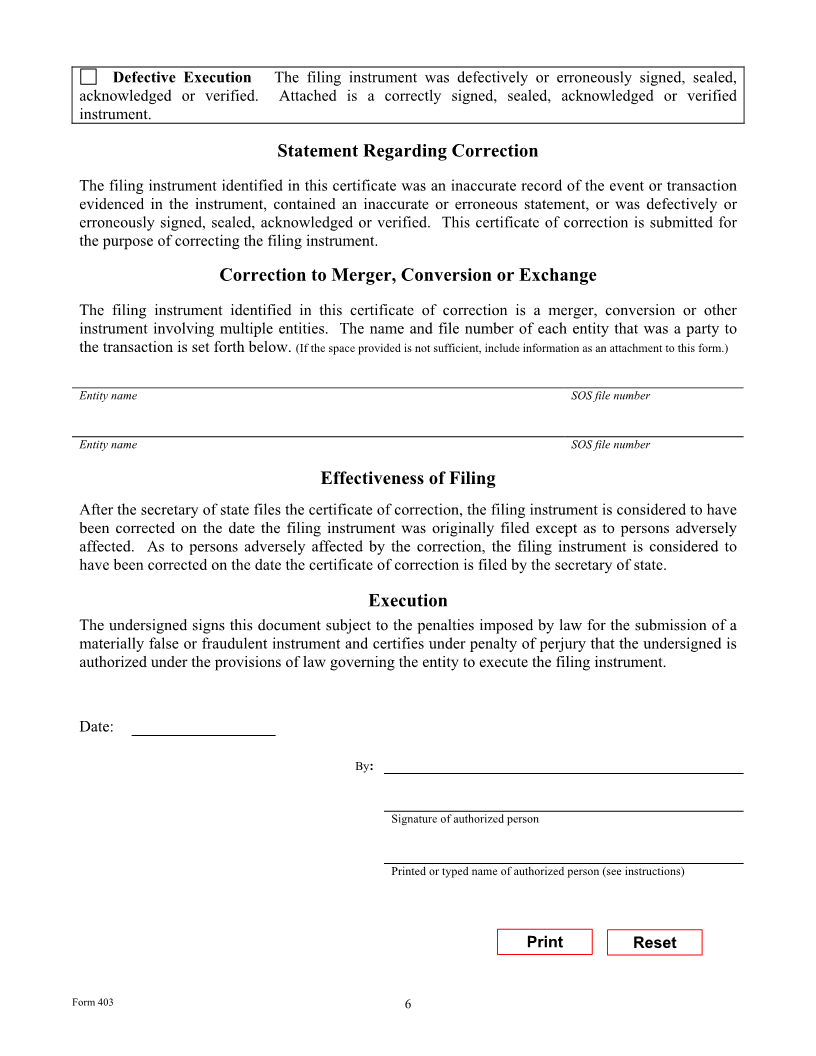

Subchapter C of chapter 4 of the Texas Business Organizations Code (BOC) governs a certificate of

correction. A filing instrument that is an inaccurate record of the event or transaction evidenced by the

instrument, that contains an inaccurate or erroneous statement, or that was defectively or erroneously

signed, sealed, acknowledged or verified may be corrected by filing a certificate of correction (BOC

§4.101). A filing instrument may be corrected to contain only those statements that the governing law

authorizes or requires to be included in the original filing instrument. A certificate of correction may not

alter, add, or delete a statement that by its alteration, addition or deletion would have caused the

secretary of state to determine that the filing instrument did not conform to the requirements of

applicable law at the time of filing (BOC § 4.102).

After the secretary of state files the certificate of correction, the filing instrument is considered to have

been corrected on the date the filing instrument was originally filed with one exception. As to a person

who is adversely affected by the correction, the filing instrument is considered to have been corrected on

the date the certificate of correction is filed.

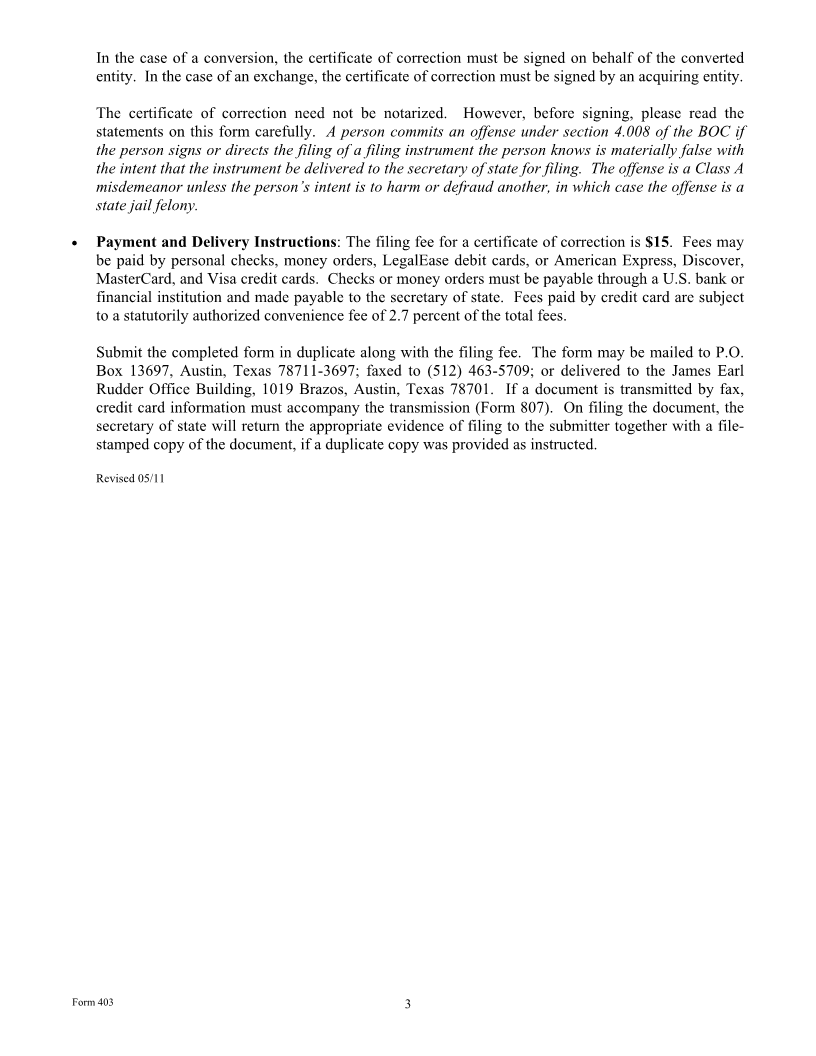

Instructions for Form

Item 1—Entity Information: The certificate of correction must contain the legal name of the

entity. If the certificate of correction corrects the name of the entity, the name as it currently

appears on the records of the secretary of state should be stated. It is recommended that the file

number assigned by the secretary of state be provided to facilitate processing of the document.

Item 2—Filing Instrument to be Corrected: Identify the filing instrument to be corrected by

description and date of filing with the secretary of state. Example: “Certificate of formation filed on

January 2, 2009.” If the filing instrument to be corrected is a merger, conversion or exchange,

additional instructions are found on page 2 of this form.

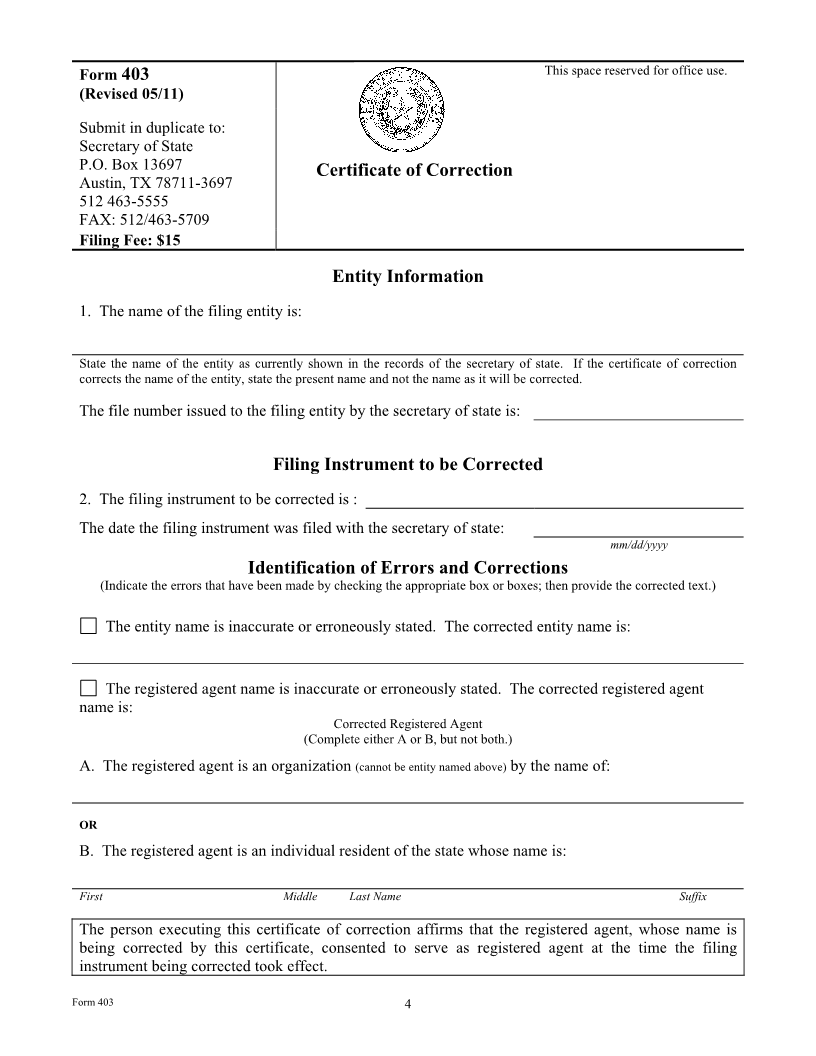

Identification of Errors and Corrections: Corrections may be made to the entity name, registered

agent name, registered office address, stated purpose, or stated duration by checking the applicable

box in this section and stating, in corrected form, the portion of the instrument to be corrected. If the

necessary corrections are other than those provided for by the check boxes, please use the section

entitled “Identification of Other Errors and Corrections.”

Correction to Entity Name: The correction to an entity name will require the secretary of state to

determine the availability of the entity name as corrected. If the entity name, as corrected, is the

same as, deceptively similar to, or similar to the name of any existing domestic or foreign filing

entity (other than the entity filing the correction), or any name reservation or registration filed with

the secretary of state, the correction cannot be filed (BOC § 5.053).

Form 403 1