Enlarge image

Form 609—General Information

(Certificate of Withdrawal of Registration of a Foreign Limited Liability Partnership)

The attached form is designed to meet minimal statutory filing requirements pursuant to the relevant

code provisions. This form and the information provided are not substitutes for the advice and services of an

attorney and tax specialist.

Commentary

A foreign limited liability partnership that has ceased to transact business in the state may voluntarily

withdraw its application for registration pursuant to section 152.906 of the Texas Business

Organizations Code (BOC).

Instructions for Form

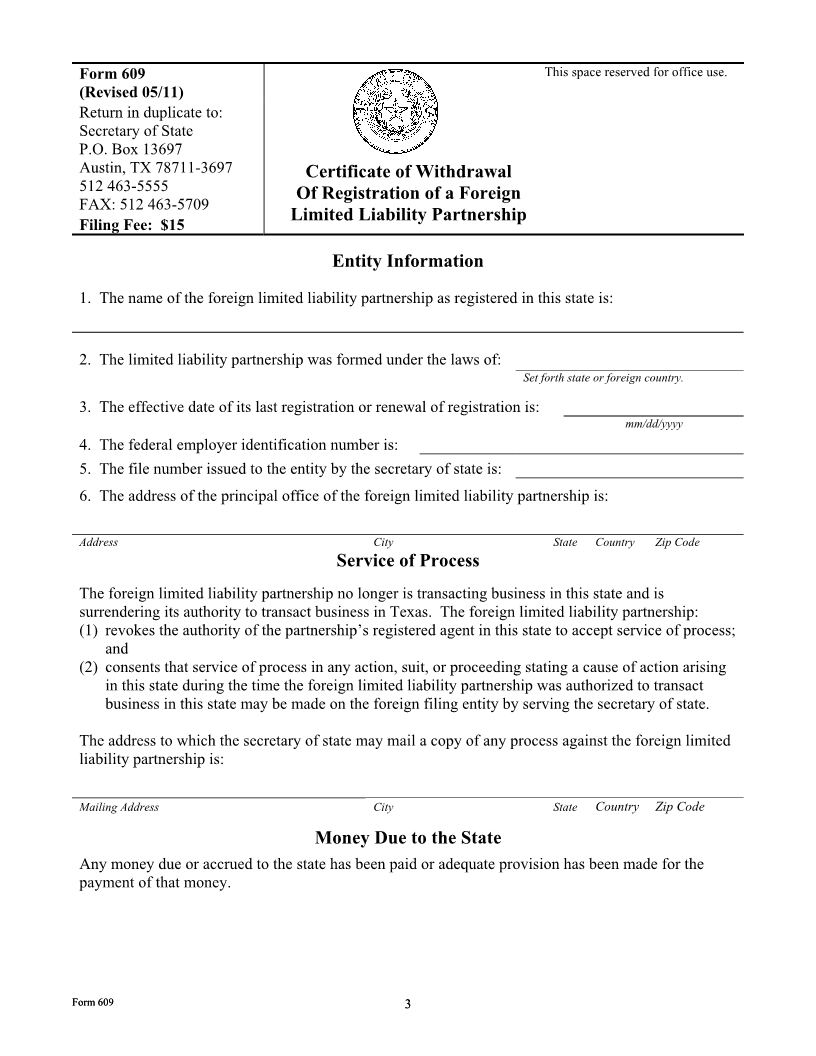

Items 1—6: Entity Information: The certificate of withdrawal of registration must contain the

legal name of the foreign limited liability partnership, the jurisdiction of formation, the federal

employer identification number, the date of effectiveness of the last application for registration or

renewal of registration, and the principal office address. It is recommended that the file number

assigned by the secretary of state be provided to facilitate processing of the document.

Service of Process: The certificate of withdrawal must indicate that the foreign limited liability

partnership is no longer transacting business in Texas. Further, the certificate must revoke the

authority of the partnership’s registered agent to accept service of process and consent that service of

process may be made on the foreign limited liability partnership by serving the secretary of state. In

addition, the application must set forth the address to which the secretary of state may mail a copy of

any process against the foreign limited liability partnership served on the secretary of state.

Money Due to the State: The certificate of withdrawal of registration must indicate that any money

due or accrued to the state has been paid or that adequate provision has been made for the payment

of the money. Please note that imitedl liability partnerships are subject to a state franchise tax.

Tax Certificate: A certificate of withdrawal of registration must be accompanied by a certificate of

account status from the Texas Comptroller of Public Accounts indicating that all taxes administered

by the Comptroller under Title 2, Tax Code have been paid and that the entity is in good standing for

the purpose of withdrawal. Please note that the Comptroller issues many different types of

certificates of account status. Do not attach a certificate or print-out obtained from the

Comptroller’s web site as this does not meet statutory requirements. You need to attach form #05-

305, which is obtained directly from a Comptroller of Public Accounts representative.

Requests for certificates or questions on tax status should be directed to the Tax Assistance Section,

Comptroller of Public Accounts, Austin, Texas 78774-0100; (512) 463-4600 or toll-free (800) 252-

1381. You also may contact tax.help@cpa.state.tx.us.

Effectiveness of Filing: A certificate of withdrawal of registration becomes effective when filed by

the secretary of state (option A). However, pursuant to sections 4.052, 4.053, and 152.907 of the

BOC the effectiveness of the instrument may be delayed to a date not more than ninety (90) days

from the date the instrument is signed (option B), but not later than the expiration date of the

partnership’s term of registration.

On the filing of a document with a delayed effective date, the computer records of the secretary of

state will be changed to show the filing of the document, the date of the filing, and the future date on

FormForm609 609 1 1