Enlarge image

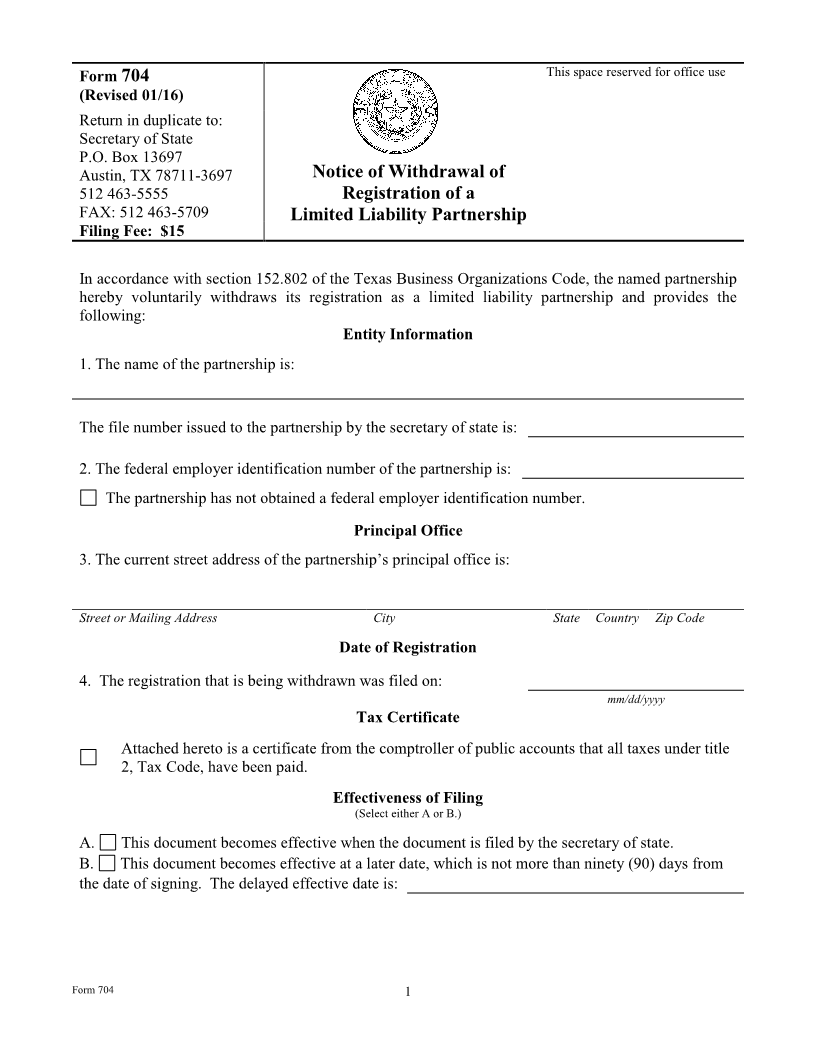

Form 704—General Information

(Notice of Withdrawal of Registration of a Texas Limited Liability Partnership)

The attached form is designed to meet minimal filing requirements pursuant to the relevant statutory

provisions. This form and the information provided are not substitutes for the advice and services of an

attorney and tax specialist.

Commentary

Pursuant to section 152.802 of the Texas Business Organizations Code (BOC), the registration of a limited

liability partnership may be voluntarily withdrawn by filing a withdrawal notice with the secretary of

state. A withdrawal notice terminates the status of the partnership as a registered limited liability

partnership as of the date of filing of the withdrawal notice or later date specified in the notice of

withdrawal.

Effective January 1, 2016, Senate Bill 859 amends subchapter J of chapter 152 of the BOC to eliminate

the annual renewal requirement and make the registration of a Texas limited liability partnership

effective until it is voluntarily withdrawn or terminated by the secretary of state. Senate Bill 859 also

imposes an annual reporting requirement on Texas LLPs.

Instructions for Form

• Items 1-2—Entity Information: Set forth the name of the partnership as currently shown on the

records of the secretary of state. Provide the file number assigned by the secretary of state and the 9-

digit federal employer identification number (FEIN) assigned to the partnership by the Internal

Revenue Service (IRS) in the appropriate fields. Enter the FEIN without punctuation; that is,

stripped of any hyphens (123456789). If the partnership has not obtained a FEIN, check the

appropriate statement and leave the field blank.

• Item 3—Principal Office Address: Provide the current street address of the partnership’s principal

office. The principal office address can be located in this state or outside the state.

• Item 4—Date of Registration: Provide the date of filing of the partnership’s application for

registration.

• Effectiveness of Filing: The withdrawal of registration of a limited liability partnership becomes

effective as of the date of filing by the secretary of state (option A). However, pursuant to sections

4.052, 4.053 and 152.802 of the BOC the effectiveness of the instrument may be delayed to a date

not more than ninety (90) days from the date the instrument is signed (option B).

On the filing of a document with a delayed effective date, the computer records of the secretary of

state will be changed to show the filing of the document, the date of the filing, and the future date on

which the document will be effective. In addition, at the time of such filing, the status of the entity

will be shown as “withdrawn” on the records of the secretary of state.

• Tax Certificate: A voluntary withdrawal of registration of a limited liability partnership must be

accompanied by a certificate of account status from the Texas Comptroller of Public Accounts

indicating that all taxes administered by the Comptroller under Title 2, Tax Code have been paid and

that the entity is in good standing for the purpose of withdrawal. Please note that the Comptroller

issues many different types of certificates of account status. You need to attach form #05-305,

Form 704 Instruction Page 1 – Do not submit with filing.