Enlarge image

Form 722—General Information

(Application for Amendment of Registration—Texas Limited Liability Partnership)

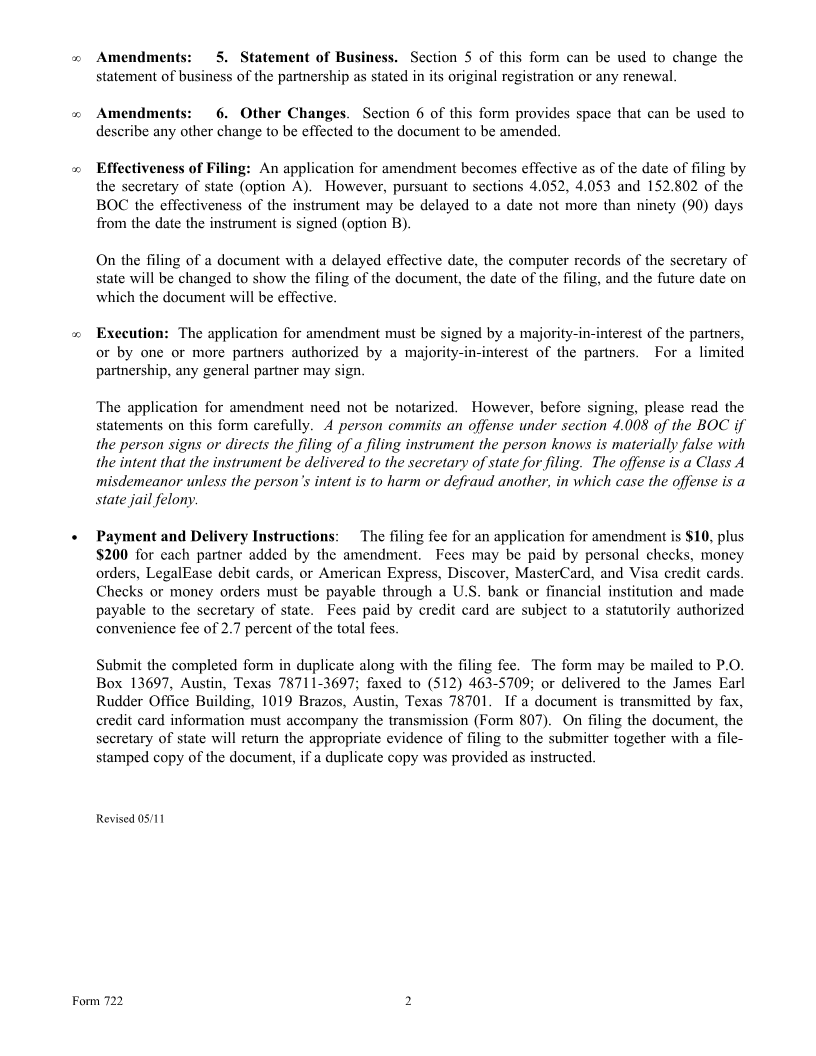

The attached form is drafted to meet minimal statutory filing requirements pursuant to the relevant code

provisions. This form and the information provided are not substitutes for the advice and services of an

attorney and tax specialist.

Commentary

Section 152.802(j) and chapter 4 of the Texas Business Organizations Code (BOC) govern amendments

to the registration of a Texas limited liability partnership.

Instructions for Form

• Entity Information: The application for amendment must contain the legal name of the limited

liability partnership, the federal employer identification number, the identity of the document being

amended and the date on which the document being amended was filed. If the amendment changes

the name of the partnership, the name as it currently appears on the records of the secretary of state

should be stated. It is recommended that the file number assigned by the secretary of state be

provided to facilitate processing of the document.

• Amendments: 1. Amended Name. If the legal name of the partnership is to be changed, state

the new name of the partnership in section 1. Please note that the legal name of the partnership must

include an appropriate organizational designation. The appropriate designations are “limited liability

partnership” or an abbreviation of that phrase. If the partnership is a limited partnership, the name

must comply with the requirements of section 5.055(a) of the BOC, and also must contain the phrase

“limited liability partnership” or “limited liability limited partnership” or an abbreviation of one of

those phrases.

The secretary of state does not review the name of the partnership, or a change of name of the

partnership, to determine whether the name conforms with the entity name availability rules.

• Amendments: 2. Federal Employer Identification Number (FEIN). If the federal employer

identification number stated on the original registration or any renewal has changed, is incorrect, or

the FEIN was not provided, complete this section to change or add the number. Enter the 9-digit

number assigned to the partnership by the Internal Revenue Service (IRS) in the field provided

without punctuation; that is, stripped of any hyphens (e.g., 123456789).

• Amendments: 3. Principal Office. Section 3 of this form can be used to change the address of

the principal office of the partnership. The principal office does not need to be in Texas.

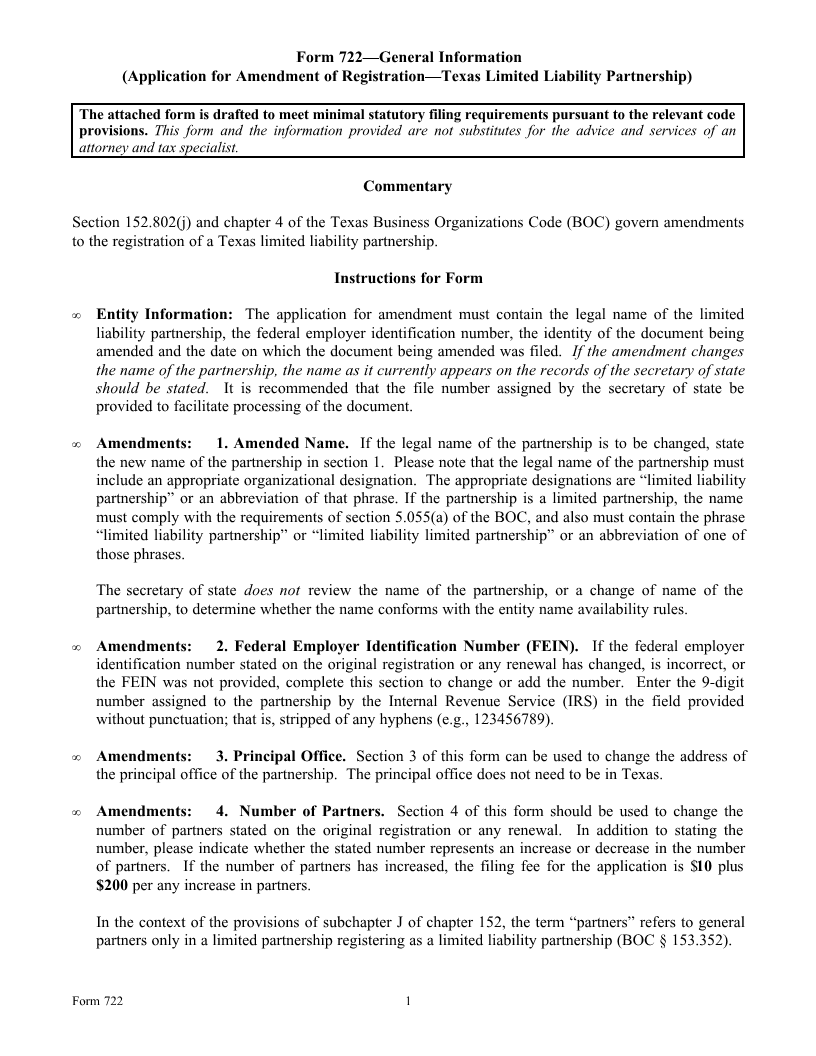

• Amendments: 4. Number of Partners. Section 4 of this form should be used to change the

number of partners stated on the original registration or any renewal. In addition to stating the

number, please indicate whether the stated number represents an increase or decrease in the number

of partners. If the number of partners has increased, the filing fee for the application is $ plus10

$200 per any increase in partners.

In the context of the provisions of subchapter J of chapter 152, the term “partners” refers to general

partners only in a limited partnership registering as a limited liability partnership (BOC § 153.352).

Form 722 1