Enlarge image

Mail completed form to:

NH Attorney General’s Office

Attn: Charitable Trusts Unit

One Granite Place South

Concord, NH 03301

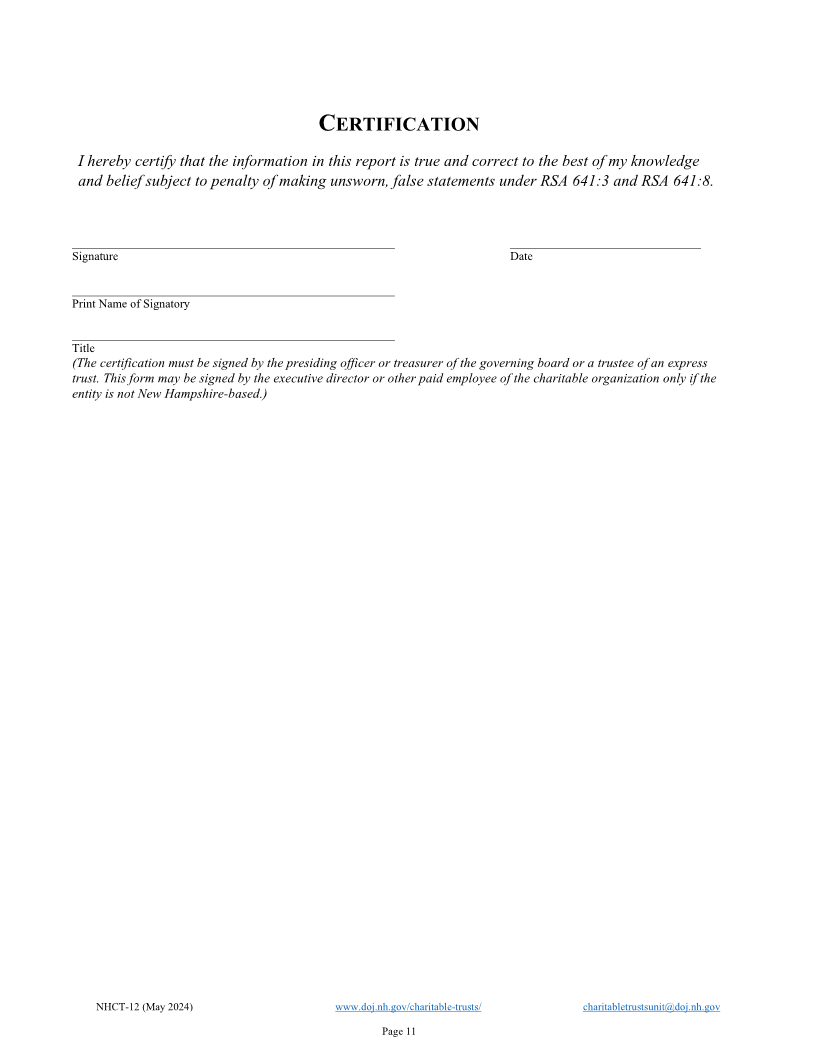

FORM NHCT-12

ANNUAL REPORT

*Instructions for the form are at the following web link:

https://www.doj.nh.gov/charitable-trusts/documents/nhct12-instructions.pdf

This form must be accompanied by a payment in the amount of $75.00, unless previously paid with Form

NHCT-14 for the reporting period. Checks must be made payable to “State of New Hampshire.”

Report is for fiscal year end date (MM/DD/YYYY): _______________________________

Is this a consolidated report for multiple years because the entity was granted a suspension of its annual

requirement?

□ Yes (if yes, state the beginning date of the consolidated report) __________________________________

□ No

CHARITABLE TRUST NFORMATIONI

NH Charitable Trusts Unit Registration No.

Entity Name □Check here if new name

City State Zip

Mailing Address □Check here if new address

Entity Website Address

CONTACT INFORMATION

Contact Name

Contact Address City State Zip

Contact Telephone Number

Contact Email Address

NHCT-12 (May 2024) www.doj.nh.gov/charitable-trusts/ charitabletrustsunit@doj.nh.gov

Page 1