Enlarge image

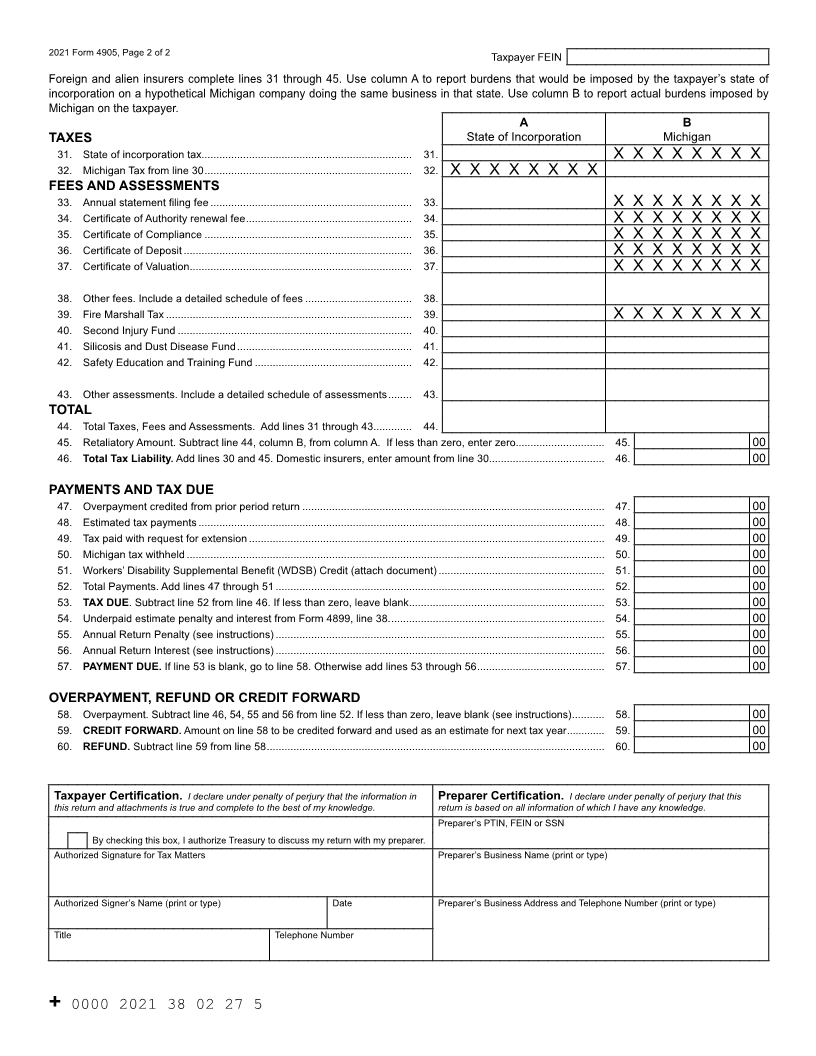

Michigan Department of Treasury

4905 (Rev. 10-21), Page 1 of 2 This form cannot be used as

an amended return; use the

Insurance Company Amended

2021 Insurance Company Annual Return for Return for Corporate Income and

Retaliatory Taxes (Form 4906).

Corporate Income and Retaliatory Taxes

Issued under authority of Public Act 38 of 2011.

1. Taxpayer Name 2. Federal Employer Identification Number (FEIN)

Address (Number, Street)

3. Check if Foreign Insurer

City State ZIP/Postal Code Country Code 4. State of Incorporation (use 2 letter abbreviation)

DIRECT PREMIUMS WRITTEN IN MICHIGAN A B

See instructions before completing lines 5 through 23. Qualified Health Ins. Policies All Other Policies

5. Gross direct premiums written in Michigan................................................................ 5. 00 00

6. Premiums on policies not taken................................................................................. 6. 00 00

7. Returned premiums on canceled policies.................................................................. 7. 00 00

8. Receipts on sales of annuities ................................................................................... 8. 00 00

9. Receipts on reinsurance assumed (see instructions) ................................................ 9. 00 00

10. Add lines 6 through 9................................................................................................. 10. 00 00

11. Direct Premiums Written in Michigan. Subtract line 10 from line 5.

If less than zero, enter zero ....................................................................................... 11. 00 00

DISABILITY INSURANCE EXEMPTION

12. Disability insurance premiums written in Michigan, not including credit or disability

income insurance premiums (see instructions) ........................................................... 12. 00 00

13. Proportional share of limit and phase-out.

Column A: Divide line 12, column A, by the sum of line 12, columns A and B.

Column B: Divide line 12, column B, by the sum of line 12, columns A and B......... 13. % %

14. Enter the sum of all disability insurance premiums from both columns of line 12

OR $190,000,000, whichever is less ............................................................................................... 14. 00

15. Gross direct premiums from insurance carrier services everywhere............................................... 15. 00

16. Phase out ........................................................................................................................................ 16. 280,000,000 00

17. Subtract line 16 from line 15. If less than zero, enter zero .............................................................. 17. 00

18. Exemption reduction. Multiply line 17 by 2 ...................................................................................... 18. 00

19. Subtract line 18 from line 14. If less than zero, enter zero .............................................................. 19. 00

20. Allocated reduced exemption.

Column A: Multiply line 19 by the percentage on line 13, column A.

Column B:Multiply line 19 by the percentage on line 13, column B ....................... 20. 00 00

21. Adjusted tax base.

Column A: Subtract line 20, column A, from line 11, column A.

Column B: Subtract line 20, column B, from line 11, column B............................... 21. 00 00

22. Multiply line 21, column A, by 0.4835% and column B by 1.25% (0.0125)................ 22. 00 00

23. Tax before credits. Add line 22, columns A and B............................................................................ 23. 00

CREDITS

24. Enter amounts paid from 1/1/2020 to 12/31/2020 to each of the following:

a. Michigan Workers’ Compensation Placement Facility ..................................................................................... 24a. 00

b. Michigan Basic Property Insurance Association .............................................................................................. 24b. 00

c. Michigan Automobile Insurance Placement Facility ........................................................................................ 24c. 00

d. Property and Casualty Guaranty Association .................................................................................................. 24d. 00

e. Michigan Life and Health Insurance Guaranty Association ............................................................................. 24e. 00

25. Add lines 24a through 24e...................................................................................................................................... 25. 00

26. Michigan Examination Fees or Regulatory Fee...................................................................................................... 26. 00

27. Credit. Multiply line 26 by 50% (0.50) ..................................................................................................................... 27. 00

28. Tax liability before recapture. Subtract line 25 and line 27 from line 23. If less than or equal to $100, enter zero . 28. 00

29. Total Recapture of Certain Business Tax Credits from Form 4902 ......................................................................... 29. 00

30. Total Michigan Tax. Add line 28 and line 29 ......................................................................................................... 30. 00

+ 0000 2021 38 01 27 7 Continue and sign on Page 2