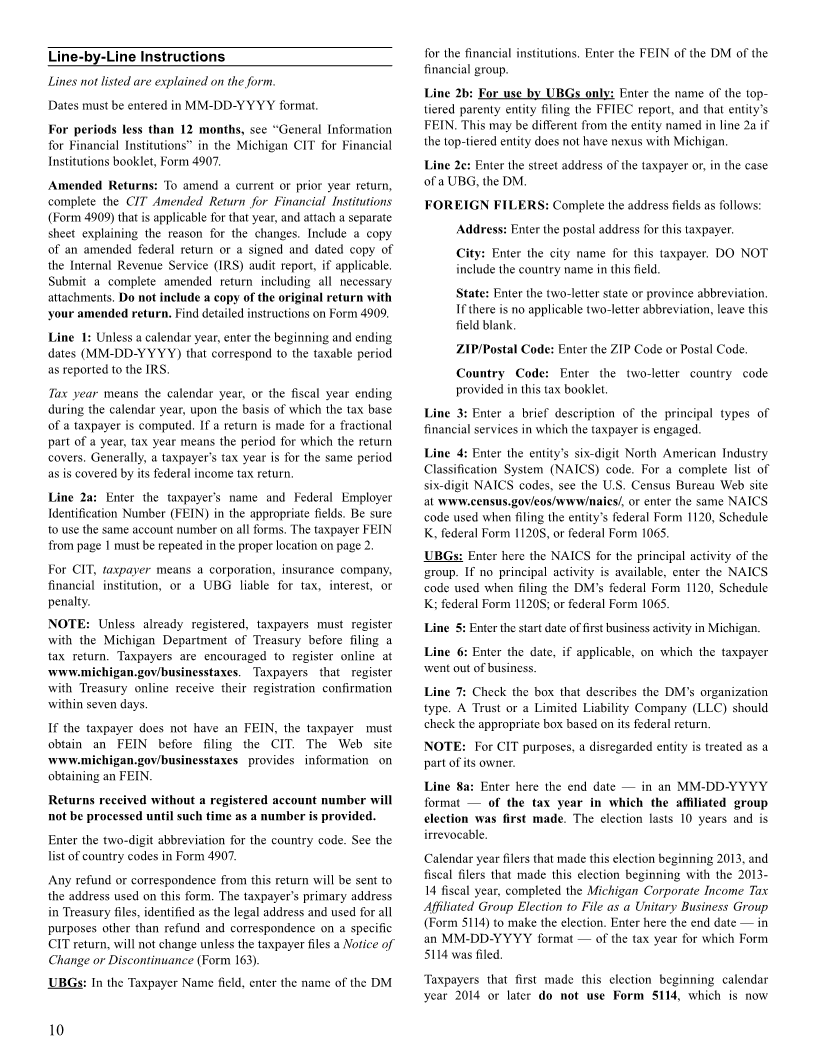

Enlarge image

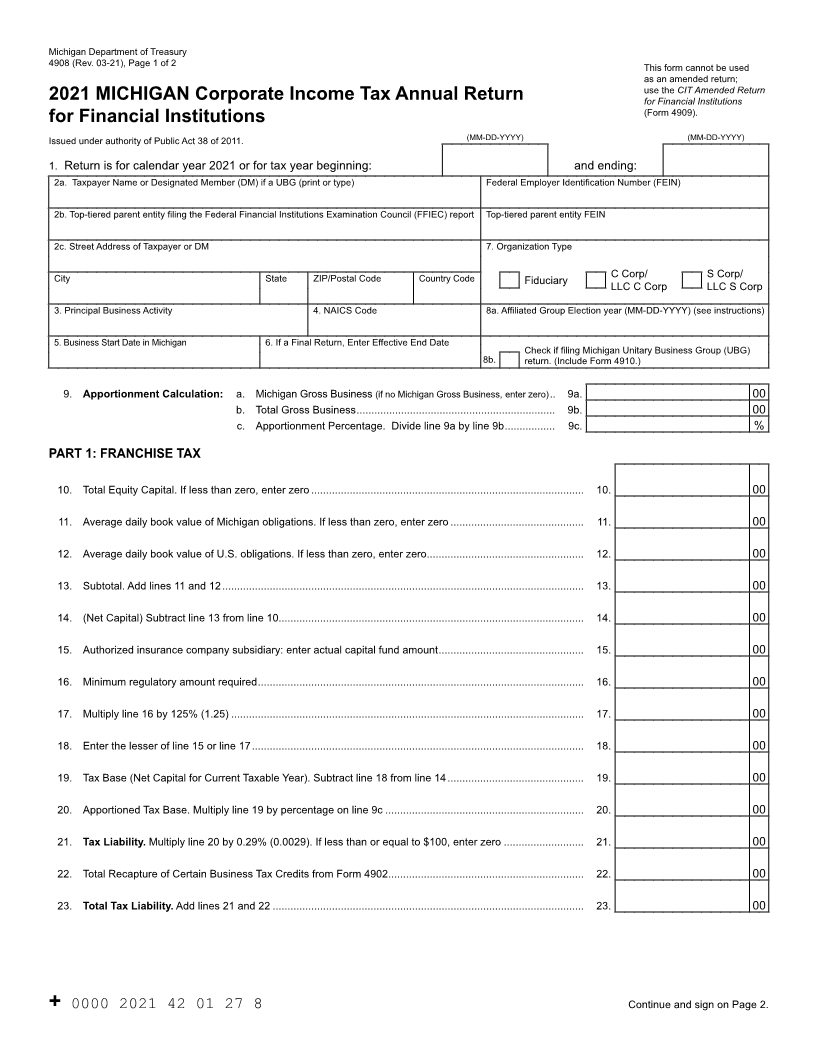

Michigan Department of Treasury

4908 (Rev. 03-21), Page 1 of 2 This form cannot be used

as an amended return;

use the CIT Amended Return

2021 MICHIGAN Corporate Income Tax Annual Return for Financial Institutions

(Form 4909).

for Financial Institutions

Issued under authority of Public Act 38 of 2011. (MM-DD-YYYY) (MM-DD-YYYY)

1. Return is for calendar year 2021 or for tax year beginning: and ending:

2a. Taxpayer Name or Designated Member (DM) if a UBG (print or type) Federal Employer Identification Number (FEIN)

2b. Top-tiered parent entity filing the Federal Financial Institutions Examination Council (FFIEC) report Top-tiered parent entity FEIN

2c. Street Address of Taxpayer or DM 7. Organization Type

City State ZIP/Postal Code Country Code Fiduciary C Corp/ S Corp/

LLC C Corp LLC S Corp

3. Principal Business Activity 4. NAICS Code 8a. Affiliated Group Election year (MM-DD-YYYY) (see instructions)

5. Business Start Date in Michigan 6. If a Final Return, Enter Effective End Date

Check if filing Michigan Unitary Business Group (UBG)

8b. return. (Include Form 4910.)

9. Apportionment Calculation: a. Michigan Gross Business(if no Michigan Gross Business, enter zero) .. 9a. 00

b. Total Gross Business ................................................................... 9b. 00

c. Apportionment Percentage. Divide line 9a by line 9b ................. 9c. %

PART 1: FRANCHISE TAX

10. Total Equity Capital. If less than zero, enter zero ............................................................................................ 10. 00

11. Average daily book value of Michigan obligations. If less than zero, enter zero ............................................. 11. 00

12. Average daily book value of U.S. obligations. If less than zero, enter zero ..................................................... 12. 00

13. Subtotal. Add lines 11 and 12 .......................................................................................................................... 13. 00

14. (Net Capital) Subtract line 13 from line 10....................................................................................................... 14. 00

15. Authorized insurance company subsidiary: enter actual capital fund amount ................................................. 15. 00

16. Minimum regulatory amount required .............................................................................................................. 16. 00

17. Multiply line 16 by 125% (1.25) ....................................................................................................................... 17. 00

18. Enter the lesser of line 15 or line 17 ................................................................................................................ 18. 00

19. Tax Base (Net Capital for Current Taxable Year). Subtract line 18 from line 14 .............................................. 19. 00

20. Apportioned Tax Base. Multiply line 19 by percentage on line 9c ................................................................... 20. 00

21. Tax Liability. Multiply line 20 by 0.29% (0.0029). If less than or equal to $100, enter zero ........................... 21. 00

22. Total Recapture of Certain Business Tax Credits from Form 4902 .................................................................. 22. 00

23. Total Tax Liability. Add lines 21 and 22 ......................................................................................................... 23. 00

+ 0000 2021 42 01 27 8 Continue and sign on Page 2.