Enlarge image

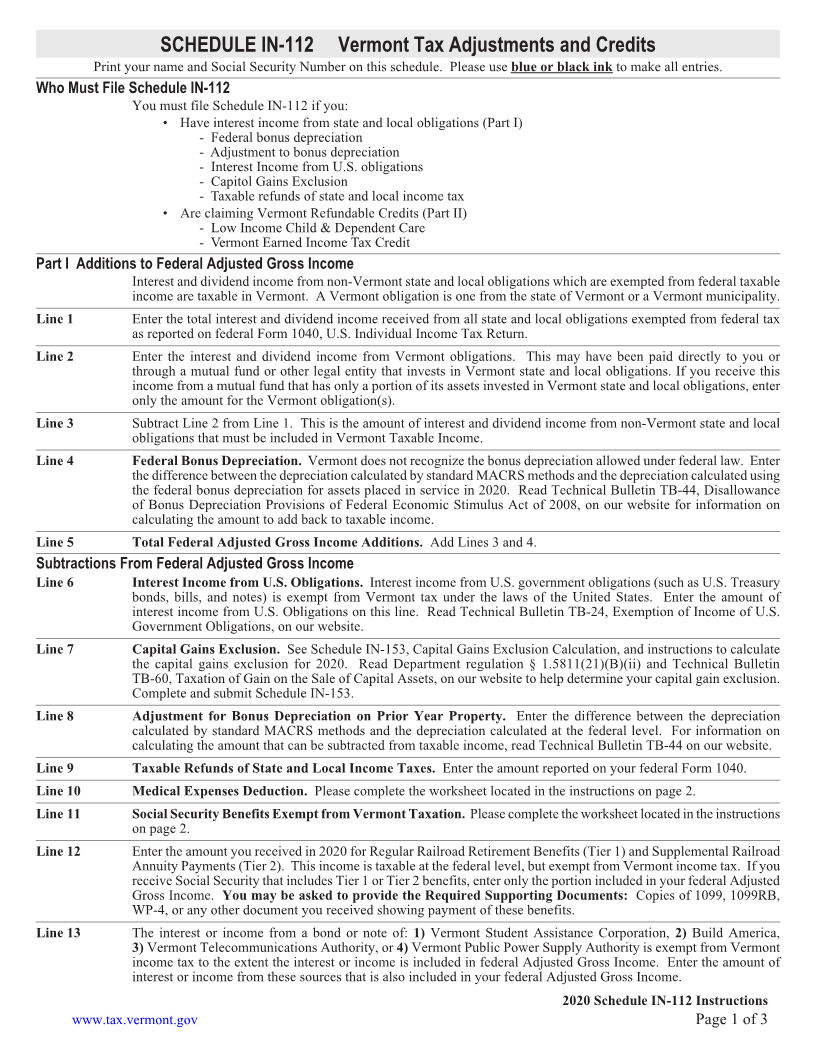

SCHEDULE IN-112 Vermont Tax Adjustments and Credits

Print your name and Social Security Number on this schedule. Please use blue or black ink to make all entries.

Who Must File Schedule IN-112

You must file Schedule IN-112 if you:

• Have interest income from state and local obligations (Part I) Page 1

- Federal bonus depreciation

- Adjustment to bonus depreciation

- Interest Income from U.S. obligations

- Capitol Gains Exclusion

- Taxable refunds of state and local income tax

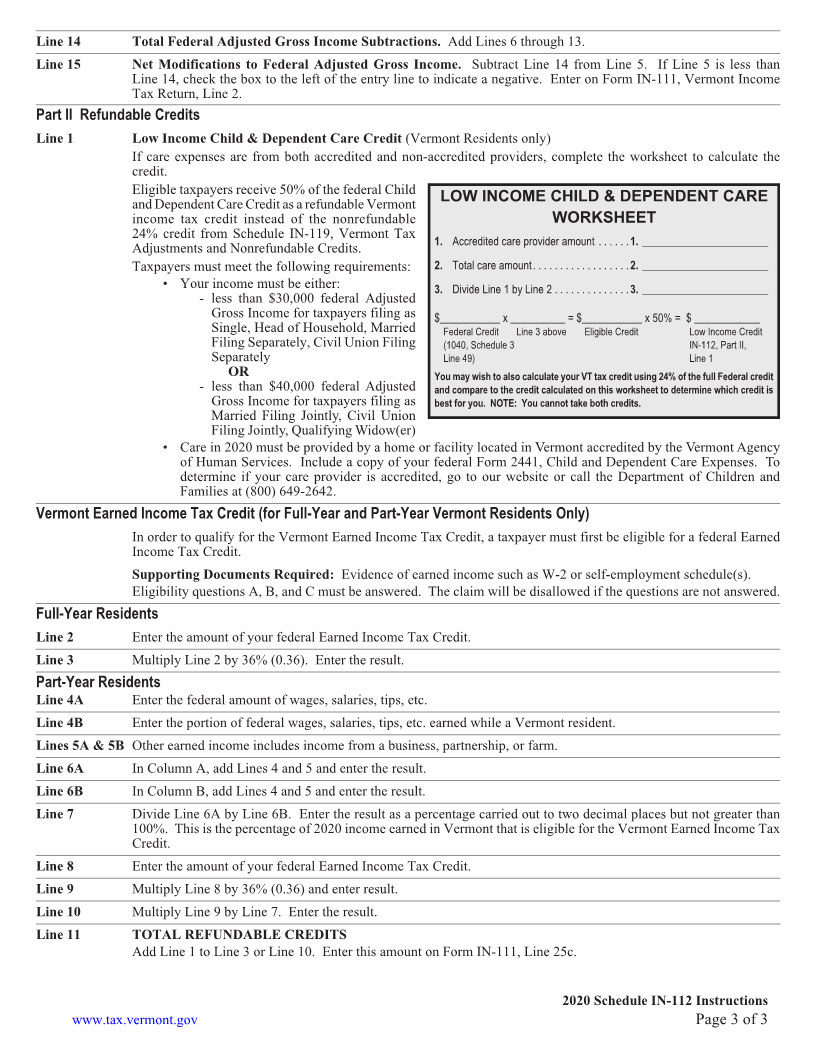

• Are claiming Vermont Refundable Credits (Part II)

- Low Income Child & Dependent Care

- Vermont Earned Income Tax Credit

Part I Additions to Federal Adjusted Gross Income

Interest and dividend income from non-Vermont state and local obligations which are exempted from federal taxable

income are taxable in Vermont. A Vermont obligation is one from the state of Vermont or a Vermont municipality.

Line 1 Enter the total interest and dividend income received from all state and local obligations exempted from federal tax

as reported on federal Form 1040, U.S. Individual Income Tax Return.

Line 2 Enter the interest and dividend income from Vermont obligations. This may have been paid directly to you or

through a mutual fund or other legal entity that invests in Vermont state and local obligations. If you receive this

income from a mutual fund that has only a portion of its assets invested in Vermont state and local obligations, enter

only the amount for the Vermont obligation(s).

Line 3 Subtract Line 2 from Line 1. This is the amount of interest and dividend income from non-Vermont state and local

obligations that must be included in Vermont Taxable Income.

Line 4 Federal Bonus Depreciation. Vermont does not recognize the bonus depreciation allowed under federal law. Enter

the difference between the depreciation calculated by standard MACRS methods and the depreciation calculated using

the federal bonus depreciation for assets placed in service in 2020. Read Technical Bulletin TB-44, Disallowance

of Bonus Depreciation Provisions of Federal Economic Stimulus Act of 2008, on our website for information on

calculating the amount to add back to taxable income.

Line 5 Total Federal Adjusted Gross Income Additions. Add Lines 3 and 4.

Subtractions From Federal Adjusted Gross Income

Line 6 Interest Income from U.S. Obligations. Interest income from U.S. government obligations (such as U.S. Treasury

bonds, bills, and notes) is exempt from Vermont tax under the laws of the United States. Enter the amount of

interest income from U.S. Obligations on this line. Read Technical Bulletin TB-24, Exemption of Income of U.S.

Government Obligations, on our website.

Line 7 Capital Gains Exclusion. See Schedule IN-153, Capital Gains Exclusion Calculation, and instructions to calculate

the capital gains exclusion for 2020. Read Department regulation § 1.5811(21)(B)(ii) and Technical Bulletin

TB-60, Taxation of Gain on the Sale of Capital Assets, on our website to help determine your capital gain exclusion.

Complete and submit Schedule IN-153.

Line 8 Adjustment for Bonus Depreciation on Prior Year Property. Enter the difference between the depreciation

calculated by standard MACRS methods and the depreciation calculated at the federal level. For information on

calculating the amount that can be subtracted from taxable income, read Technical Bulletin TB-44 on our website.

Line 9 Taxable Refunds of State and Local Income Taxes. Enter the amount reported on your federal Form 1040.

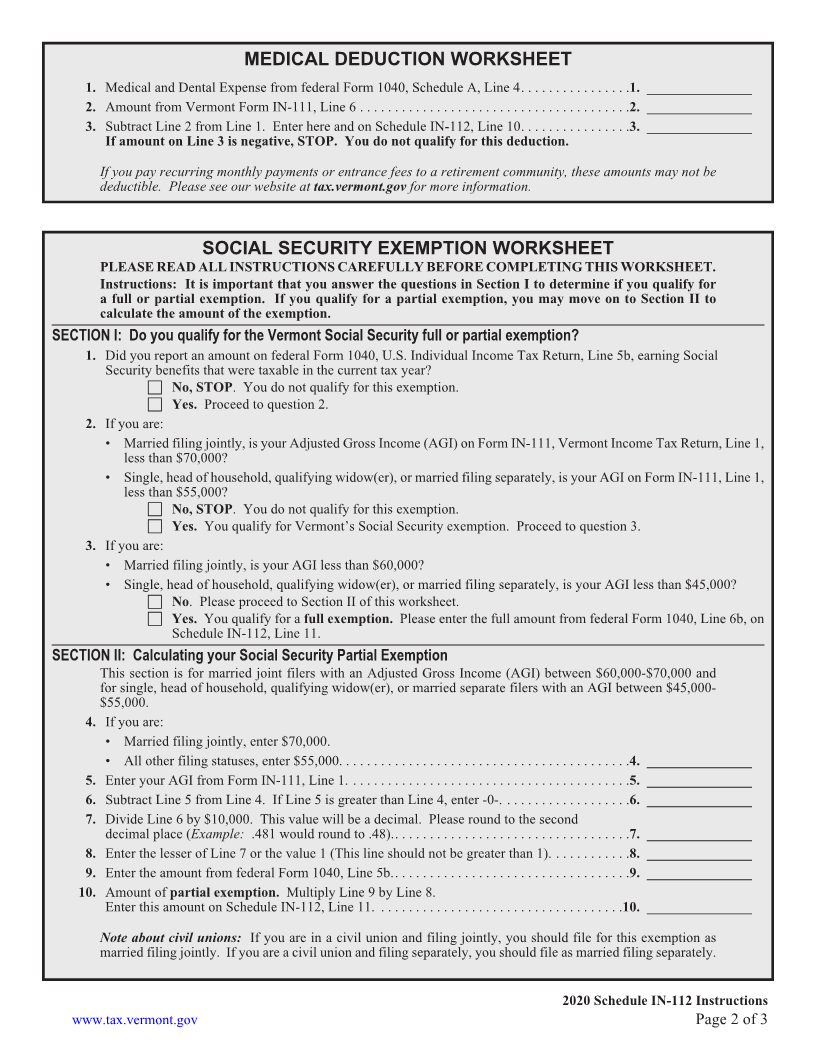

Line 10 Medical Expenses Deduction. Please complete the worksheet located in the instructions on page 2.

Line 11 Social Security Benefits Exempt from Vermont Taxation. Please complete the worksheet located in the instructions

on page 2.

Line 12 Enter the amount you received in 2020 for Regular Railroad Retirement Benefits (Tier 1) and Supplemental Railroad

Annuity Payments (Tier 2). This income is taxable at the federal level, but exempt from Vermont income tax. If you

receive Social Security that includes Tier 1 or Tier 2 benefits, enter only the portion included in your federal Adjusted

Gross Income. You may be asked to provide the Required Supporting Documents: Copies of 1099, 1099RB,

WP-4, or any other document you received showing payment of these benefits.

Line 13 The interest or income from a bond or note of: 1) Vermont Student Assistance Corporation, Build2)America,

3) Vermont Telecommunications Authority, or 4)Vermont Public Power Supply Authority is exempt from Vermont

income tax to the extent the interest or income is included in federal Adjusted Gross Income. Enter the amount of

interest or income from these sources that is also included in your federal Adjusted Gross Income.

2020 Schedule IN-112 Instructions

www.tax.vermont.gov Page 1 of 3