Enlarge image

STOP: DO NOT USE FOR 2021 HOMESTEAD DECLARATION AND PROPERTY TAX CREDIT FILING This form is for last year’s filing and will not be accepted for tax year 2021 homestead declaration and property tax credit filing.

Enlarge image | STOP: DO NOT USE FOR 2021 HOMESTEAD DECLARATION AND PROPERTY TAX CREDIT FILING This form is for last year’s filing and will not be accepted for tax year 2021 homestead declaration and property tax credit filing. |

Enlarge image |

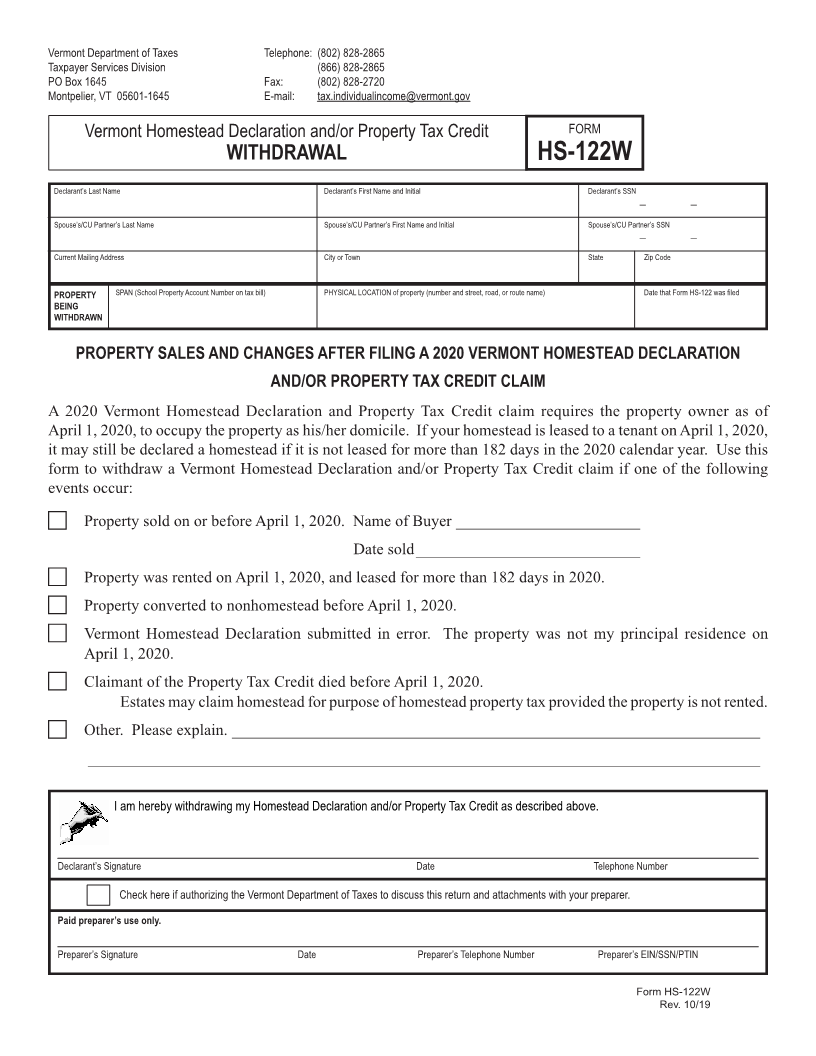

Vermont Department of Taxes Telephone: (802) 828-2865

Taxpayer Services Division (866) 828-2865

PO Box 1645 Fax: (802) 828-2720

Montpelier, VT 05601-1645 E-mail: tax.individualincome@vermont.gov

Page 1

Vermont Homestead Declaration and/or Property Tax Credit FORM

WITHDRAWAL HS-122W

Declarant’s Last Name Declarant’s First Name and Initial Declarant’s SSN

_ _

Spouse’s/CU Partner’s Last Name Spouse’s/CU Partner’s First Name and Initial Spouse’s/CU Partner’s SSN

_ _

Current Mailing Address City or Town State Zip Code

PROPERTY SPAN (School Property Account Number on tax bill) PHYSICAL LOCATION of property (number and street, road, or route name) Date that Form HS-122 was filed

BEING

WITHDRAWN

PROPERTY SALES AND CHANGES AFTER FILING A 2020 VERMONT HOMESTEAD DECLARATION

AND/OR PROPERTY TAX CREDIT CLAIM

FORM (Place at FIRST page)

A 2020 Vermont Homestead Declaration and Property Tax Credit claim requires the property owner as of Form pages

April 1, 2020, to occupy the property as his/her domicile. If your homestead is leased to a tenant on April 1, 2020,

it may still be declared a homestead if it is not leased for more than 182 days in the 2020 calendar year. Use this

form to withdraw a Vermont Homestead Declaration and/or Property Tax Credit claim if one of the following

events occur: 1 - 1

Property sold on or before April 1, 2020. Name of Buyer _______________________

Date sold ____________________________

Property was rented on April 1, 2020, and leased for more than 182 days in 2020.

Property converted to nonhomestead before April 1, 2020.

Vermont Homestead Declaration submitted in error. The property was not my principal residence on

April 1, 2020.

Claimant of the Property Tax Credit died before April 1, 2020.

Estates may claim homestead for purpose of homestead property tax provided the property is not rented.

Other. Please explain. __________________________________________________________________

____________________________________________________________________________________

I am hereby withdrawing my Homestead Declaration and/or Property Tax Credit as described above.

FORM (Place at LAST page)

Form pages

Declarant’s Signature Date Telephone Number

Check here if authorizing the Vermont Department of Taxes to discuss this return and attachments with your preparer.

Paid preparer’s use only.

1 - 1

Preparer’s Signature Date Preparer’s Telephone Number Preparer’s EIN/SSN/PTIN

Form HS-122W

Rev. 10/19

|