Enlarge image

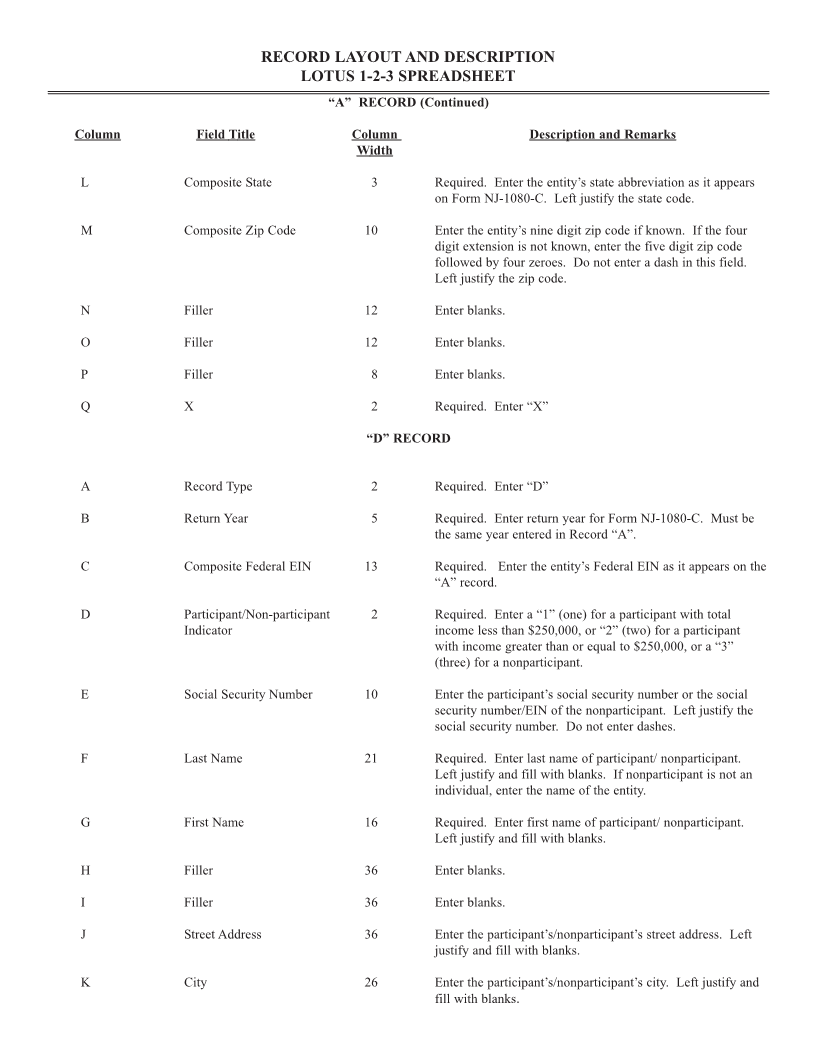

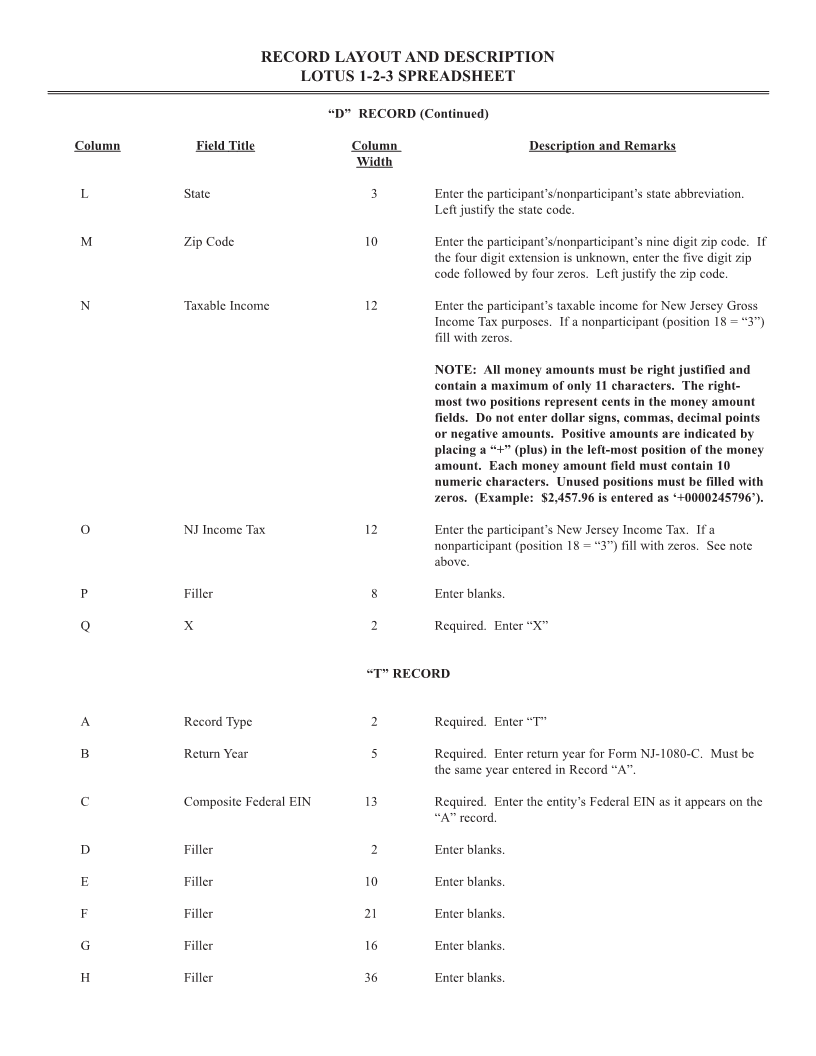

RECORD LAYOUT AND DESCRIPTION

LOTUS 1-2-3 SPREADSHEET

• Enter all information in UPPER CASE only.

• Do not use column headings.

• Use Row 1 for the ‘A’ record.

• Use Row 2 for the first ‘D’ record.

• Use the row immediately after the last ‘D’ record for the ‘T’ record.

• Do not leave any rows blank.

• Save file as ‘EXCEL Worksheet’.

• All diskettes must contain the 8 character entry NJ1080DR as the file name. The New Jersey Division of Taxation will reject

and return unprocessed any diskette not properly identified internally by NJ1080DR. A diskette must not contain any file or

data set other than NJ1080DR.

“A” RECORD

Column Field Title Column Description and Remarks

Width

A Record Type 2 Required. Enter “A”

B Return Year 5 Required. Enter return year for Form NJ-1080-C. For 2000,

enter “2000”.

C Federal EIN 13 Required. Enter the entity’s Federal EIN as it appears on

Form NJ-1080-C. If the Federal EIN as it appears on Form

NJ-1080-C is nine digits in length, enter three zeros in the

three positions after the ninth digit of the EIN. Do not enter

dashes. Left justify the Federal EIN.

D Filler 2 Enter blanks.

E Filler 10 Enter blanks.

F Filler 21 Enter blanks.

G Filler 16 Enter blanks.

H Composite Name 36 Required. Enter the entity’s name as it appears on Form NJ-

1080-C. Left justify and fill with blanks.

I Composite Trade Name 36 Enter the entity’s trade name, if applicable, as it appears of

Form NJ-1080-C. Left justify and fill with blanks.

J Composite Street Address 36 Required. Enter the entity’s street address as it appears on

Form NJ-1080-C. Left justify and fill with blanks.

K Composite City 26 Required. Enter the entity’s city as it appears on Form NJ-

1080-C. Left Justify and fill with blanks.