Enlarge image

1 2023 Form NJ-1040X

Use of Form NJ‑1040X When to File

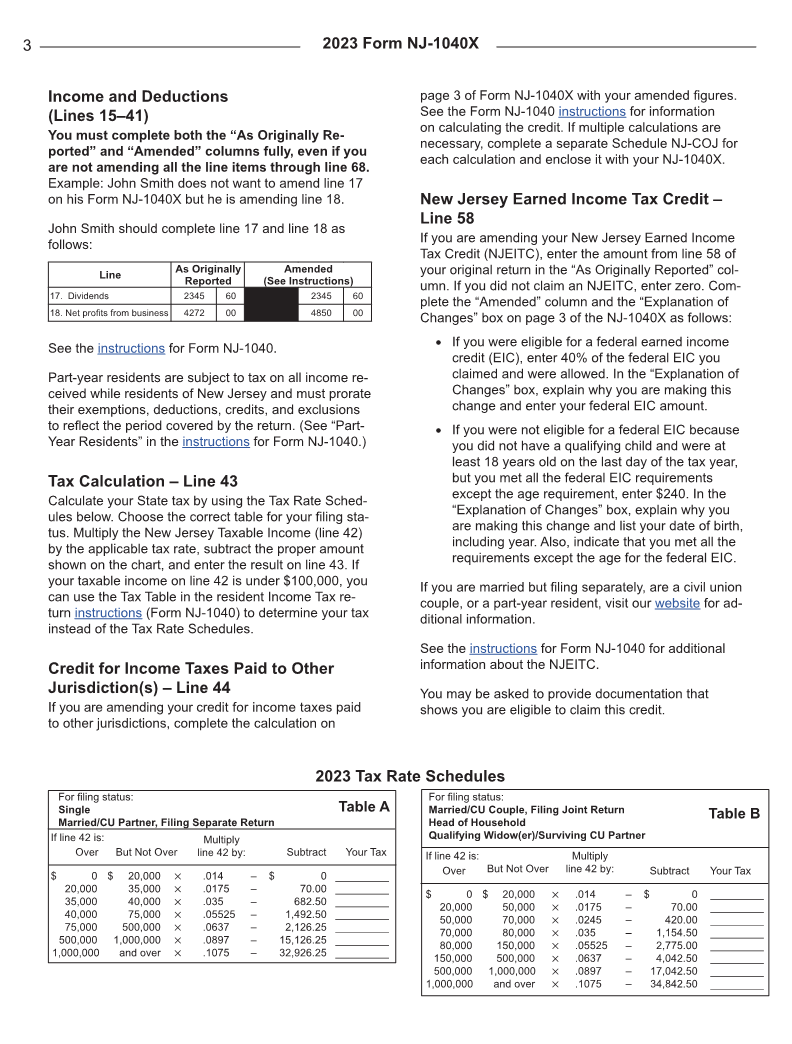

You must use Form NJ-1040X for the appropriate tax File Form NJ-1040X only after you have filed your

year to change (amend) any information reported original resident Income Tax return and you need

on your original resident Income Tax return (Form to change the original return. You cannot use Form

NJ‑1040 or return that was filed using approved ven- NJ‑1040X to file an original resident return.

dor software). If you have already filed a 2023 resident

Income Tax return and you need to change any of

the information reported or provide information that Where to File

was missing, you must use the 2023 Form NJ‑1040X. Mail Amended Returns (Form NJ-1040X) to:

Failure to use Form NJ‑1040X to amend a resident State of New Jersey

Division of Taxation

return will delay the processing of your return and/

Revenue Processing Center

or refund.

PO Box 664

Note: You must fill out both the “As Originally Re- Trenton NJ 08646‑0664

ported” and “Amended” columns of Form

NJ‑1040X completely, even though certain Name and Social Security Number

items in the “Amended” column are not being Your name and Social Security number must be en-

amended. tered on Form NJ-1040X and all accompanying sched-

ules. If you are filing a joint return, include both Social

Time Period for Refunds. Amended returns claim-

Security numbers in the same order as on the original

ing a refund must be filed within three years from the

return.

time the return was filed or two years from the time

the tax was paid, whichever is later. If the return is not

received within this time limit, it will be considered past Taxpayer Signature

the statute and the refund claim will be disallowed. You must sign and date your NJ-1040X in blue or

black ink. Both husband and wife/civil union part‑

Amending Nonresident Returns. New Jersey does ners must sign a joint amended return.A return

not have a separate form for amending nonresident without the proper signatures cannot be processed.

returns. To amend a nonresident return, use Form

NJ-1040NR for the appropriate tax year and check

the box at the top of the return. Do not use Form Tax Preparers

NJ‑1040X to amend a nonresident return. Anyone who prepares a return for a fee must sign

the return as a “Paid Preparer” and enter their Social

Security number or federal pre parer tax identification

Enclosures with Form NJ‑1040X number. Include the company or corporation name

If you are amending an item of income, deduction, or and federal identification number if applicable. A tax

credit that requires supporting documents, you must preparer who fails to sign the return or provide a tax

enclose the applicable schedule or form when filing identification number may incur a $25 penalty for each

Form NJ-1040X. omission.

Forms W‑2 and 1099. You must enclose copies of

your W‑2s and/or 1099s that show New Jersey In- Calendar Year or Fiscal Year Ended

come Tax withheld. Include copies even if you are not Like the resident Income Tax return, Form NJ-1040X

amending the amount of tax withheld. Also include is different for each year. The calendar year or fiscal

copies if you are claiming excess New Jersey unem- year must be the same as the year covered by the

ployment insurance/workforce development partner- original return that is being amended. Example: John

ship fund/ supplemental workforce fund contributions Smith discovers an error on his 2022 New Jersey resi-

and/or family leave insurance contributions. dent Income Tax return while preparing his tax return

for 2023. To correct the error on his 2022 tax return,

Returns Filed Electronically. If you filed your origi- he must file Form NJ‑1040X for Tax Year 2022. The

nal return electronically, enclose with Form NJ-1040X calen dar year on his NJ‑1040X will be 2022 even

all supporting schedules or forms (W‑2, Schedules though he is preparing the NJ‑1040X in 2024.

NJ‑COJ and NJ‑DOP, NJ‑BUS‑1, NJ‑BUS‑2, NJK‑1,

etc.) that you would have enclosed if you had filed the

original return on paper — including those that support

items that are not being amended.