Enlarge image

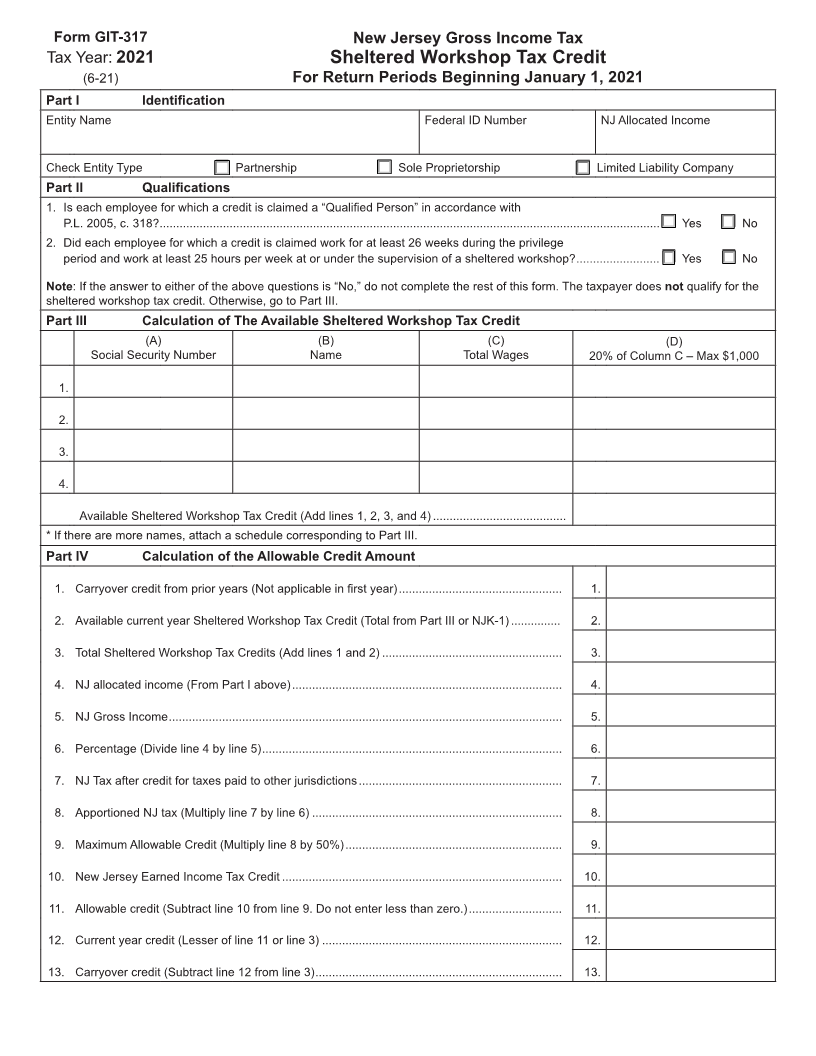

Form GIT-317 New Jersey Gross Income Tax

Tax Year: 2021 Sheltered Workshop Tax Credit

(6-21) For Return Periods Beginning January 1, 2021

Part I Identification

Entity Name Federal ID Number NJ Allocated Income

Check Entity Type Partnership Sole Proprietorship Limited Liability Company

Part II Qualifications

1. Is each employee for which a credit is claimed a “Qualified Person” in accordance with

P.L. 2005, c. 318? ...................................................................................................................................................... Yes No

2. Did each employee for which a credit is claimed work for at least 26 weeks during the privilege

period and work at least 25 hours per week at or under the supervision of a sheltered workshop? ......................... Yes No

Note: If the answer to either of the above questions is “No,” do not complete the rest of this form. The taxpayer does not qualify for the

sheltered workshop tax credit. Otherwise, go to Part III.

Part III Calculation of The Available Sheltered Workshop Tax Credit

(A) (B) (C) (D)

Social Security Number Name Total Wages 20% of Column C – Max $1,000

1.

2.

3.

4.

Available Sheltered Workshop Tax Credit (Add lines 1, 2, 3, and 4) ........................................

* If there are more names, attach a schedule corresponding to Part III.

Part IV Calculation of the Allowable Credit Amount

1. Carryover credit from prior years (Not applicable in first year) ................................................. 1.

2. Available current year Sheltered Workshop Tax Credit (Total from Part III or NJK-1) ............... 2.

3. Total Sheltered Workshop Tax Credits (Add lines 1 and 2) ...................................................... 3.

4. NJ allocated income (From Part I above) ................................................................................. 4.

5. NJ Gross Income ...................................................................................................................... 5.

6. Percentage (Divide line 4 by line 5) .......................................................................................... 6.

7. NJ Tax after credit for taxes paid to other jurisdictions ............................................................. 7.

8. Apportioned NJ tax (Multiply line 7 by line 6) ........................................................................... 8.

9. Maximum Allowable Credit (Multiply line 8 by 50%) ................................................................. 9.

10. New Jersey Earned Income Tax Credit .................................................................................... 10.

11. Allowable credit (Subtract line 10 from line 9. Do not enter less than zero.) ............................ 11.

12. Current year credit (Lesser of line 11 or line 3) ........................................................................ 12.

13. Carryover credit (Subtract line 12 from line 3) .......................................................................... 13.