Enlarge image

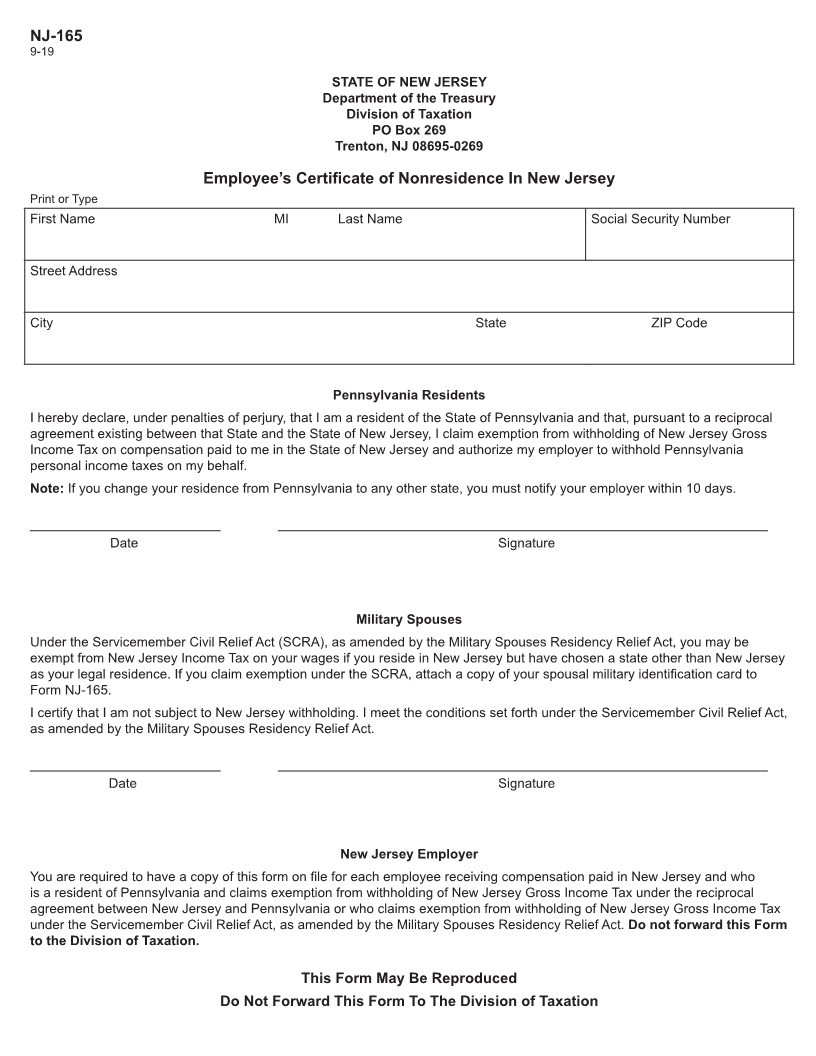

NJ-165

9-19

STATE OF NEW JERSEY

Department of the Treasury

Division of Taxation

PO Box 269

Trenton, NJ 08695-0269

Employee’s Certificate of Nonresidence In New Jersey

Print or Type

First Name MI Last Name Social Security Number

Street Address

City State ZIP Code

Pennsylvania Residents

I hereby declare, under penalties of perjury, that I am a resident of the State of Pennsylvania and that, pursuant to a reciprocal

agreement existing between that State and the State of New Jersey, I claim exemption from withholding of New Jersey Gross

Income Tax on compensation paid to me in the State of New Jersey and authorize my employer to withhold Pennsylvania

personal income taxes on my behalf.

Note: If you change your residence from Pennsylvania to any other state, you must notify your employer within 10 days.

Date Signature

Military Spouses

Under the Servicemember Civil Relief Act (SCRA), as amended by the Military Spouses Residency Relief Act, you may be

exempt from New Jersey Income Tax on your wages if you reside in New Jersey but have chosen a state other than New Jersey

as your legal residence. If you claim exemption under the SCRA, attach a copy of your spousal military identification card to

Form NJ-165.

I certify that I am not subject to New Jersey withholding. I meet the conditions set forth under the Servicemember Civil Relief Act,

as amended by the Military Spouses Residency Relief Act.

Date Signature

New Jersey Employer

You are required to have a copy of this form on file for each employee receiving compensation paid in New Jersey and who

is a resident of Pennsylvania and claims exemption from withholding of New Jersey Gross Income Tax under the reciprocal

agreement between New Jersey and Pennsylvania or who claims exemption from withholding of New Jersey Gross Income Tax

under the Servicemember Civil Relief Act, as amended by the Military Spouses Residency Relief Act. Do not forward this Form

to the Division of Taxation.

This Form May Be Reproduced

Do Not Forward This Form To The Division of Taxation