Enlarge image

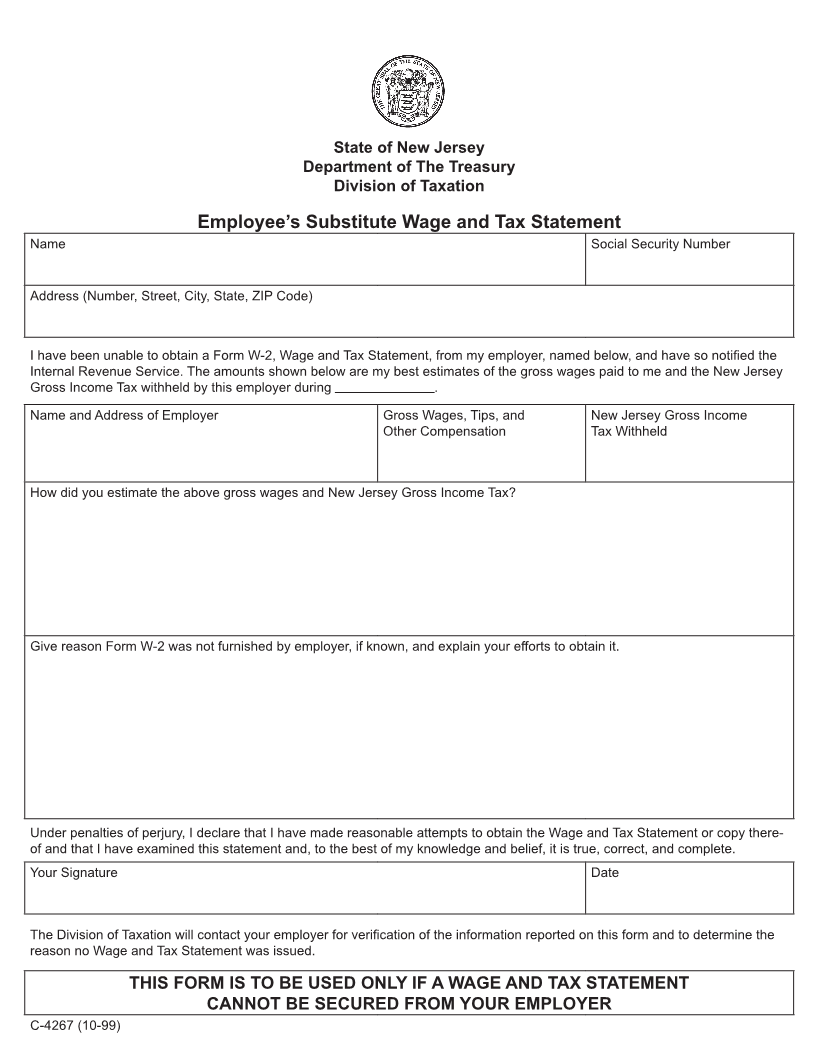

State of New Jersey

Department of The Treasury

Division of Taxation

Employee’s Substitute Wage and Tax Statement

Name Social Security Number

Address (Number, Street, City, State, ZIP Code)

I have been unable to obtain a Form W-2, Wage and Tax Statement, from my employer, named below, and have so notified the

Internal Revenue Service. The amounts shown below are my best estimates of the gross wages paid to me and the New Jersey

Gross Income Tax withheld by this employer during .

Name and Address of Employer Gross Wages, Tips, and New Jersey Gross Income

Other Compensation Tax Withheld

How did you estimate the above gross wages and New Jersey Gross Income Tax?

Give reason Form W-2 was not furnished by employer, if known, and explain your efforts to obtain it.

Under penalties of perjury, I declare that I have made reasonable attempts to obtain the Wage and Tax Statement or copy there-

of and that I have examined this statement and, to the best of my knowledge and belief, it is true, correct, and complete.

Your Signature Date

The Division of Taxation will contact your employer for verification of the information reported on this form and to determine the

reason no Wage and Tax Statement was issued.

THIS FORM IS TO BE USED ONLY IF A WAGE AND TAX STATEMENT

CANNOT BE SECURED FROM YOUR EMPLOYER

C-4267 (10-99)