Enlarge image

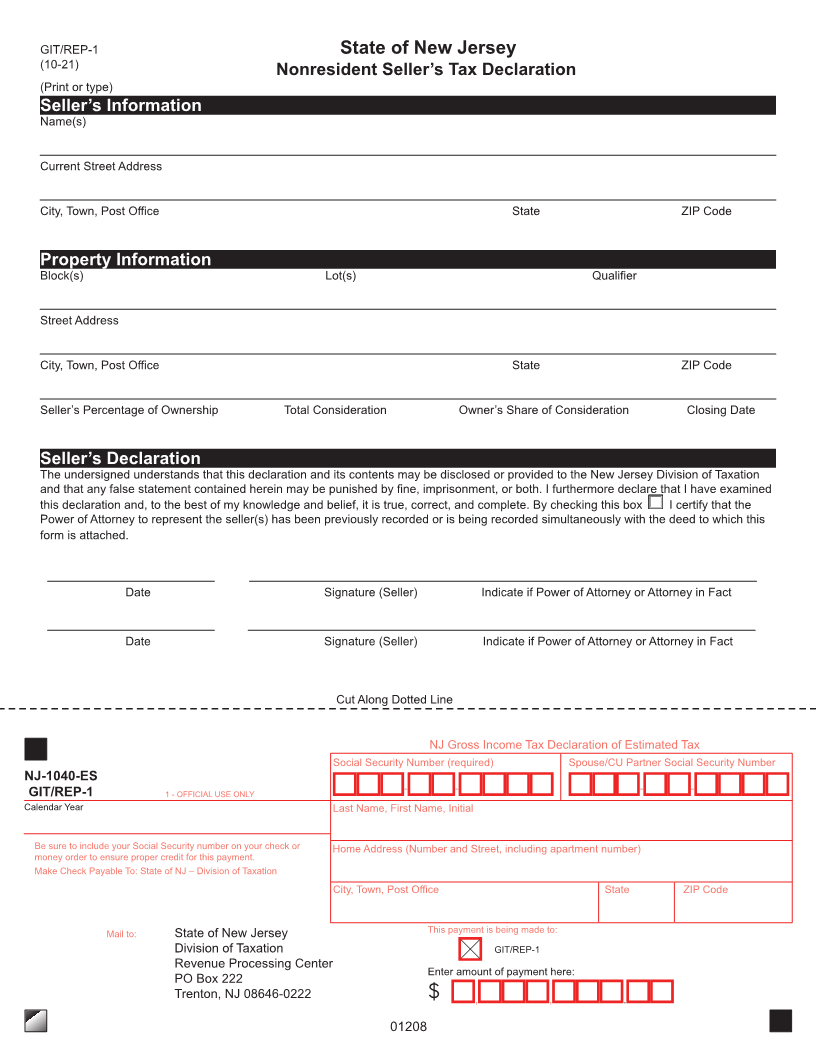

GIT/REP-1 State of New Jersey

(10-21)

Nonresident Seller’s Tax Declaration

(Print or type)

Seller’s Information

Name(s)

Current Street Address

City, Town, Post Office State ZIP Code

Property Information

Block(s) Lot(s) Qualifier

Street Address

City, Town, Post Office State ZIP Code

Seller’s Percentage of Ownership Total Consideration Owner’s Share of Consideration Closing Date

Seller’s Declaration

The undersigned understands that this declaration and its contents may be disclosed or provided to the New Jersey Division of Taxation

and that any false statement contained herein may be punished by fine, imprisonment, or both. I furthermore declare that I have examined

this declaration and, to the best of my knowledge and belief, it is true, correct, and complete. By checking this box I certify that the

Power of Attorney to represent the seller(s) has been previously recorded or is being recorded simultaneously with the deed to which this

form is attached.

Date Signature (Seller) Indicate if Power of Attorney or Attorney in Fact

Date Signature (Seller) Indicate if Power of Attorney or Attorney in Fact

Cut Along Dotted Line

NJ Gross Income Tax Declaration of Estimated Tax

Social Security Number (required) Spouse/CU Partner Social Security Number

NJ-1040-ES

GIT/REP-1 1 - OFFICIAL USE ONLY - - - -

Calendar Year Last Name, First Name, Initial

Be sure to include your Social Security number on your check or Home Address (Number and Street, including apartment number)

money order to ensure proper credit for this payment.

Make Check Payable To: State of NJ – Division of Taxation

City, Town, Post Office State ZIP Code

Mail to: State of New Jersey This payment is being made to:

Division of Taxation GIT/REP-1

Revenue Processing Center

Enter amount of payment here:

PO Box 222

Trenton, NJ 08646-0222 $ , , .

01208