Enlarge image

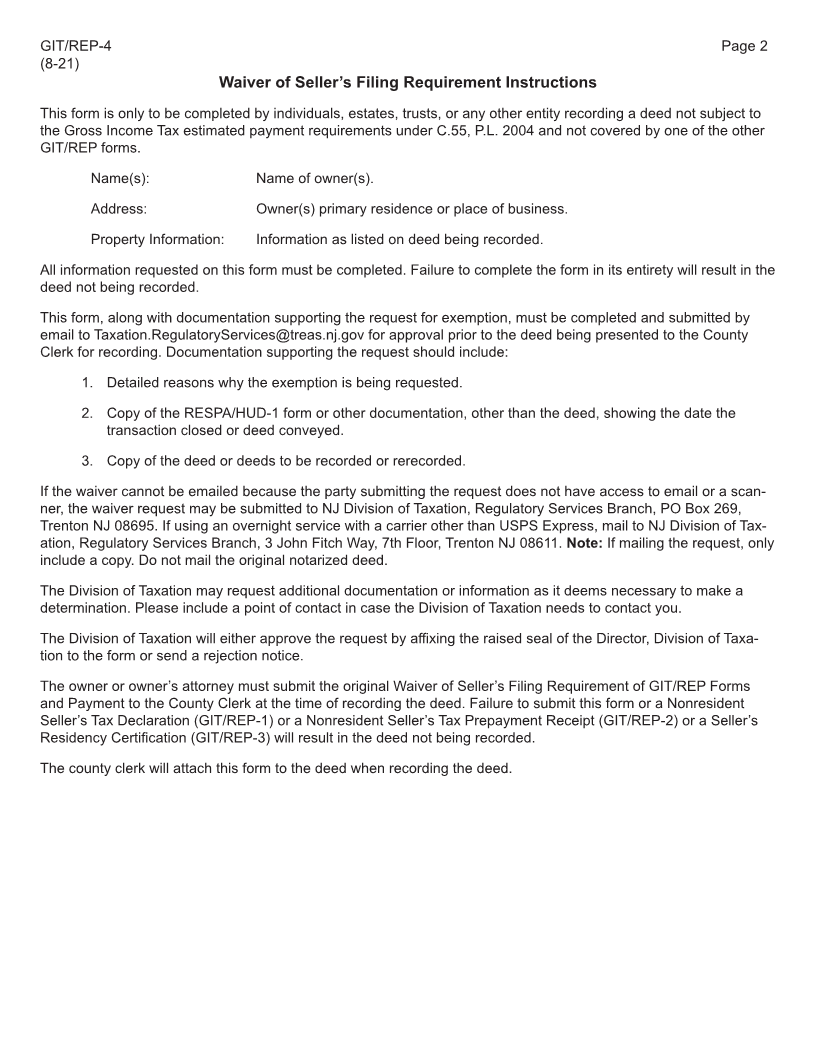

GIT/REP-4 State of New Jersey

(8-21)

Waiver of Seller’s Filing Requirement of

GIT/REP Forms and Payment

(C.55, P.L. 2004)

(Print or Type)

Do not use this form to claim a refund. See Form A-3128.

Owner’s Information

Name(s)

Current Street Address

City, Town, Post Office State ZIP Code

Property Information (Brief Property Description)

Block(s) Lot(s) Qualifier

Street Address

City, Town, Post Office State ZIP Code

Division of Taxation Waiver Declaration

This waiver form with the raised seal of the New Jersey Division of Taxation at the bottom right-hand corner may be

presented to the appropriate county recording officer for recording along with the deed of the owner as identified in the

information above. This form represents that the Division of Taxation has granted a waiver of the requirement that the

grantor/seller/transferor of the subject real property named herein need not file a GIT/REP-1, GIT/REP-2, or GIT/REP-3 form

or pay any tax on estimated gain from the transfer pursuant P.L. 2004, c. 55, and that the county recording officer is hereby

authorized to accept this waiver form in lieu of any other GIT/REP form without payment of any tax on estimated income

gain.

By affixing the Seal of the Director, Division of

Taxation, this date

(Date)

the Division of Taxation has authorized this waiver.

Original Form Must be Submitted to County Clerk. Photocopies are NOT Acceptable.