Enlarge image

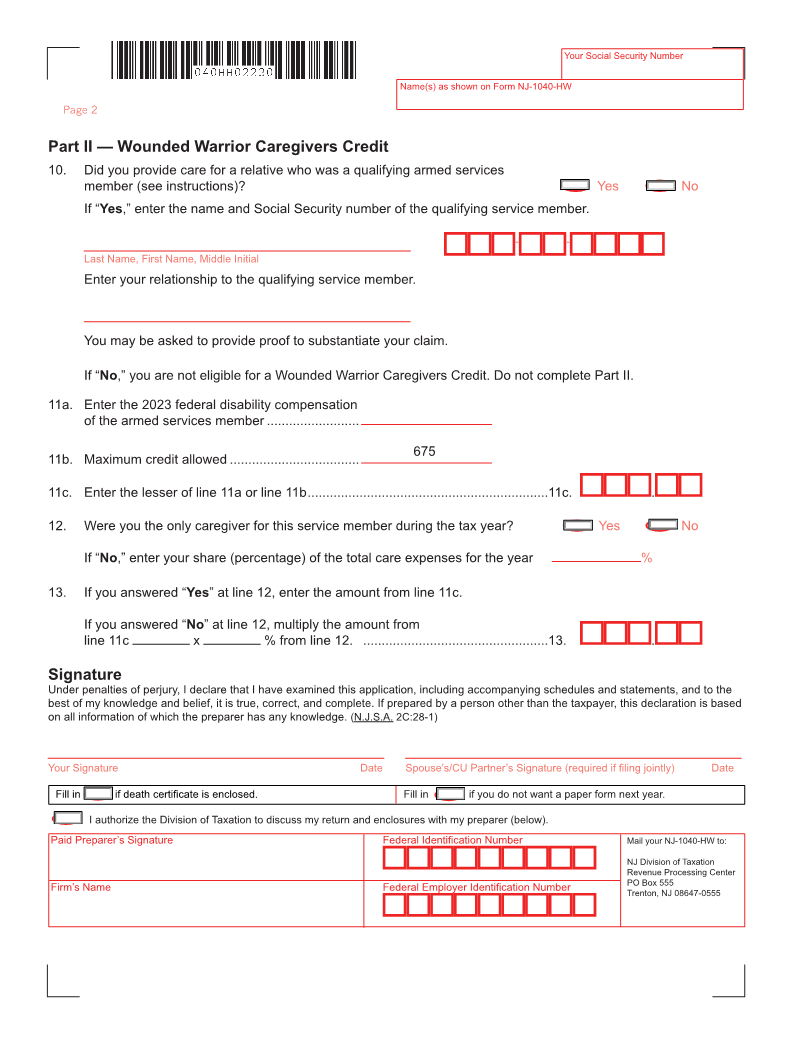

2023 NJ-1040-HW

State of New Jersey

Property Tax Credit Application

Wounded Warrior Caregivers Credit Application

Your Social Security Number (required) Last Name, First Name, Initial (Joint Filers enter first name and middle initial of each. Enter

spouse’s/CU partner’s last name ONLY if different.)

- -

Spouse’s/CU Partner’s SSN (if filing jointly) Home Address (Number and Street, including apartment number)

- -

County/Municipality Code (See Table page 52) City, Town, Post Office State ZIP Code

1. Single Fill in if your address has changed

2. Married/CU Couple, filing joint return

3. Married/CU Partner, filing separate return NJ RESIDENCY STATUS From: M M / D D /32

6. Part-year residents, provide months/days

4. Head of Household you were a New Jersey resident during 2023:

To: M M / D D /32

5 Qualifying Widow(er)/Surviving CU Partner

Do Not File This Application If:

• You file a 2023 New Jersey resident return, Form NJ-1040; or

• Your income is more than $20,000, excluding Social Security income ($10,000 if filing status is single or

married/CU partner, filing separate return). You must file Form NJ-1040.

You can use Form NJ-1040-HW even if you are eligible for only ONE of the credits.

If you are applying for the Property Tax Credit, complete Part I. If you are applying for the Wounded Warrior

Caregivers Credit, complete Part II. If you are applying for both credits, complete both Parts I and II.

Part I — Property Tax Credit

7. Indicate whether at any time during 2023 you either owned a home or rented a dwelling in New Jersey as your

principal residence (main home) on which property taxes (or rent) were paid. Fill in the appropriate oval. If you

were both a homeowner and a tenant during the year, fill in “Both.”

Homeowner Tenant Both None (Fill in only one)

If “Homeowner” or “Tenant” or “Both,” you may be asked to provide proof of property taxes or rent paid on your

main home. If “None,” you are not eligible for a Property Tax Credit.

8a. On December 31, 2023, were you age 65 or older? Yourself Yes No

Spouse/CU Partner Yes No

8b. On December 31, 2023, were you blind or disabled? Yourself Yes No

Spouse/CU Partner Yes No

If you (and your spouse/CU partner) answered “No,” to all the questions at lines 8a and 8b, you are not eligible

for the Property Tax Credit.

9. On October 1, 2023, did you own and occupy a home in New Jersey as

your main home? Yes No

Division 1 2 3 4 5 6 7

use