Enlarge image

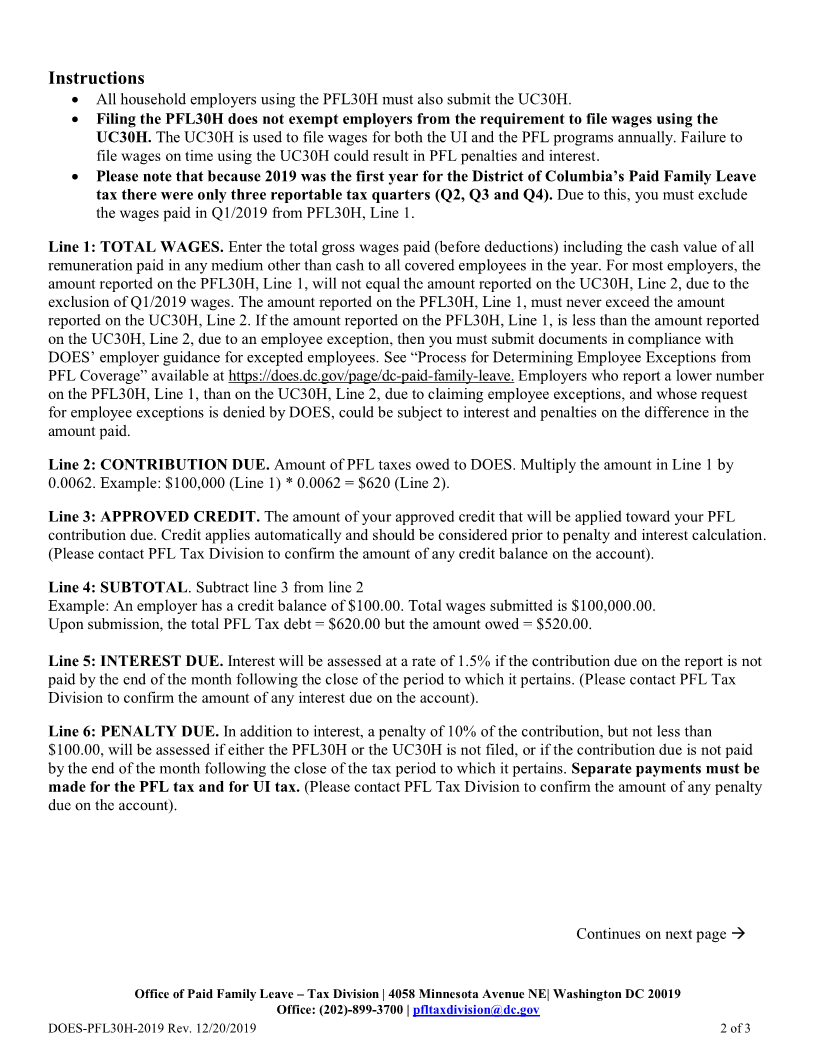

GOVERNMENT OF THE DISTRICT OF COLUMBIA DEPARTMENT OF EMPLOYMENT SERVICES

PFL30H

NOTE: You must complete the UC30H before completing this form.

FORM ID:

EMPLOYER’S ANNUAL POSTMARK DATE

DOES-PFL30H-2019 CONTRIBUTION AND WAGE

REPORT (DO NOT USE THIS SPACE)

EMPLOYER ACCOUNT #: EMPLOYER’S NAME AND ADDRESS FEDERAL EIN:

YEAR ENDING:

TAX RATE:

SEE INSTRUCTIONS ON PAGE 2

Only use this form if you are a Household Employer who files UI taxes annually

1. TOTAL WAGES PAID (to all covered workers this year – same amount reported on UC30H, line 2) $_________________

2. CONTRIBUTION DUE (Multiply line 1 by the tax rate of 0.62% (0.0062) $_________________

3. APPROVED CREDIT $_________________

4. SUBTOTAL (Subtract line 3 from line 2) $_________________

5. PLUS INTEREST DUE $_________________

6. PLUS PENALTY DUE $_________________

7. EQUALS TOTAL REMITTANCE AMOUNT (Add line 4, 5 and 6) $_________________

(Make check or money order payable to “DC Treasurer”)

STATUS CHANGES

8. ENTER THE APPROPRIATE INFORMATION BELOW IF ANY CHANGE HAS OCCURED:

CERTIFICATION

I CERTIFY THAT THE INFORMATION CONTAINED IN THIS REPORT AND ANY WAGE REPORTS

ATTACHED HERETO IS TRUE AND CORRECT AND THAT NO PART OF THE TAX WAS OR WILL BE

DEDUCTED FROM EMPLOYEES’ WAGES.

DATE:

SIGNATURE: TELEPHONE:

PRINT NAME: TITLE:

Office of Paid Family Leave – Tax Division | 4058 Minnesota Avenue NE| Washington DC 20019

Office: (202)-899-3700 | pfltaxdivision@dc.gov

DOES-PFL30H-2019 Rev. 12/20/2019 1 of 3