- 2 -

Enlarge image

|

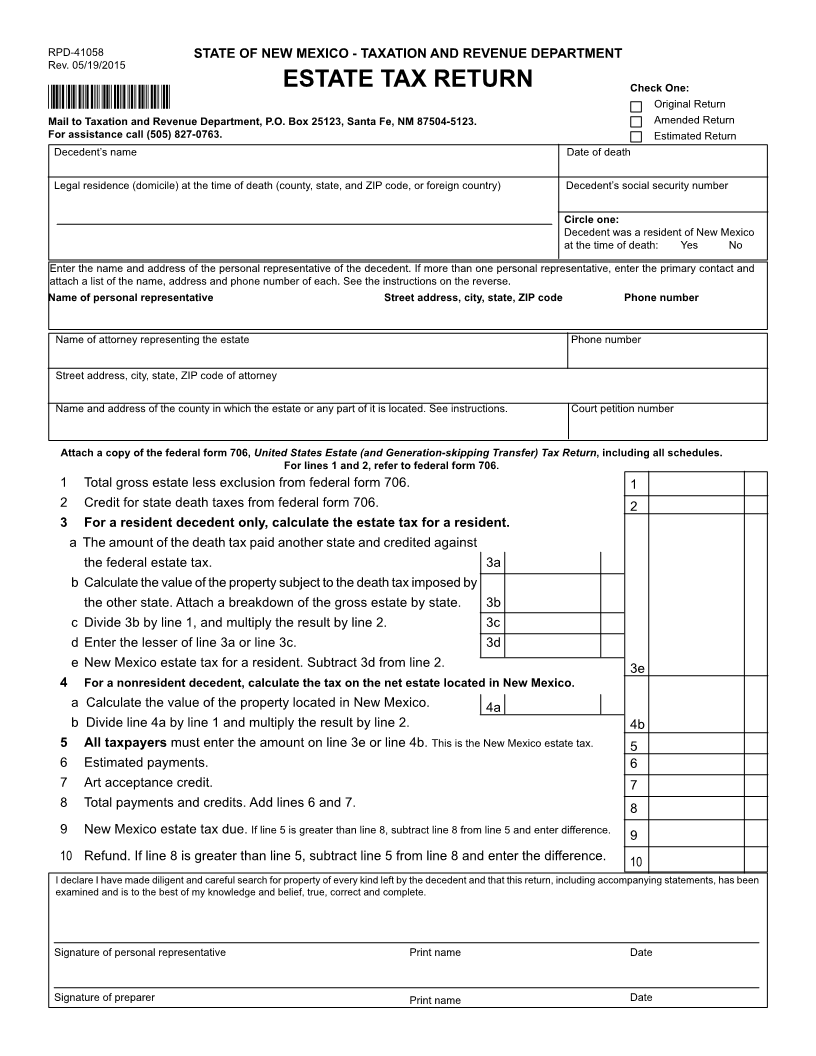

RPD-41058 STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

Rev. 05/19/2015

ESTATE TAX RETURN INSTRUCTIONS

WHO MUST FILE THIS FORM: Lines 4a and 4b. Complete if the decedent was a nonresident of New

The personal representative of every estate subject to the tax imposed by Mexico. A nonresident of New Mexico shall compute the tax by multiplying

the Estate Tax Act {7-7-1 to 7-7-12 NMSA 1978} who is required by the the federal credit by a fraction, the numerator of which is the value of the

laws of the United States to file a federal estate tax return shall file a return property located in New Mexico and the denominator of which is the value of

for the taxes due under the Estate Tax Act and a copy of the federal estate the decedent’s gross estate. Property located in New Mexico includes debts

tax return with the Department on or before the date the federal estate tax arising from transactions in, or having a business situs in New Mexico and

return is required to be filed. The due date is nine months following the date from the securities of any corporation or other entity organized under the

of death plus any extension of time for filing the federal estate tax return. laws of New Mexico. The transfer of the personal property of a nonresident

The estate tax is an amount equal to the federal credit for state death tax decedent is exempt from the tax imposed by this Act to the extent that the

imposed on the transfer of the net estate of every resident, and the net personal property of residents is exempt from taxation under the laws of

estate located in New Mexico of every nonresident. the state in which the nonresident is domiciled. Real property in this state

belonging to a nonresident decedent includes royalty interests in oil, gas

HOW TO COMPLETE THE FORM: or similar leases or property interests. For purposes of the Estate Tax Act,

Complete the information requested for the decedent, the personal repre- mortgages are considered personal property and cannot be netted against

sentative, the attorney if applicable, and the names of the county(ies) in the value of real property located in New Mexico.

which the estate or any part of the estate is located.

• Circle yes or no to indicate the residency status of the decedent. A Line 5. All taxpayers must complete this line. Enter line 3e if the decedent

decedent is a resident when domiciled in New Mexico at the time of is a resident or line 4b if the decedent is a nonresident.

death.

Line 7. Enter any art acceptance credit allowed. Works of art may be

• Enter the name and address of the personal representative or if more accepted in lieu of payment of estate tax under certain circumstances. A

than one, enter the primary contact on the form and attach a list of the decedent’s estate may pay all or a part of any tax owed by the decedent’s

name, address, and phone number of each personal representative. estate to the state by payment in the form of one or more works of art in

Personal representative means the executor or administrator of a the manner provided by the Art Acceptance Act {7-7-15 to 7-7-20 NMSA

decedent, or if no executor or administrator is appointed, qualified and 1978}, provided the decedent has so directed by a will, or the personal

acting, any person who has possession of any property. representative finds that this method of payment is advantageous to the

• Enter the name of the New Mexico county(ies) or the name and address estate. To claim the credit, attach the following to the New Mexico estate

of any county(ies) located outside of New Mexico in which the estate tax return: a) a copy of the appraisal of the work, b) the Board of Regents

or any part of the estate is located. If more than one county, attach a of the Museum of New Mexico’s judgment to accept the works of art as

list. NOTE: If you wish a certificate to be sent to a county outside New payment or partial payment for the estate tax, and (c) the Taxation and

Mexico, you must provide a mailing address for the out-of-state county Revenue Department’s notice of agreement to accept the works of art as

clerk’s office. The Department shall file a certificate indicating no tax payment. The value of the art cannot exceed the amount of the estate tax

due or that all tax is paid with the clerk of the county(ies) as specified owed by the decedent’s estate.

by the personal representative or other person who has filed the return.

Penalty will be assessed if the entity fails to file timely or to pay when due

Line 1 and 2. Complete the information as requested from federal form the amount on line 9. The Department will calculate penalty by multiplying

706, United States Estate (and Generation-skipping Transfer) Tax Return. the amount on line 9 by 2%, then by the number of months or partial months

for which the return or payment is late, not to exceed 20% of the tax due.

Lines 3a through 3e. Complete if the decedent was a resident of

The penalty may not be less than $5.00.

New Mexico on the date of death. Credit may be allowed for estate tax

paid to another state and credited against the federal estate tax. If no tax

Interest will be assessed if the amount on line 9 was not paid by the

was paid to another state, enter the amount from line 2 on line 3e and go

due date. Interest is computed on a daily basis, at the rate established by

to line 5. When the total gross estate is located within New Mexico, the

the U.S. Internal Revenue Code (IRC), of the unpaid amount for each day

entire portion of the federal state death tax credit is due.

the payment is late. The formula for calculating daily interest is: tax due x

A credit for tax paid to another state is allowed when any property the daily interest rate for the quarter x number of days late = interest due.

of a resident is subject to a death tax imposed by another state for

NOTE: If any adjustment is made in the basis for computation of any federal

which a federal credit for state death tax is allowed. To qualify, the tax

tax, the estate must file with New Mexico an amended return within 30

imposed by the other state must not be qualified by a reciprocal provi-

days. Attach a copy of the amended federal return and all attachments.

sion allowing the property to be taxed in the state of the decedent’s

domicile. The amount of the credit for tax paid to the other state is

NOTE: When you provide a check as payment, you autho-

equal to the lesser of:

rize us to use information from your check to make a one-

1. the amount of the death tax paid the other state and credited

time electronic fund transfer from your account. When we

against the federal estate tax, or

use information from your check to make an electronic fund

2. an amount computed by multiplying the federal credit by

transfer, funds may be withdrawn from your account as soon

a fraction, the numerator of which is the value of the property

subject to the death tax imposed by the other state and the as the same day you make your payment.

denominator of which is the value of the decedent’s gross estate.

|