- 3 -

Enlarge image

|

TRD-31109 STATE OF NEW MEXICO

Rev. 08/20/2016

TAXATION AND REVENUE DEPARTMENT

EMPLOYER'S QUARTERLY WAGE, WITHHOLDING AND WORKERS'

COMPENSATION FEE REPORT

Instructions

Who Must File: Beginning January 1, 2006, Employers who

are not required to submit Form ES903, Employer's Quarterly These reports and applicable taxes and fees due may be filed

Wage and Contribution Report, and pay state unemployment when you sign into Taxpayer Access Point (TAP) online at

insurance tax, must file Form TRD-31109, Employer's Quarterly https://tap.state.nm.us.

Wage, Withholding and Workers' Compensation Fee Report.

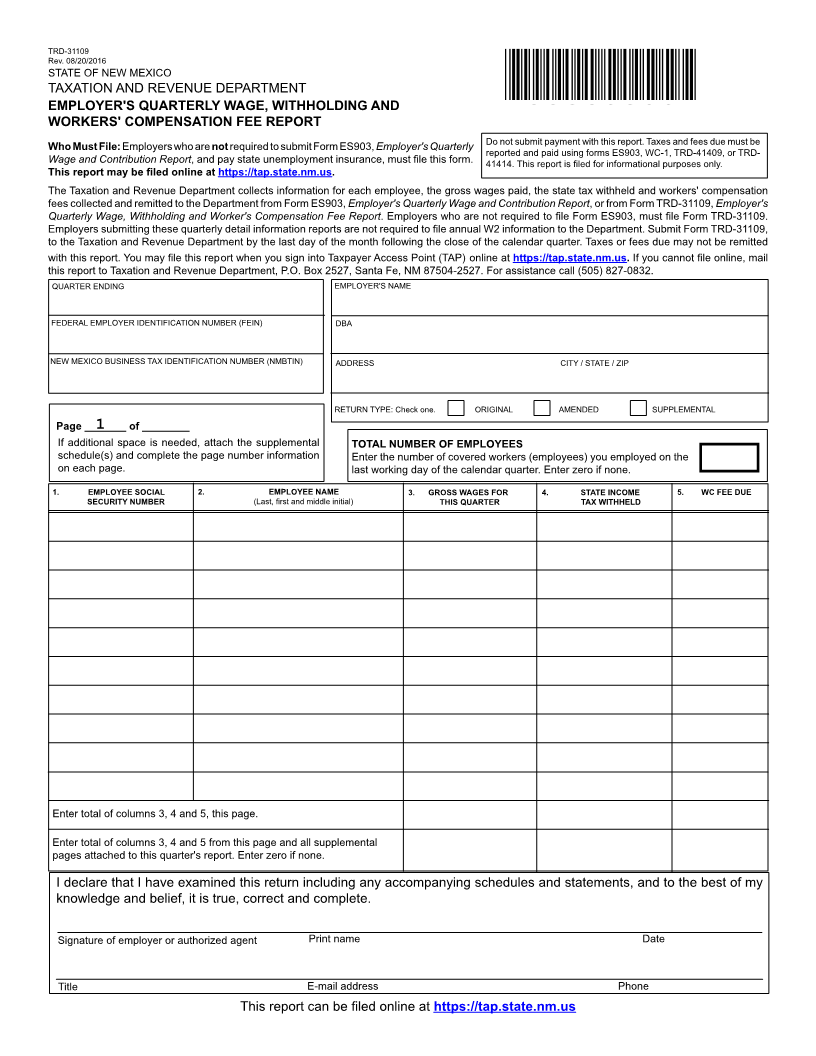

The Taxation and Revenue Department collects the following Completing the top portion of Form TRD-31109, Employer's

information for each employee: the gross wages paid, the state Quarterly Wage, Withholding and Workers' Compensation Fee

tax withheld and the workers' compensation fees collected Report. Enter the employer's Federal Employer Identification

and remitted to the Department. The information is gathered Number (FEIN) and New Mexico Business Tax Identification

from Form ES903, Employer's Quarterly Wage and Contribu- Number (NMBTIN). Enter the month, day and four-digit year

tion Report, or from Form TRD-31109, Employer's Quarterly of the last day of the calendar quarter of the report period. The

Wage, Withholding and Worker's Compensation Fee Report. date should be entered as mm/dd/yyyy. Complete the name

Employers who are not required to file Form ES903, must file and address block, and check the box to indicate whether the

Form TRD-31109. Employers submitting these quarterly detail report type is an original, amended or supplemental report.

information reports are not required to file annual W2 informa- An amended report type is a report submitted to supersede a

tion to the Department. previously filed original report. A supplemental report type is

a report submitted to add to the original or amended report.

Form TRD-31109, Employer's Quarterly Wage, Withholding

and Workers' Compensation Fee Report, must be submitted Complete the total number of pages included in this report. When

to the Taxation and Revenue Department by the last day of the additional space is needed to complete the quarter's report,

month following the close of the calendar quarter. If any due attach a completed supplemental schedule(s) and complete

date falls on a Saturday, Sunday or legal holiday, the due date the page numbering on each page. Use as many supplemental

is the next business day. schedules to Form TRD-31109, Employer's Quarterly Wage,

Withholding and Workers' Compensation Fee Report, as

File online at https://tap.state.nm.us. If you cannot file online,

needed. Enter the number of workers (employees) to whom

mail Form TRD-31109 to Taxation and Revenue Department,

the Workers' Compensation Fee applies. This is the number

P.O. Box 2527, Santa Fe, NM 87504-2527. For assistance call

of covered employees you employed on the last working day

(505) 827-0832.

of the calendar quarter. If you have no covered employees on

Do not remit taxes or fees due with this report. Filing Form TRD-the last working day of the quarter, enter zero.

31109 is not a substitute for filing Form TRD-41409 or TRD-

41414, reporting and remitting tax withheld from employees, Column Instructions:

or WC-1 (RPD-41054), Workers' Compensation Fee Return, In columns 1 and 2, enter the employee's social security number

reporting the workers' compensation fees paid. Your payment and name. Complete the name by entering the last name first,

may not be properly recorded, if paid with Form TRD-31109. followed by a comma, the first name and the middle initial. In

column 3, enter the gross wages paid to the employee during the

How to pay withholding tax and workers' compensation quarter. In column 4, enter the amount of New Mexico income

fees. You must report and pay withholding tax on Form TRD- tax withheld during the quarter. If a Workers' Compensation

41409 or TRD-41414 on or before the 25th of the month fol- Fee was due for the employee, enter the total fees due for the

lowing the close of your report period. A report period may be quarter. Include the employer and employee portions or $4.30

a calendar month, quarter or semi-annual period. Check your per covered worker (employee).

registration certificate to determine whether you are a monthly,

quarterly or semi-annual filer. You must report and pay workers' Completing the report:

compensation fees on Form WC-1 on or before the last day of At the bottom of Form TRD-31109, and the supplemental

the month following the close of a calendar quarter. schedule(s), enter the sum of the columns 3, 4 and 5. On the

first page, also enter the total of columns 3, 4 and 5 from all

Filing online. pages of the form and supplemental schedules attached. Sign

The Department encourages all taxpayers to file electronically. and date the report. Include the title, e-mail address and phone

It is safe, secure and saves time and money. Online filing is number of the employer or authorized agent as requested.

available and is encouraged for the following reports:

• TRD-31109, Employer's Quarterly Wage, Withholding and Obtaining a quality paper form:

Workers' Compensation Fee Report; When filing using a paper return, you must use a quality printed

• ES-903, Employer's Quarterly Wage and Contribution form obtained from your local district office or downloaded from

Report; our web site at www.tax.newmexico.gov. Do not use a photocopy

• WC-1, Workers' Compensation Fee Return; of the first page of the report. However, you may use quality

• TRD-41409, Non-wage Withholding Tax Return; and photocopies of the supplemental page.

• TRD-41414, Wage Withholding Tax Return

|