Enlarge image

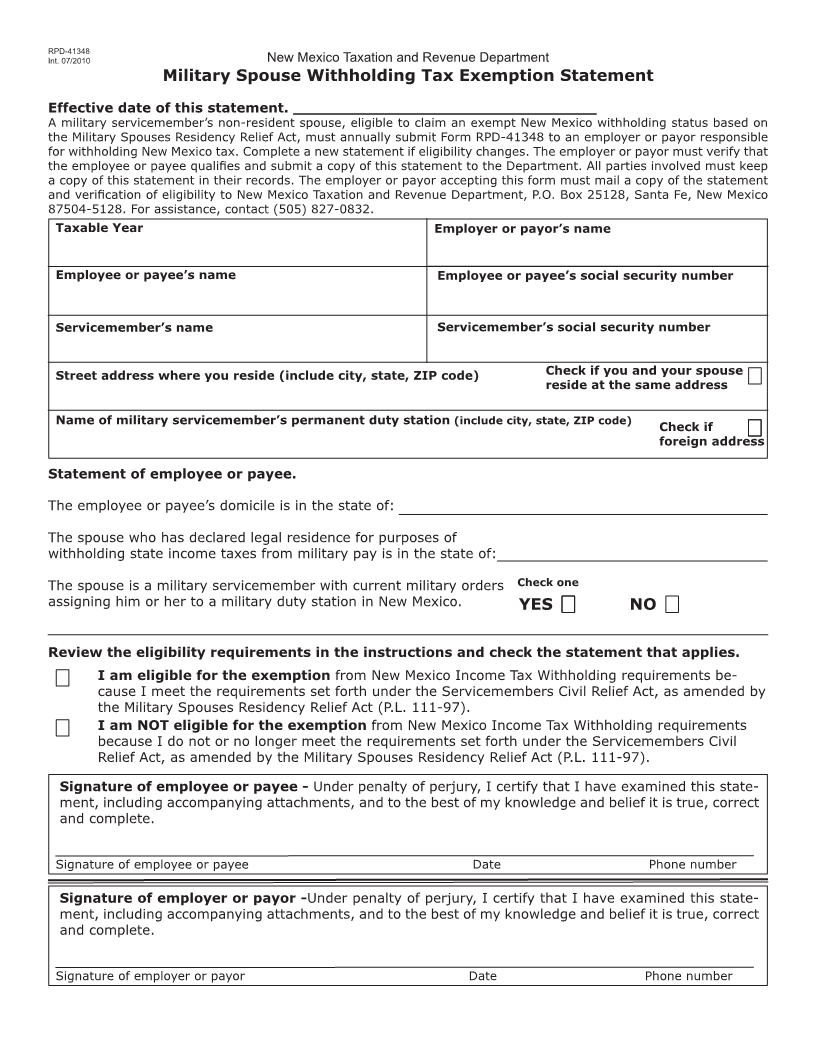

RPD-41348

Int. 07/2010 New Mexico Taxation and Revenue Department

Military Spouse Withholding Tax Exemption Statement

Effective date of this statement. ________________________________

A military servicemember’s non-resident spouse, eligible to claim an exempt New Mexico withholding status based on

the Military Spouses Residency Relief Act, must annually submit Form RPD-41348 to an employer or payor responsible

for withholding New Mexico tax. Complete a new statement if eligibility changes. The employer or payor must verify that

the employee or payee qualifies and submit a copy of this statement to the Department. All parties involved must keep

a copy of this statement in their records. The employer or payor accepting this form must mail a copy of the statement

and verification of eligibility to New Mexico Taxation and Revenue Department, P.O. Box 25128, Santa Fe, New Mexico

87504-5128. For assistance, contact (505) 827-0832.

Taxable Year Employer or payor’s name

Employee or payee’s name Employee or payee’s social security number

Servicemember’s name Servicemember’s social security number

Street address where you reside (include city, state, ZIP code) Check if you and your spouse

reside at the same address

Name of military servicemember’s permanent duty station (include city, state, ZIP code)

Check if

foreign address

Statement of employee or payee.

The employee or payee’s domicile is in the state of:

The spouse who has declared legal residence for purposes of

withholding state income taxes from military pay is in the state of:

The spouse is a military servicemember with current military orders Check one

assigning him or her to a military duty station in New Mexico. YES NO

Review the eligibility requirements in the instructions and check the statement that applies.

I am eligible for the exemption from New Mexico Income Tax Withholding requirements be-

cause I meet the requirements set forth under the Servicemembers Civil Relief Act, as amended by

the Military Spouses Residency Relief Act (P.L. 111-97).

I am NOT eligible for the exemption from New Mexico Income Tax Withholding requirements

because I do not or no longer meet the requirements set forth under the Servicemembers Civil

Relief Act, as amended by the Military Spouses Residency Relief Act (P.L. 111-97).

Signature of employee or payee - Under penalty of perjury, I certify that I have examined this state-

ment, including accompanying attachments, and to the best of my knowledge and belief it is true, correct

and complete.

Signature of employee or payee Date Phone number

Signature of employer or payor -Under penalty of perjury, I certify that I have examined this state-

ment, including accompanying attachments, and to the best of my knowledge and belief it is true, correct

and complete.

Signature of employer or payor Date Phone number