Enlarge image

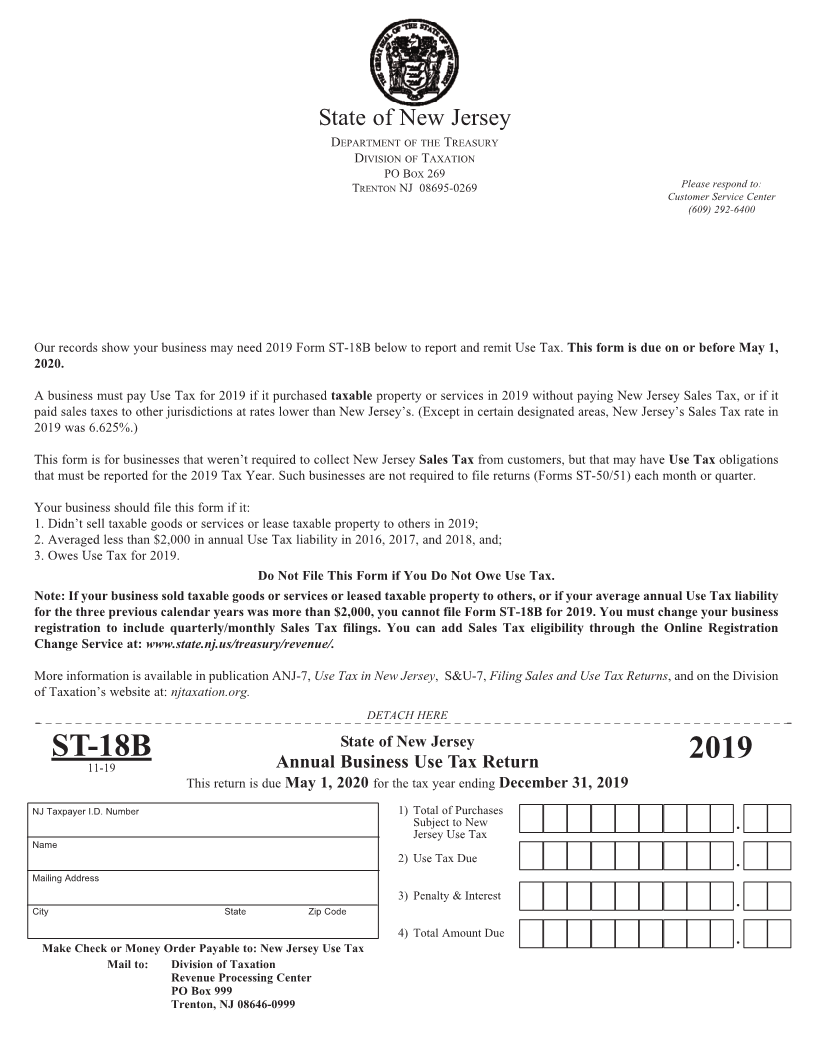

State of New Jersey

De partmeNtofthe r eaSuryt

DiviSioNof axatioNt

po B 269ox

treNtoNNJ 08695-0269 Please respond to:

Customer Service Center

(609) 292-6400

our records show your business may need 2019 form St-18B below to report and remit use tax. This form is due on or before May 1,

2020.

a business must pay use tax for 2019 if it purchased taxableproperty or services in 2019 without paying New Jersey Sales tax, or if it

paid sales taxes to other jurisdictions at rates lower than New Jersey’s. (except in certain designated areas, New Jersey’s Sales tax rate in

2019 was 6.625%.)

this form is for businesses that weren’t required to collect New Jersey Sales Taxfrom customers, but that may have Use Taxobligations

that must be reported for the 2019 tax year. Such businesses are not required to file returns (forms St-50/51) each month or quarter.

your business should file this form if it:

1. Didn’t sell taxable goods or services or lease taxable property to others in 2019;

2. averaged less than $2,000 in annual use tax liability in 2016, 2017, and 2018, and;

3. owes use tax for 2019.

Do Not File This Form if You Do Not Owe Use Tax.

Note: If your business sold taxable goods or services or leased taxable property to others, or if your average annual Use Tax liability

for the three previous calendar years was more than $2,000, you cannot file Form ST-18B for 2019. You must change your business

registration to include quarterly/monthly Sales Tax filings. You can add Sales Tax eligibility through the Online Registration

Change Service at: www.state.nj.us/treasury/revenue/.

more information is available in publication aNJ-7, Use Tax in New Jersey, S&u-7, Filing Sales and UseTax Returns, and on the Division

of taxation’s website at:njtaxation.org.

DETACH HERE

State of New Jersey

ST-18B11-19 Annual Business Use Tax Return 2019

this return is dueMay 1, 2020 for the tax year endingDecember 31, 2019

NJ Taxpayer I.D. Number 1)total of purchases

Subject to New

Jersey use tax .

Name

2)use tax Due

Mailing Address .

3)penalty & interest

City State Zip Code .

4)total amount Due

Make Check or Money Order Payable to: New Jersey Use Tax .

Mail to: Division of Taxation

Revenue Processing Center

PO Box 999

Trenton, NJ 08646-0999