Enlarge image

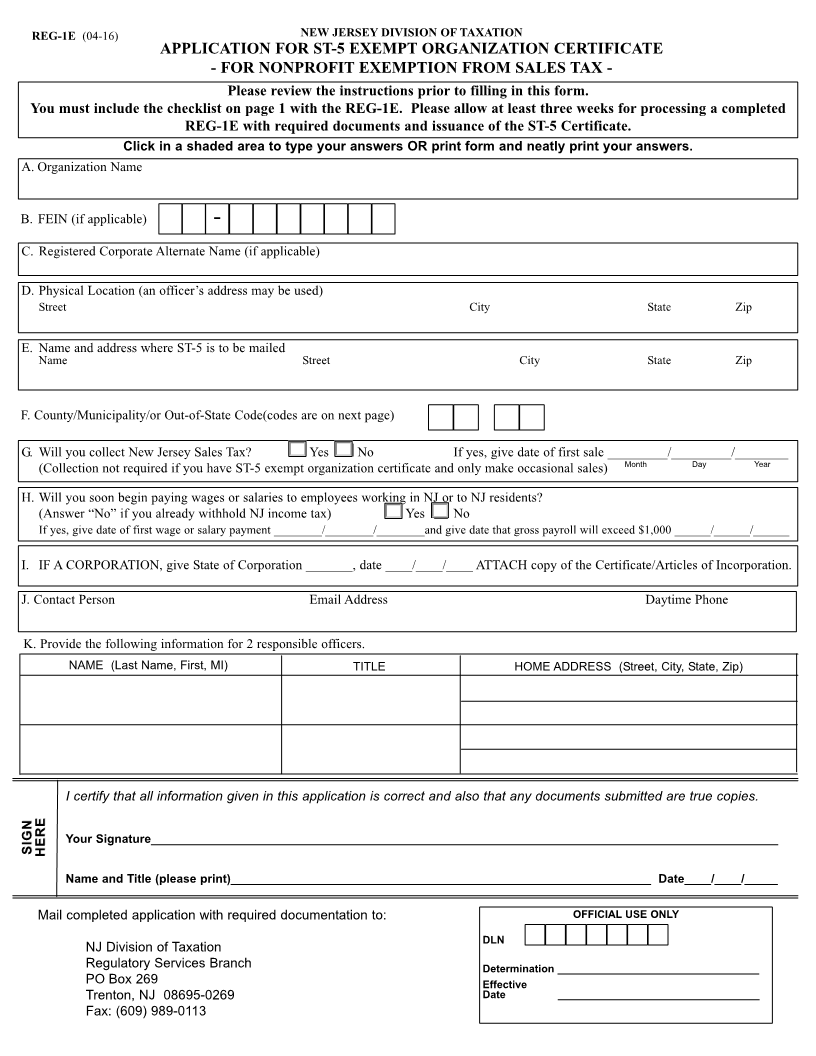

New Jersey Division of Taxation

Application for ST-5 Exempt Organization Certificate

Important information.

Please fax or mail your REG-1E application once. Do not send multiple copies.

You cannot use another state’s exemption certificate to claim exemption on goods and services in New Jersey. The

required proof of exemption in New Jersey is the ST-5 exempt organization certificate.

After submission of your completed application and required paperwork, allow the Division at least three weeks for

processing.

The Division may require the applicant to submit additional documents and information.

Required documentation checklist. Check off each item you are including with your REG-1E and all that apply.

Note that unless these boxes are checked and the documentation submitted, you will not receive a Form ST-5.

An IRS determination letter stating that the organization is exempt from income tax under 501(c)(3); or group

exemption letter and letter or listing from your central organization indicating that your subunit is included under

a group 501(c)(3) exemption;

The applicant is an organization without a 501(c)(3) determination letter because it is a:

religious organization,

PTA/PTO,

volunteer emergency organization, i.e., volunteer fire companies; rescue, ambulance, first aid, or

emergency companies or squads,

veterans organization;

An incorporated organization must provide a copy of the Certificate/Articles of Incorporation from the

State where the organization is Incorporated;

An unincorporated organization must provide a copy of the Bylaws or any governing document such as a

Constitution, Charter or Trust Agreement;

A recent copy of a certificate of good standing from the State where the organization is incorporated, if

applicable; and

A recent copy of filing with Charities Registration, if applicable.

Do not attach federal Form 1023, Application for Recognition of Exemption.

Cost to file.

There is no fee for filing the REG-1E application.

Where to file.

Mail your completed application and all attachments to: NJ Division of Taxation, Regulatory Services Branch, Exempt

Organization Unit, Box 269, Trenton, NJ 08695. You may fax your paperwork to 609-989-0113.

How to file.

You must complete all applicable sections on the REG-1E application. The New Jersey Division of Taxation cannot

process an incomplete application.

You should use the REG-1E application to register for New Jersey sales tax and withholding taxes, where applicable. If

your organization has more than one location, you must file a REG-1E application for each location using the same

Federal Employer Identification Number (FEIN).